Winning with Social Media Marketing for Banks & Credit Unions

Are you deciding whether to redirect marketing and business development dollars at your bank or credit union for Social Media or other Digital Marketing Efforts? Well, we are here to tell you that the two could not be more right for each other!

Social Media Basics

Why Social Media is a Perfect Fit for Financial Institutions

Are you deciding whether to redirect marketing and business development dollars at your bank or credit union for Social Media or other Digital Marketing Efforts? With 4.6+ BILLION people around the world using social media, we are here to tell you that you are on the right track! And here’s why…

Credit Unions and Community Banks are All About Service to their Customers and Members and Social Media is Too!

Social Media Marketing success comes with developing authentic relationships, cultivating your fans and followers, and helping them with problems and challenges. Local banks and credit unions are all about this TOO! It’s their entire mission really. So why not bring FIs and Social Media together?

Being Genuine and Real is What Works on Social - It’s No Different for Financial Institutions

Community financial institutions are created to bring financial services and economic opportunities to the surrounding communities. The best examples are transparent with customers or members and have people's best interests at the heart of what they do.

Community financial institutions are created to bring financial services and economic opportunities to the surrounding communities. The best examples are transparent with customers or members and have people's best interests at the heart of what they do.

This kind of mission and purpose works PERFECTLY on Social Media platforms. People online can sniff out insincerity very quickly, but with credit unions and community banks the mission IS service to the people they work with, so being genuine and real is just part of why they exist in the first place! It's just that simple.

The Next Generation of Credit Union Members and Community Bank Customers are on Social Media and Have Questions that YOU can Answer!

We can all agree that one of the goals for any FI is to attract new members or customers. Young adults are a prime market since they bring with them an increase in disposable income as well as a need for education and guidance when making major financial decisions like buying their first home. Enter Social Media! Finding a way to bridge the gap and convey important information in a creative and fun way is a great way to increase your FI's exposure and get new loyal members or customers at the same time!

Community-based Financial Institutions REALLY Care About People, While So Many Other Businesses Online are Just Faking It

Now this one might get us in trouble, but we are going to say it anyway. Most large national banks or online-only lenders are in business to make money, and they do that through fees, higher interest rates, lower costs or other hidden costs. These FIs are not in the business of serving the 'underserved' or really caring about the people that bank with them. In fact, they are profit-making machines designed principally to benefit their employees and stockholders.

How is this related to Social Media? Well, to succeed on Social Media, brands must come across as more caring, rather than as large, faceless companies trying to make money. So, what do they do? They FAKE IT! They try to share lots of cool stuff and post information as though they are interested in being helpful, all with the hope that you’ll take the bait and spend your money.

But with community financial institutions the motivation is very different. Your FIs really DO care! That’s why you exist in the first place. So Social Media Marketing is that much easier because your content is true and doesn’t need to be faked or dressed up. It really IS all about helping people.

/Winning-with-Social-Media-Marketing-Exculsively-for-Banks-and-Credit-Unions-by-FI-GROW-Tablet.png)

Send a free copy to your inbox now!

Your Ad Budget

If You Don't Have an Ad Budget Don't Waste Your Time

When Facebook first became popular, it was easy to organically reach thousands of people, but nowadays you're lucky if you can get in front of 6% of your fans without spending money to be there! Facebook has turned into a fully pay-to-play platform. If you're not putting ad dollars behind your posts your content isn't going to go far.

Now, don't get us wrong... it's a good idea to monitor your social media pages in case customers make comments, leave reviews, or ask questions. And posting on social to keep your pages active is also essential. But you shouldn't believe that can drive significant traffic to your website or generate leads without forking up some cash. In this day and age this is just the cost of doing business.

There are a number of factors you need to consider when determining how much your credit union or bank should spend on social media ads.

A good place to start would be in ads manager. When in ads manager, click the hamburger menu on the top left corner and select 'audiences'. Create a new audience and plug in your membership zip codes OR the counties you serve. Facebook will then give you a potential reach estimate.

Once you know what your potential reach, we recommend starting with a daily budget of $7-$10 a day for every 500,000 people Facebook finds as your potential audience. So, for example, if you have a potential reach of 1 million people, we would recommend starting with a daily budget of $14-$20 a day or a monthly budget of $420 - $600 for any given campaign.

