5 Key Ways Your Bank or Credit Union Should Be Using LinkedIn to Grow

Don't Miss An Episode, Subscribe Now

This guest blog was originally published on CUInsight.

Implement these four great tips for your Bank or Credit Union on LinkedIn today!

Implement these four great tips for your Bank or Credit Union on LinkedIn today!

1. Help all Bank or Credit Union Employees Improve Their LinkedIn Profiles

Lots of professionals still think LinkedIn is still just being used for finding a job, so obviously they don’t want to encourage their employees to be there, because they worry they will leave and find work somewhere else. In my opinion this should NOT be a huge worry for financial institutions.

First off, most community-based financial institutions are GREAT places to work. So encouraging your employees to put their best foot forward online is only an advantage to you. And here’s why… Many people in sales and marketing are quickly becoming very adept at prospecting with LinkedIn. The platform is a great way to reach out to small businesses and other local professionals. If you employees have strong profiles this helps your brand look even better!

Here are a few easy fixes to personal profiles that your employees can make RIGHT NOW:

- Have a nice photo and make sure all the information is up to date

- Make sure their current position links to your institution as the employer (And if you don’t have a company page, get to work on that immediately!!)

- Include Key words in your Headline/Header

- Write a nice summary of your skills in the first person

- Post something at least once per week

- Join a few relevant groups that connect to your role at the bank or credit union

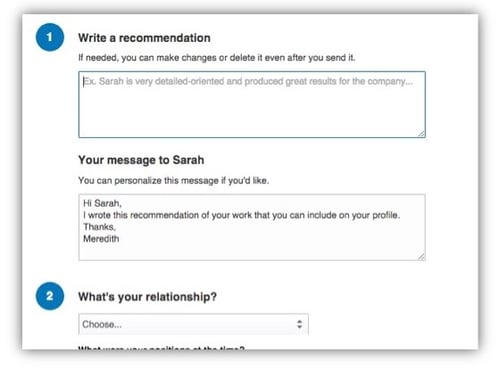

2. Ask Satisfied Members or Customers for Recommendations on LinkedIn

This one sometimes makes people uncomfortable, but it’s essential. Recommendations add immediate credibility to any LinkedIn profile. Employees who work directly with members on business services such as loans, visas, or new accounts are already building great relationships with these people. It’s not a huge inconvenience to ask someone you’ve helped to spread the word.

Sending a simple email with a link to your profile to 10 members you know well takes only 15 minutes tops, and the impact can be huge!

These recommendations could be the way their personal LinkedIn connections make the decision to contact you about joining the Credit Union or taking out a loan themselves. This is just another great way to AMPLIFY positive word of mouth online.

Learn More: The Definitive Guide to Social Media Marketing for Financial Institutions

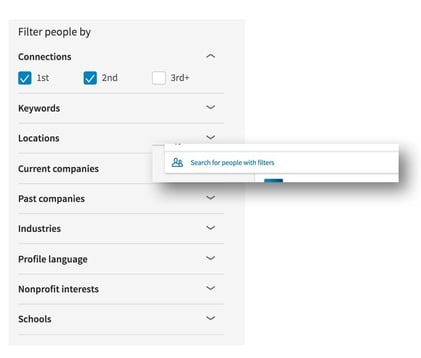

3. Use Advanced LinkedIn Searches (Filters) to Prospect & Connect with Local Business Professionals

With Advanced searches on LinkedIn, Commercial Lending Officers or others interested in networking with local business professionals can easily narrow their targets with an amazing array of identifying factors. You can search with zip codes and then narrow by business size, type of business and even job title.

We recommend dividing up these results and then connecting with these local people in an attempt to spread the word about you and the bank or credit union and all the great services that your CU offers members.

And don’t just connect with the generic message from LinkedIn. Dig a little deeper into their profile or even search for them on Facebook and put in something that will help you more authentically connect. You might also consider asking a mutual LinkedIn connection for an introduction to get the conversation started!

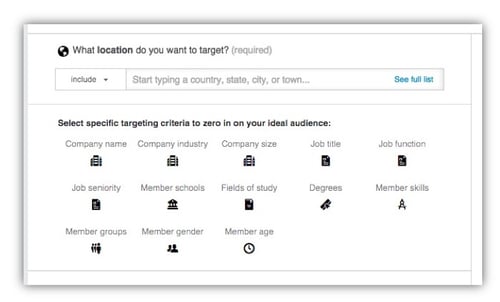

4. Use LinkedIn Ads to Promote Your Own Original Content or Relevant Webpages

These ads can be highly targeted based on lots of great factors as well, similar to the advanced search options shown above. We like to narrow by zip codes, and then tailor content based on job title and/or company size. You can also target specific industries in the same manner.

Make sure the content you are writing or sharing is relevant to your target audience and provides some benefit or solution to a challenge the person might be facing. You should also link to content on your website that they might find interesting and include a call-to-action for the reader to do something that will potentially move them closer to doing business with your Credit Union in the future.

5. Advertise Open Staff Positions On LinkedIn

Although LinkedIn ads tend to be a bit more expensive than other social media platforms, we recommend that banks and credit unions promote job postings if they are in need of more qualified applicants. You can narrow your posts to be shown to people based on job title, years of experience, industry and age. All of these factors would help a FI show a job opening to just the right people.

We work with clients regularly on all of these strategies and we also implement for them. Email us today for more information on how we can help your Credit Union achieve amazing results with online marketing!

Blog comments