Bank & Credit Union CEOs, Time to Put Your Money Where Your Mouth Is!!

Don't Miss An Episode, Subscribe Now

Ok, so now that I have your attention, we really need to talk about your priorities.

It’s been over five years now that we've worked with only community banks and credit unions around digital sales and marketing, and I’m continually noticing one thing again, and again… There seems to be a desire from CEOs to shift the organization's approach to acquiring new customers or members and asset growth, but there remains a lack of real commitment to make this change happen using digital assets. Let me explain.

Our agency has just recently started helping clients project manage website redesigns, so we know first hand that if you really want to grow your Financial Institution your website should be:

- Your BEST sales person,

- Your branch that literally NEVER closes, and

- Your highest trafficked location, by a MILE!!

But, in a recent survey from my friends at CU Grow, they noted that the average Financial Institution spent $40k on their website. The average bank branch costs well over $1 million, and this doesn’t even include annual maintenance costs!

So, what is the deal with these kinds of budgeting priorities? A website should be constantly tweaked, maintained and optimized; it should be designed out of the gate to convert leads, and sell your amazing products and services. This won’t happen with a measly $40k budget and then three years of stagnation until you touch it again!

This shift is called growth driven design, and it works! (Google it!)

And the website process is just the start of my complaints around budgeting in community-based financial institutions. What about marketing budgets?

I consistently see mid-sized FIs with only one person in the marketing department, or maybe two, if they are lucky! And these staff are also constantly asked to do projects outside of their marketing area of responsibility. They often don’t have time or access to on-going training to stay up to speed on the changing marketing place, and they lack budgets that are flexible and growing.

Again and again I hear from CEOs that they want loan growth, customer growth, more engagement, and to better connect marketing leads with conversions. But you can’t do all of this without making a real commitment to process, and that requires three main things: 1. Staff, 2. Budget and 3. Time!

Here’s why…

Staffing Changes Needed at Community Financial Institutions

Now I’m not saying you need to go out and hire a bunch of new people, but there are two clear shifts happening within the institutions that I see having the most digital success.

First, FIs need to train teams around the changing consumer buying journey and how to better reach members and potential new members online and via mobile.

This can include working with an outside partner for training or attending one of the many training programs put on by CUNA or other great national and regional conferences.

I also firmly believe that you should encourage (read: require) staff to allocate 1-3 hours per week for online or in-person training of some kind, and then make sure they have the time available to make this happen. (And this means NOT over-loading them with ad-hoc requests of all sorts that fill up their days!!)

Secondly, if I were a CEO at a credit union today, I would strongly consider consolidating marketing and sales staff under one departmental umbrella of business development or revenue growth.

This is needed because marketing and sales teams MUST be more closely aligned to better coordinate the handoff of digital leads for member service sales follow up. And having revenue teams that work together to meet growth goals is the key! There should be absolutely NO competition between these two groups for staffing or budget. It must be a unified effort.

[FREE DOWNLOAD: E-Book - 12 Decisive Steps to Grow Your Financial Institution]

Budget Changes in Financial Marketing that Really Work

Now here’s where things get tricky for me, as I’m NOT a numbers person, and would never claim to be. But I know that FIs have the funds they need to make many of the changes I’ve already mentioned.

The money is somewhere, it’s just about priorities.

If branch walk-in traffic is down, then what are you doing to re-purpose your staff in those locations to better leverage their time, expertise and knowledge? Why not create a team of marketing and member service (sales) professionals that work as a unit, some in headquarters AND some in branches, and connect marketing and sales efforts with actual conversions?

Give your team a shared budget for digital ads, social media, a marketing tool or integrated CRM, and content creation, and then let them use these channels to bring in new members or launch campaigns to cross sell to existing members!

The FIs we see having the most success have created a growth team that spans departments and brings talented staff members together in multiple locations.

But this isn’t the status quo, it’s not easy, and it takes budget and time to develop.

Digital Growth is a Marathon, Not a Sprint

I was on the phone with a CEO last week and he and I had a great conversation about all of these shifts in digital priorities and approaches. And then he asked me, “well this is all great and I like it, but how can I grow loans NOW?” Truly, I was at a loss.

We are NOT in the business of driving short-term bumps in loan growth for a financial institution. That’s just not what we do, and that kind of short-sighted approach will NOT lead to long-term success.

We are advocates of the long game, and you want to know why?

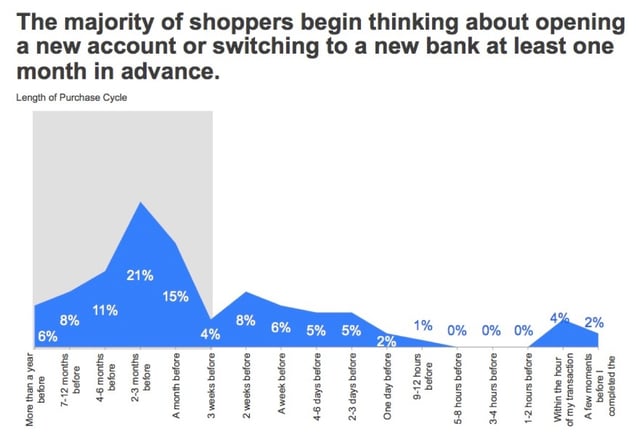

The average banking consumer takes 3 weeks to 6 months to make a new account or product decision! And they consult on average 8.9 sources of information along the way. These are big purchases for most people, and these kinds of decision don’t happen overnight.

Furthermore, hawking special rates to get short-term loan growth won’t help your financial institution build a foundation for long-term success.

In order to remain relevant in this age of Fintech and online-only banking opportunities, local banks and credit unions need to continue to build trust and rapport with their customers/members. And you don’t do this with fly-by-night rate promotions.

You do this by providing meaningful financial solutions and building real relationships with people. You do this by being understanding, and treating people with care and compassion. And these things can be highlighted digitally with great content, testimonials and thoughtful campaigns.

These are the characteristics that make community financial institutions continue to stand out in today’s financial world, and these will be the foundation for building future success. But without proper staffing, budgeting priorities and a time commitment to the process, these advantages will be lost to big banks and ever evolving Fintech solutions.

If you want to learn more or if we can help please get in touch with me! We live for this stuff! :)

This is a Guest Blog that Originally appeared on CUInsight.

Blog comments