You could also add an additional budget for other campaign types. We like to run engagement ads because with these types of placements, you can reach new potential customers/members at the lowest possible cost. On average, the cost per result for engagement ads should be around $0.02! Yes, TWO CENTS! Since results are so cheap, you can spend much less on these campaigns, just a few dollars a day, and see great results.

Fan growth ads will help you grow your credit union or bank's social media following. The more fans you have, the more potential organic reach you have. We do not like to harp on 'total fans,' so we usually suggest to our clients to only spend a few dollars a day on these types of ads.

The largest portion of your ads should be used for website click or conversion ads. These will generate traffic to your website or leads for your lending or new accounts teams to follow up with.

Social Strategy

How to Create a Successful Social Media Marketing Strategy for Your Financial Institution

Creating a well-designed strategy is the backbone to any successful marketing or sales approach. With that in mind, we often weave in social media for larger campaigns for clients, and here’s how we do it.

Set SMART Social Media Goals to Begin With

With any strategy this one should really go without saying… SMART goals are:

.png?width=320&name=Smart%20Goals%20(1).png) Even though these simple rules may seem obvious to some people, again and again we have clients tell us that they want to grow Facebook or Instagram likes & followers. This is what we call a ‘vanity metric,' and while goals around metrics like these may qualify as measurable, they are not terribly impactful. After all, we’ve yet to meet a CEO or Board Member whose priority in marketing strategy is page likes on social media.

Even though these simple rules may seem obvious to some people, again and again we have clients tell us that they want to grow Facebook or Instagram likes & followers. This is what we call a ‘vanity metric,' and while goals around metrics like these may qualify as measurable, they are not terribly impactful. After all, we’ve yet to meet a CEO or Board Member whose priority in marketing strategy is page likes on social media.

Even when you do define the size of a target like 'page likes' remember you need to take goals further and make them more strategic SMART goals in order to really drive success that matters to your leadership team.

Instead perhaps you could set a goal of reaching 20% of your total customer or membership base within the first 6 months of your new social media push. This kind of a result shows valuable touch points with your current customers, which is important when people are visiting branch locations less and less.

Engagement with existing customers or members as a goal makes more sense in terms of relevance to your larger business goals and objectives - who wouldn’t want to interact more with their known customers? And it’s also specific, time bound, attainable and measurable. So it has the all the hallmarks of a great strategic goal.

Find Key Progress Indicators Along the Way to Achieving Larger Objectives

When we create a social media strategy for our clients, we encourage them to include larger annual account, loan or total asset growth goals. But your Financial Institution can’t reach those goals without lots of other smaller steps along the way. This is why it is essential to make sure you identify some Key Progress Indicators (KPIs) that can be measured in 30, 60 or 90-day increments to ensure you’re heading in the right direction.

For example, if you have a goal of growing your total consumer loan portfolio by $100 million, and one key part of that portfolio is credit card growth, then each month you may want to track new visitors to the credit card information page on your FI’s website.

A SMART goal for this approach might be to increase traffic to this page by 10-30%, depending on the revenue growth goal and your current conversion rate for leads to new customers. Website click ads from Facebook and Instagram are a great way to increase traffic to specific product or service pages on your website.

But if you’re still unsure what your current conversion rates are, as many of our new clients admit, you could also consider tracking credit card applications submitted and have similar goals that are driven by your larger revenue growth objectives.

Again, you can’t open new credit cards without applications, and these types of incremental KPIs will help you understand where you might need to focus your social media and marketing and sales efforts to achieving your larger goals. These kinds of KPIs will also give you clear points along the buyer’s journey you can track, and better understand where you’re losing people throughout the application and sales process.

To Have Good Engagement, Behind the Scenes Content Is KEY

Now, this might be one of the most important parts to any successful social media marketing strategy. A lot of people think it’s all about audience growth… that is, how many fans or followers you have. But that really means nothing once you hit an acceptable level that indicates your social platform is established and legitimate. And senior managers want revenue impacts, but those come later in the process. Those are the long-term goals.

What we have learned over many years of work in this area is that it’s the engagement with people on social media that is KEY to your short and long-term success. Whether you want to grow accounts, engage more with current customers, or reach a brand-new market with your products and services, if you aren’t engaging on your social media platforms, you’re literally just wasting your time. And time is money!

