Why Mobile is Essential to Your Bank or Credit Union Growth Strategy

Don't Miss An Episode, Subscribe Now

Are you wondering if your "non-responsive," "somewhat dated," but "still functions ok," website is really hurting your bank or credit union growth?

Well the answer is a resounding... Y-E-S!!!

Here are just a few recent stats that might help you see why the user's mobile experience is essential for the growth and development of your bank or credit union:

- 80% of Internet Users Own a Smartphone*

- 83% of Mobile Users Say That a Seamless Experience Across Devices is VERY Important*

- 57% of Users Say They Won't Recommend a Business With a Poorly Designed Mobile Site!**

- Apps Account for 89% of Mobile Media Time*

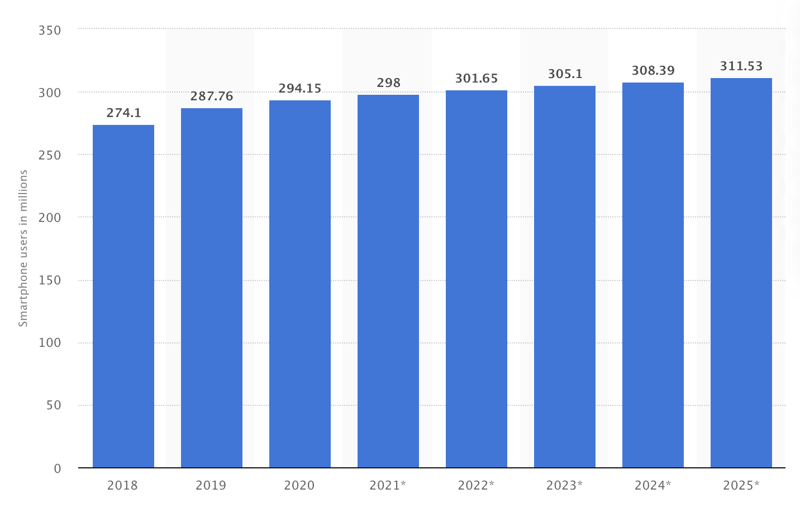

We are talking about over 298 MILLION smartphone users in the U.S. alone, and that number is only growing (see chart below).

If you want to drive growth to your Financial Institution, the time to drastically improve your users' mobile experience is now!

U.S. SMART PHONE USE PROJECTIONS - 2010-2019

And what all of these numbers mean in real terms is this...

Your Customer's Experience with Your Brand is Key.

The experience a smartphone user has on their phone drives, to a huge extent, where they decide to spend their time and money.

Consumers want an omni-channel experience with the businesses they interact with on a regular basis. Which means they want to have a similar experience on mobile, desktop websites and in person at bank or credit union branches.

What does that look like... well, it should be responsive, personalized and friendly. All of these mobile interactions should feel good to your customers and build confidence in your bank or credit union's ability to serve a user's many and varied financial needs.

User Experience Drives Word of Mouth Referrals

A huge factor in the banking buyer's journey is what they hear about from friends and family. If you current customers aren't thrilled with their mobile-banking experience, and the topic comes up amongst friends or family, they are MUCH less likely to recommend your institution.

Keep in mind that the reverse is also very true.

If your members/customers are happy they will share those experiences with others. And on social media, if users are liking, commenting or sharing any of your bank or credit union's content, these interactions show up for their friends and family online, which is tantamount to a digital word-of-mouth recommendation of your institution!

So stay engaged with members and customers online in order to get in front of potential new customers as well!

Mobile Banking is an Absolute Must

For many, and especially the all-important Millennials and Gen Z, when a financial institution doesn't have a fully-functioning mobile app, with the all-important remote-deposit capture (RDC), many potential new customers won't even consider the other features your App does have.

These key features of your mobile app need to be implemented ASAP! So set your priorities now and move projects into high gear if necessary.

Reach Underserved Customers via Mobile.

The final suggestion for the growth and development of your bank or credit union is providing an under-served population access to financial services. (Which is often the case for many community chartered CUs). If so... it's worth noting that "sixty-seven percent of the unbanked have access to a mobile phone, 65 percent of which are smartphones."**

The time for delaying needed upgrades to your bank or credit union websites and mobile apps are behind you. The future is now. contact us today, we can help.

*http://www.socialmediatoday.com/marketing/8-mobile-marketing-stats-help-you-plan-2016

**http://www.federalreserve.gov/econresdata/consumers-and-mobile-financial-services-report-201503.pdf

Blog comments