deepen share of wallet

lower average member age

align sales & marketing

GROW!

We help credit unions and community banks

FI GROW Solutions is the premier financial industry agency for digital marketing, sales, and website development.

FGS Has Been Featured In...

Our Services

Revolutionize your bank or credit union's digital presence by working with our team of experts. We create robust digital experiences that align marketing and sales efforts and enable your financial institution to have a meaningful impact and achieve your goals! .by

Our Resources are FREE

For Financial Professionals

Get the latest from FI GROW

Share your email and FI GROW will send you marketing and sales expertise for your bank or credit union. Trusted by more than 2,100 financial professionals for industry information.

Client Case Studies

New Digital Branch Launched

The CU needed a new website to function better as a lead-generating digital branch, open 24/7/365.

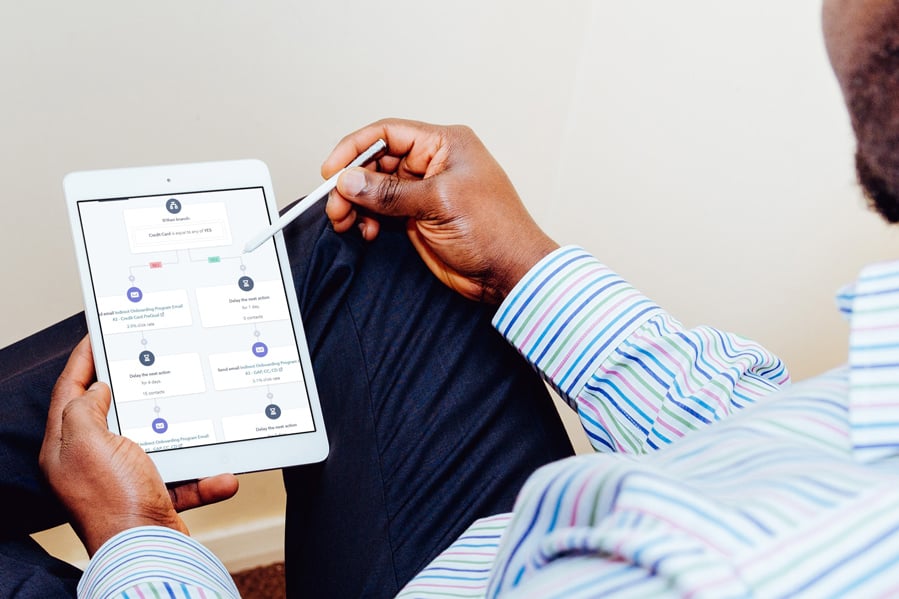

In-Direct Onboarding Success

This credit union was able to grow relationships through a robust digital on-boarding of new in-direct members. Here's how!

Auto Loan Growth During COVID

This CU was determined to continue to serve members with a competitative Auto Loan product, even during unprecedented times.

Testimonials

We require no long-term commitment so you can decide to reduce or even end services at any time. We do this because we believe our results should be why you decide to stay with us.

But let's hear what our clients have to say...

Digital-First Strategy

FI Grow has helped us launch a digital-first marketing strategy since January of 2020 and I don’t know how our two-person marketing team could’ve accomplished everything we have without them. They have a vast knowledge of marketing and sales initiatives and are extremely accessible. Their ROI reporting is robust and transparent, making it easy for us to measure the success of our digital ad spend and the overall value of our partnership with FI Grow.

Christin V.

Chief Marketing Officer

Allegiance Credit Union

Real Results!

Working with our FI GROW team we are able to drive direct qualified conversations from our social channels. Our credit union Board can easily see the value of maintaining quality, targeted content. We connect with our target personas daily by working with FI GROW.

Jenn W.

Chief Marketing Officer

Copper State Credit Union

Best Decision

Hiring FIGROW Solutions has been the best marketing decision we have made in 2020!

Brent R.

SVP/Chief Lending Officer

Allegiance Credit Union

Latest Episodes

-

Marketing is not the problem if your loans are not closing. In this episode, Meredith Olmstead and...

Marketing is not the problem if your loans are not closing. In this episode, Meredith Olmstead and... -

.jpg) 7 min read.

7 min read.Episode 110 - Built on Data - How Financial Institutions Should Structure Website Content

Most financial institutions say they believe in data-driven marketing, but very few are actually... -

Planning an online banking upgrade? Don’t overlook your communication strategy. In this episode of...

Planning an online banking upgrade? Don’t overlook your communication strategy. In this episode of... -

9 min read.

9 min read.Episode 108 - What does data driven marketing for banks and credit unions really look like

Too often, "data-driven marketing" gets tossed around without real meaning. In this episode of the... -

In this closing episode of 2025, Meredith Olmsted and Danielle Fancher take a step away from...

In this closing episode of 2025, Meredith Olmsted and Danielle Fancher take a step away from... -

AI is everywhere, but that doesn’t mean your content has to sound like a robot wrote it. In Episode...

AI is everywhere, but that doesn’t mean your content has to sound like a robot wrote it. In Episode... -

In this episode of the Hit Record Podcast, Meredith Olmstead and FI GROW's Digital Ads Director,...

In this episode of the Hit Record Podcast, Meredith Olmstead and FI GROW's Digital Ads Director,... -

In this episode of the Hit Record Podcast, CEO Meredith Olmstead is joined by Digital Marketing...

In this episode of the Hit Record Podcast, CEO Meredith Olmstead is joined by Digital Marketing...