But, don’t just take our word for it, here’s the proof…

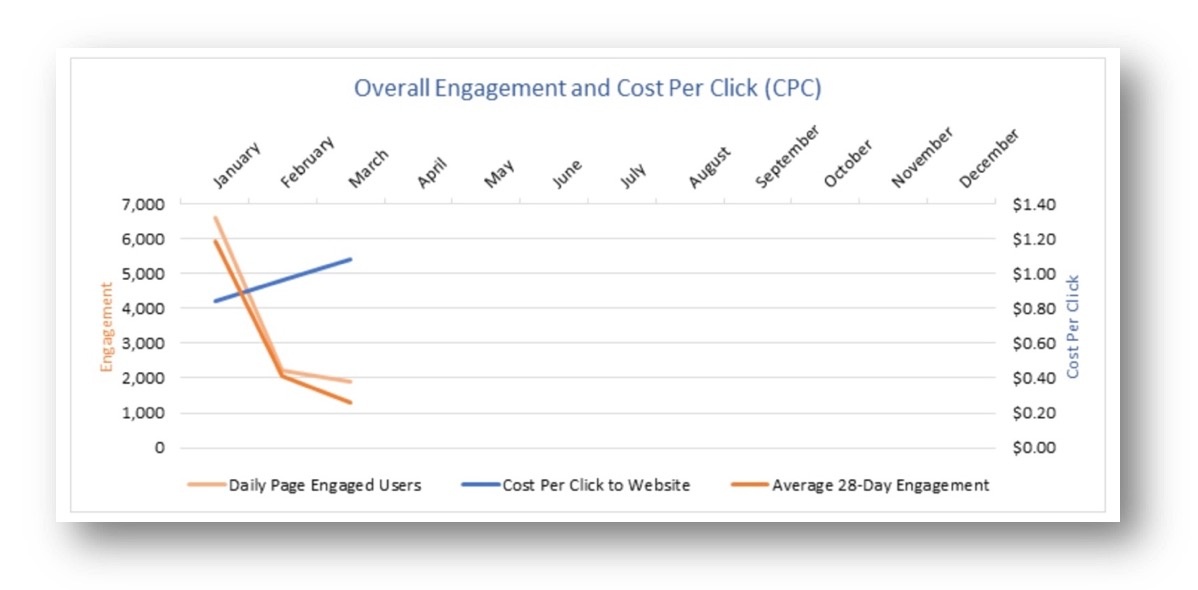

Recently we had a customer who, due to pressure from senior management, moved away from sharing content on Facebook and Instagram that was fun, entertaining and engaging. Their marketing team wasn’t thrilled with the change, but against our recommendations they still wanted to try the shift, to “just see what happens.”

In just 60 days the impact was striking! They saw a dramatic drop in their overall engagement on both platforms, plummeting from roughly 33% engagement each week to only 8% each week! Wow!

Now what you might say is, ‘So what? Who really cares about engagement rates on social media?’ And honestly, this is an excellent question. Digging a little deeper into the results from this shift away from trying to engage, we also saw that the costs of driving traffic from Facebook and Instagram went up dramatically as their overall engagement went down.

So, as people were doing less liking, commenting and sharing of their content posted on social media, Facebook began to charge the financial institution more for clicks sending users to their website. Their cost per click was going up as their overall engagement went down.

For some institutions it can be difficult to find and post “fun” content on social media. Often staff or leadership just don’t understand how a post that it NOT directly related to a product or service is benefiting their institution in the long run. But whether you like it or not, social media networks own their platforms and they make the rules.

Social platforms will only organically display content that’s considered valuable by their users, and user engagement = value.

When people engage less often Facebook ends up charging the business more because they assume users have a lower ‘affinity’ with your page, so you should pay more for the reach and clicks.

It’s complicated, but to effectively utilize these networks you have to work within their defined parameters. And to be successful your social media strategy has to align with the way in which these social networks work, so if you aren’t dedicated to engaging with your audience in a fun or useful way you might as well just give up and go home.

Don’t Spread Yourself Too Thin on Social

This one is super easy… we recommend not launching more than two social platforms at any one time. Sometimes we will tell clients to just start with one. The reason is simple, most credit unions and community banks are already massively under-staffed. So even though someone’s job title is marketing they might also do lots of other administrative tasks that simply fall into their laps on a daily basis.

Even with help from an outside agency, social media marketing is a serious commitment. It takes time to learn how to do it well, and then continual time to maintain these platforms and post and engage on them regularly. So, starting slowly is always the best rule of thumb.

You can always add an extra network six-months in, once you’ve got your weekly workflow down. But opening a bunch of networks and then letting them go stale is unprofessional and can lead to comments and reviews that go without response. Which is never a good scenario.

Write It Down, Check It Regularly

We’ve all heard the quotes about this one… but truly, a goal that’s not written down is just a wish. And we all know what happens to most of those, most of the time.

So, make sure you and your team record your social media marketing strategy and then make sure you look at it at least monthly to check your progress.

We have actually added a way to quickly reference larger goals around KPIs and budget in every meeting we have with our clients. These tend to be twice a month, and we use goals as a quick starting point for the rest of the meeting.

Maybe this works for you, maybe it doesn’t, but having a regular reminder of larger goals and objectives is important if you want to keep your team on track.

Involve All the Key Players & Define Exactly WHO Does WHAT

Again, this one sounds simple, but never assume that others know what is expected of them. After all, you know what they say about making assumptions…

In our strategies we work backward from larger annual goals, to smaller campaign objectives and then finally tactical steps that are typically weekly or daily responsibilities. But we don’t stop there. For every small tactical step, we define for clients whether it’s their team who is doing the task or whether it is our team.

Then each internal team divides up those tasks and assigns them. So, if at the end of Q1, you see your Facebook engagement rates have plummeted you don’t have to wonder who to talk to. You know you need to address this with the staff members who should be posting and engaging on that platform each day.

And clearly defining responsibilities makes it easier to identify weaknesses or when someone is perhaps over extended and has run out of time to adequately perform their regular duties.

Guide Continued Below ⇓

/Winning-with-Social-Media-Marketing-Exculsively-for-Banks-and-Credit-Unions-by-FI-GROW-Tablet.png)

Send a free copy to your inbox now!

Content Types

What Social Media Content Your Financial Institution Should Share

Engaging Social Media Content is Essential to Online Marketing Success

One of the services we provide clients is to curate effective content each month for their social media platforms. We make a lot of the same suggestions, so here's a list of the top 5 kinds of content we recommend. Consider these ideas as you build your Bank or Credit Union's own social media marketing strategy.

1. Tips & Tricks (Video Tips are Ideal on Social Media!)

These work best when they are made as a post (with an image of some kind) that demonstrates a short but useful tip. We also like to use short tip videos as well. You can find these from sources like ClickVue, which offers a very affordable monthly subscription for Financial Institutions.

Remember that sharing great tips positions your Bank or Credit Union as a trusted advisor, which goes a long way to building rapport with existing customers and potential new customers.

Here's one video we just posted for a client about credit card tips for college students:

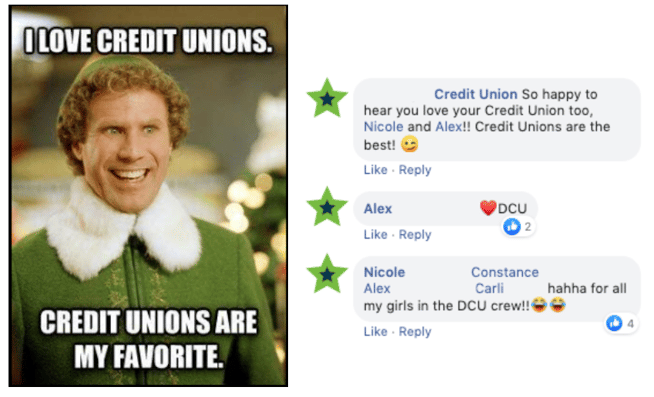

2. Profiles or Testimonials from Your Internal Staff or Customers

Profiling staff is a great way to humanize your Credit Union or Bank brand, and it's a great way to engage with the friends and family of your biggest asset, the people who work for you! We like to do these staff profiles in a fun way with split pictures of staff as adults side-by-side with baby pictures. But don't forget to have social media staff policies in place before you start this kind of contest.

Content from positive customer experiences works very well on social media. We often run testimonial contests for clients to generate more real-world examples, and then share these stories again and again.

Testimonials are great at generating engagement on social media, and they inspire others to consider doing business with your institution. We also use testimonials in email marketing as they are much more authentic than just promoting a more generic "great rates and member service" message. We've also written about some other great contest ideas that work well for FIs.

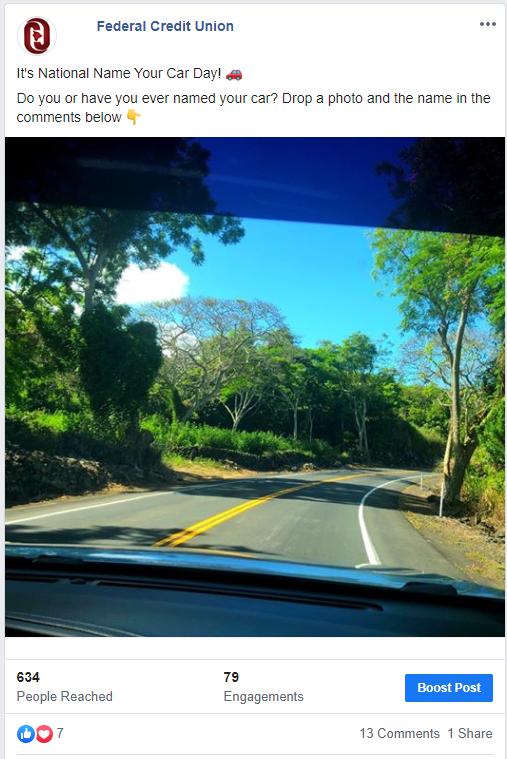

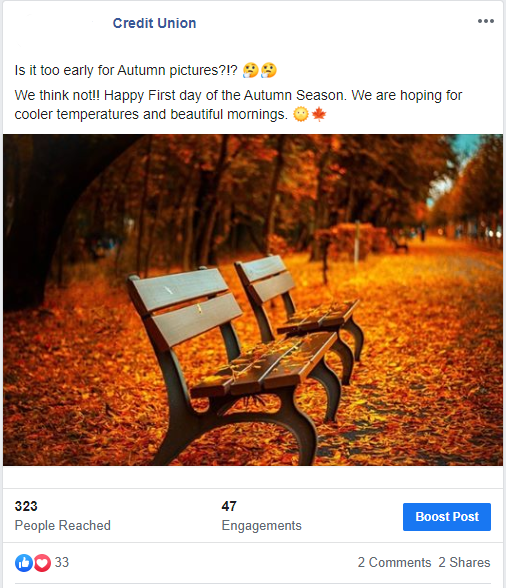

3. Engaging Reels, Questions or Inspirational Images are Great on Social Media

These kinds of posts are extremely engaging for social media users. We share them on our own Facebook and Instagram pages, and often curate similar content for clients. You can also brand your images if you make them yourself, which is a great way to keep your logo top-of-mind. But don't brand everything you share, as those types of edited images feel less authentic.

Just remember to reply to significant comments and have a response plan in place for your staff to help them monitor these kinds of social media posts.

You can also add questions to posts like these to encourage engagement. Remember that easy questions make it more likely that a reader will take 10 seconds to answer, and when someone engages with your content, they will be more likely to see your content again in the future.

Video is also becoming more and more important on social media. Don't be afraid to get silly and show off your financial institution's personality through short funny videos!! It could be something as simple as a boomerang of a group of staff members cheering their morning coffee, wishing everyone a happy Monday, or a video tour of a new branch... the possibilities are endless! Get creative and encourage your staff to do the same.

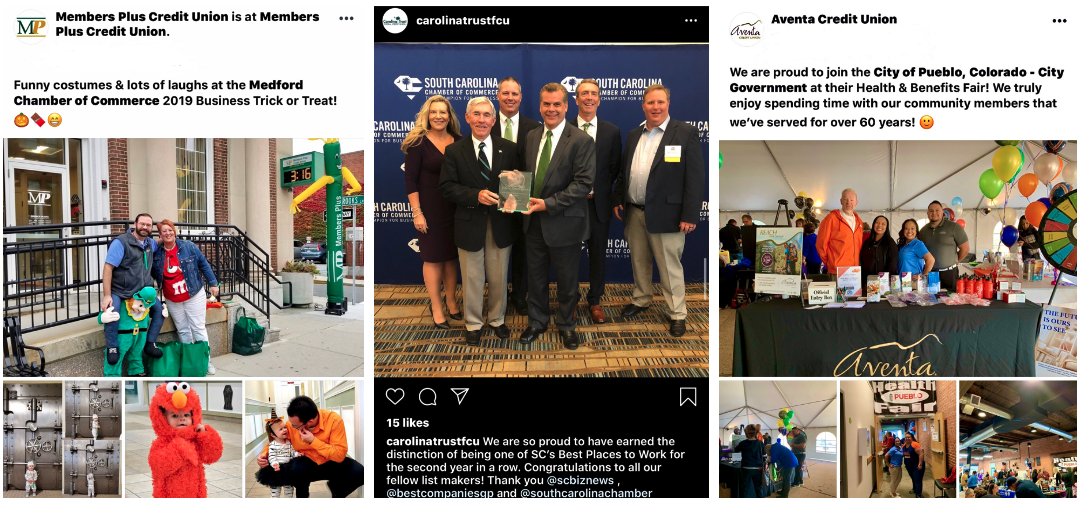

4. Behind the Scenes Photos

This type of content is a great way to showcase staff, community events, special events, branch photos, the possibilities are endless! Prove the strength of your brand and internal community by being transparent and authentic with the content you share online. Members/customers love to feel like they are a part of the team!

Here's some of our favorite examples:

Notice the quality of these photos? This is KEY.. Especially for platforms like Instagram.

You want to be sharing clear, colorful & eye-catching photos in order to get the engagement and performance you are striving for.

5. Sharing Financial Wellness Tips

Financial tips are a great way to bring visible value to your followers and showcase your thought leadership in the banking industry. With that being said, be careful about trying to sell your products within these posts.

Positive lifestyles and wellness habits are taking over social media platforms, whether it is fashion bloggers, fitness trainers or nutritionists, there are just too many influencer types to count!

Why not share your personalized knowledge about ways your followers can stay financially healthy?

However, be sure to keep it unique! You don't want to be sharing content that followers are already aware of... such as making a budget, not eating out, or cutting back on shopping. Make these tips creative, fun and attainable, this way you will gain your follower's attention!

"Content is King." Use these tips to help inspire your own online marketing efforts, or feel free to contact us about how we can help your Financial Institution with your own inbound or social media marketing strategy!

Post Comments

How Your Staff Should Respond to Positive & Negative Social Media Comments

No matter how hard you try to avoid it, eventually someone will say something not-so-nice on your one of your credit union social media platforms. And the delete button should only be used in situations that have no way of being resolved or clearly violate your social media policy. Here are 5 ways you should respond to negative social media comments.

1. On Social Media, Pick Your Battles:

Sometimes you have to follow the rule "the customer is always right." The picture below shows a meme of a "Sea Horse." Although this was a play on words (we were not talking about an actual seahorse) by agreeing with the comment, we turned this into a positive experience. No need to get into a grammar debate about something silly and fun.

2. Be a Mediator:

The only thing worse than one negative comment is a negative exchange between two (or more) people. You can't control what other people are going to say, so regular monitoring is critical to quickly defuse these situations. Thankfully, we chimed into this conversation early on, and actually got an apology!

3. Kill Them with Kindness:

In this day and age, we have little to no control over what comments arise on our social media business pages. And let's be honest, everyone is entitled to their own personal opinions. However, what you can influence is the way you respond to the opinions shared by others. How your team reacts to situations online will ultimately help quickly resolve any issues, but if your team let's emotion get the better of them, they can also make things much worse.

Responding to comments, reviews and complaints online in a positive manner will allow your followers to see you made the conscious effort to defuse any relevant situations and went out of your way to make things right. We recommend that you acknowledge any emotional perspective or feelings of frustration or anger. Oftentimes being heard is really what people want to know has occurred. Treating complaints as a learning opportunity for your staff and not always shifting blame will not only reflect on your FI's member service, but will also highlight your brand and mission for everyone to see!

In this example, several people were posting comments about another financial institution in the comment area on the page. No need to bash the other FI, after all, there's plenty of business to go around! So, share the love! :)

4. Even if You Do Not Know the Answer, Respond Anyway:

When you notice a question or concern about your product or service, respond immediately, even if you do not know the answer yet. For example, if someone says that online banking is down, and they cannot log in, consider responding with:

"(Name), are you still experiencing this problem? We are so sorry to hear you're having trouble with our online banking, thank you for making us aware of this problem. We will look into this immediately. Please feel free to private message us with any personal details if necessary."

Then make sure you do what you say you're going to do. Look into the situation as fast as you can and respond both publicly and privately once you determine what the issue is and/or have it resolved.

These types of problems that occasionally arise with online banking are also good reasons why you need to designate one staff member to be on call at ALL times, including evenings and weekends. If people can't access their accounts and share that with you online, they will expect a response within a couple of hours. You should meet these expectations of a quick response time whenever possible.

5. Be Helpful and Understanding:

If there is a less than positive post, instead of answering with a "well, you're wrong" type of attitude, guide them to resolve the situation.

In this particular instance, we followed up with this member privately via direct message, in order to safely retrieve their contact information. From there, we recommended that a staff member or manager follow-up with this member to formally apologize and make things better if at all possible.

The majority of the time, people share their thoughts and emotions via social media reviews because they want to be heard and they feel they haven't yet. By directly contacting the member, apologizing, learning from it and ensuring it won't happen again, you not only mend a relationship, but you gain back trust as well.

It's important to reply to the comment and if you can, share that the situation has been resolved. First, this lets anyone on your team know this has been handled AND second it let's the other readers/followers know you have reached out and corrected your problems with the individual.

It is important to keep up with any negative comments on your page and always respond with an appropriate and timely message. The vast majority of comments will be positive, but on the occasion that someone has something critical to say, it's essential that your staff responds quickly. By doing this you demonstrate that you take your customer's feedback and concerns seriously.

Tip: The only time you should delete a comment is if it is destructive, spam, individual includes profanity, includes personal or account details or is regarding illegal activity.

Engagement Contests

Social Media Contests that Really Work for Financial Institutions

With clients we always recommend they consider running some social media contests on their various platforms, just to get the proverbial 'ball rolling'. These contests have ranged from the old-school 'Page-Like' contest, which are now against Facebook promotion guidelines, to 'selfie' contests and perhaps even a larger incentive prizes like a paid mortgage for a year!!

Here are specific examples of social media contests for financial institutions you can implement today!

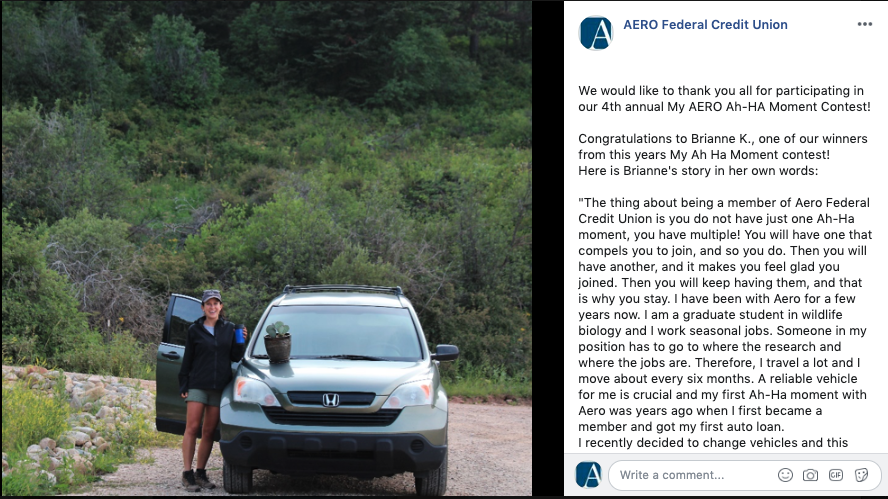

1. Member/Customer Testimonial Contests

Once your online audience has been established and you are consistently interacting with your customers or members, you should consider a testimonial contest. We typically run these for 3 weeks and promote them via emails, social media and social media ads targeted to members or social media users who have recently visited the website.

We recommend offering 1-3 larger prizes, like $200-300, to encourage members to share their experiences. You should also make sure to require 2-3 short paragraphs so that you get meaningful entries. Each entry should include a visual, as these add value to the testimonial and paint a picture to the story being told.

These typically yield 20-30 amazing entries (depending on your FI's size). These also make great content as the testimonials can be used throughout the year to promote your Financial Institution in emails, ads, blogs, social media and other online assets.

2. Pet Photo Contest- Comment to Win!

With the rules always changing on social media it's hard to know what contests will work and which will not. However, we've found some great results from several of our clients who have implemented a Pet Photo Contest!

With the rules always changing on social media it's hard to know what contests will work and which will not. However, we've found some great results from several of our clients who have implemented a Pet Photo Contest!

This contest is simple and fun for many reasons: 1. Who doesn't love cute pet photos 2. If you are like us you have plenty of pictures just waiting to be shared on your camera roll 3. Again, if you're like us you think your pet is THE cutest, sweetest, cuddly-est pet in the whole wide world 4. Add these to social media feed, stories or highlight wheels for fun and (extra) cute content.

Here's how. Ask your members, staff or followers to share a photo of their pet along with their name, type of pet and a 1-2 fun facts! Let the contest run for a few days and then randomly select your winners. We recommend 3-4 winners with a fairy large prize. ($25-$50 gift card)

The video is example entries from our client's staff pet photo contest: (& made into a highlight wheel!)

EXTRA BONUS TIP - Make a Landing Page with Full Rules

Facebook HATES long posts with a ton of marketing and disclaimer mumbo jumbo. We started making landing pages for our clients will the full rules and disclosures on them. That way we can keep the contest post short, sweet and engaging and link to the website for full details. This will give your post more organic AND paid reach.

Mistakes to Avoid

There is no such thing as a 'one size fits all' marketing strategy in today's day and age. In the fast-paced digital age, your strategy and techniques should change with each sunset and sunrise, on a day-to-day basis. We've recently written in detail about the Honest Truth About Online Marketing for Financial Institutions. Here's some mistakes you definitely need to avoid:

Mistake #1: Thinking That Because You USE Social Media You Automatically Know How to Best Run MARKETING There!

Just USING a social media platform doesn't make someone an EXPERT, it just makes them a USER. Often staff think that because they are on Instagram or Facebook during personal time, they will have the know-how to do marketing for their bank or credit union. But it's essential that staff get some training before getting started, and then continue to get support as your efforts progress.

That's why we always prioritize training along with implementation for clients. We offer amazing one-off training workshops for FIs and their staff, and we also work on a retainer basis for credit unions and banks that wish to be more focused and strategic with their efforts.

Mistake #2: Being Interruptive on Social Media

In case you're wondering, just broadcasting promos doesn’t work! Social media is about relationships.

As of 2023, there are 302.25 MILLION people in the US who have some form of social media presence. That is 91% of the current US population! This number is continuously growing, so it's essential to be present on these platforms.

But no one wants to be jarred out of their online experience. If you are posting on Facebook don't just share about your products and services and talk on and on about yourself! Don't be the annoying person at the party who only talks and never listens. Be inspired by the platform and share content that is appropriate.

Our biggest rule... we tell clients to focus on being either ENTERTAINING or USEFUL. Period.

Mistake # 3: Not Having a Clear Strategy with a Clear Timeline & SMART Goals

Without this how do you know what you are really trying to accomplish?

According to Google’s Zero Moment Of Truth study, the average consumer takes a minimum of 30-60 days, and often longer, when making purchase decisions around banking. And they consult an average of 8.9 sources of information in this decision-making process!

Clearly social media (and other digital assets) must be a key part of a financial institution's marketing strategy.

When your customers interact with you on social media they create a digital 'paper trail.' Their friends and family can actually see that interaction, and this type of activity can create reach to people you otherwise wouldn’t have been able to connect with. This type of 'word of mouth' is so much more effective than other forms of awareness because it’s coming from someone they know.

Mistake #4: Not Putting Significant Budget & Ad Dollars Behind Social Media Efforts (This is All About Priorities!)

Think of it this way... Banks and Credit Unions will invest on average $1.3 million to build a new branch and call it an asset, but if you suggest they spend $60,000 for redesigning or marketing their website and they think of this as an expense. This is a slippery slope for FIs.

Branch traffic is undoubtedly on the decline (with in person teller transactions having decreased by 45% since 1992), but website and mobile traffic has never been higher. In fact, according to The Financial Brand, 61% of U.S. internet users bank online, and that number is only increasing! Clearly Banks and Credit Unions need to adjust their marketing budgets accordingly!

The Free Guide

/Winning-with-Social-Media-Marketing-Exculsively-for-Banks-and-Credit-Unions-by-FI-GROW-Tablet.png)

Send a free copy to your inbox now!

Work With Us

FI GROW Solutions helps banks and credit unions with marketing and sales strategy from individual campaigns to mergers and full rebrands. We also build new websites into fully functioning and robust digital branches.