Better Aligning Sales & Marketing for Your Bank or Credit Union

Don't Miss An Episode, Subscribe Now

This live blog is based on my attendance to the live virtual session at Inbound 2020 - from Jeff Davis "Togetherness: Aligning Sales and Marketing to Accelerate Growth"

Key Insights in this Discussion of Better Aligning Marketing and Sales at Your Financial Institution

1. Are Sales & Marketing Misaligned? Here's a few indicators that you might have a problem...

Poor quality leads can indicate that there is a misalignment between the two teams. If marketing and sales goals don't coordinate this will lead to huge problems.

If there is no sharing of information between both departments there will be less long-term success or there's a dysfunctional or overly competitive relationship between the two teams you might have misalignment.

Dd you know that 80% of leads generated by marketing are ignored by sales?... But believe it or not, marketing expertise can give sales insight into a few key characteristics that help drive increased sales.

Discover More: What Executives Need to Know When Investing in Digital

2. Organizations are Making these Decisions Via Consent NOT Consensus

Often organizations have 10+ stake-holders in the mix when making decisions that will better align sales and marketing, and getting this many people in complete agreement can be virtually impossible.

Here are several steps to get leaders on the same page and in agreement to consent to move forward, even if they are skeptical.

KEY Steps to Better Sales & Marketing Alignment

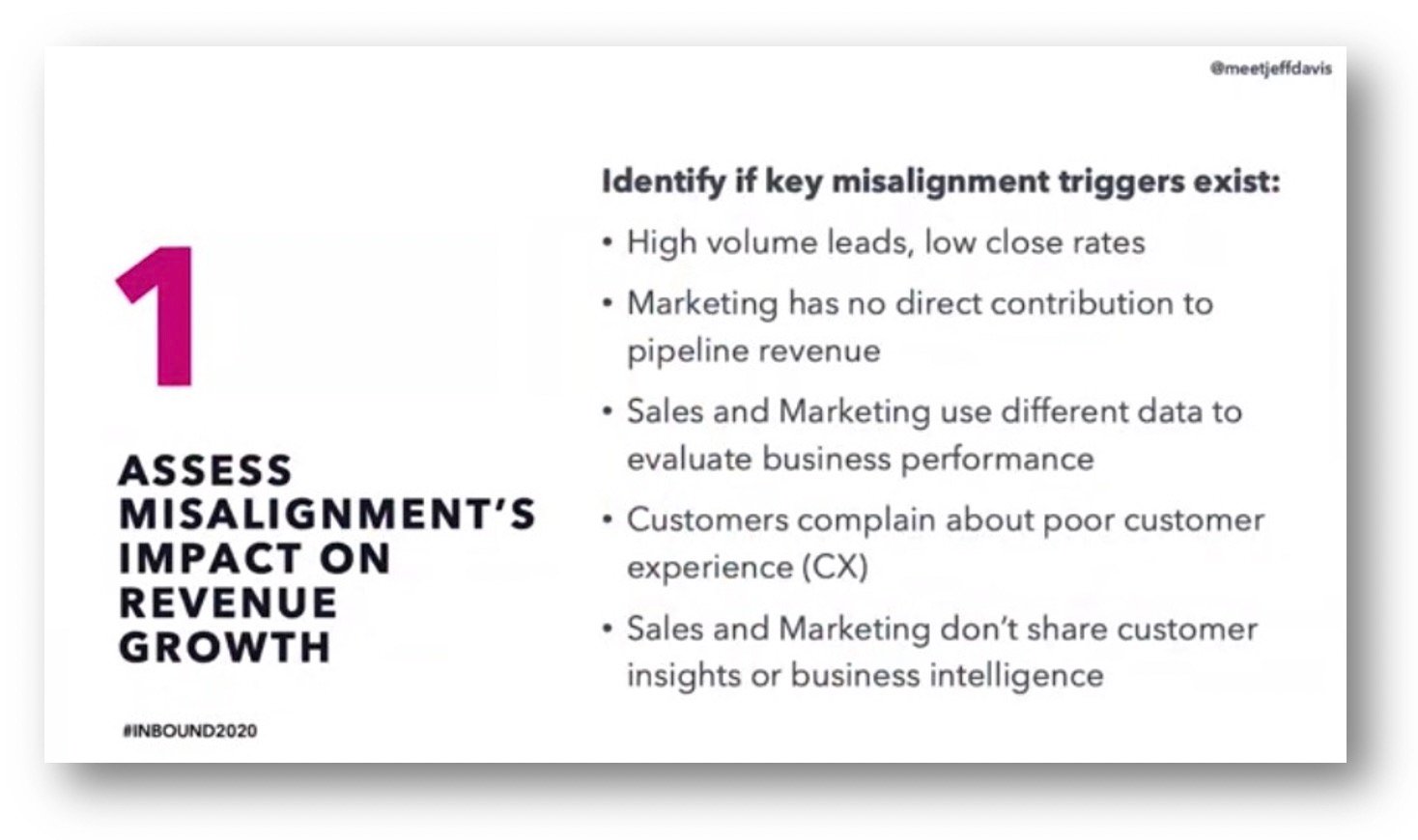

1. Assess the Misalignment - Q: Is it having significant impact on revenue growth?

You'll need to have a senior team and stake-holders meeting and work though some of the metrics that could indicate that there is an issue. Are you seeing high volume leads but low close rates? Is the customer experience suffering? Are there few ways sales and marketing share customer insights with each other on a regular basis?

Answering yes to any of these questions is a clear indication that you have a misalignment between your sales/customer service and marketing teams.

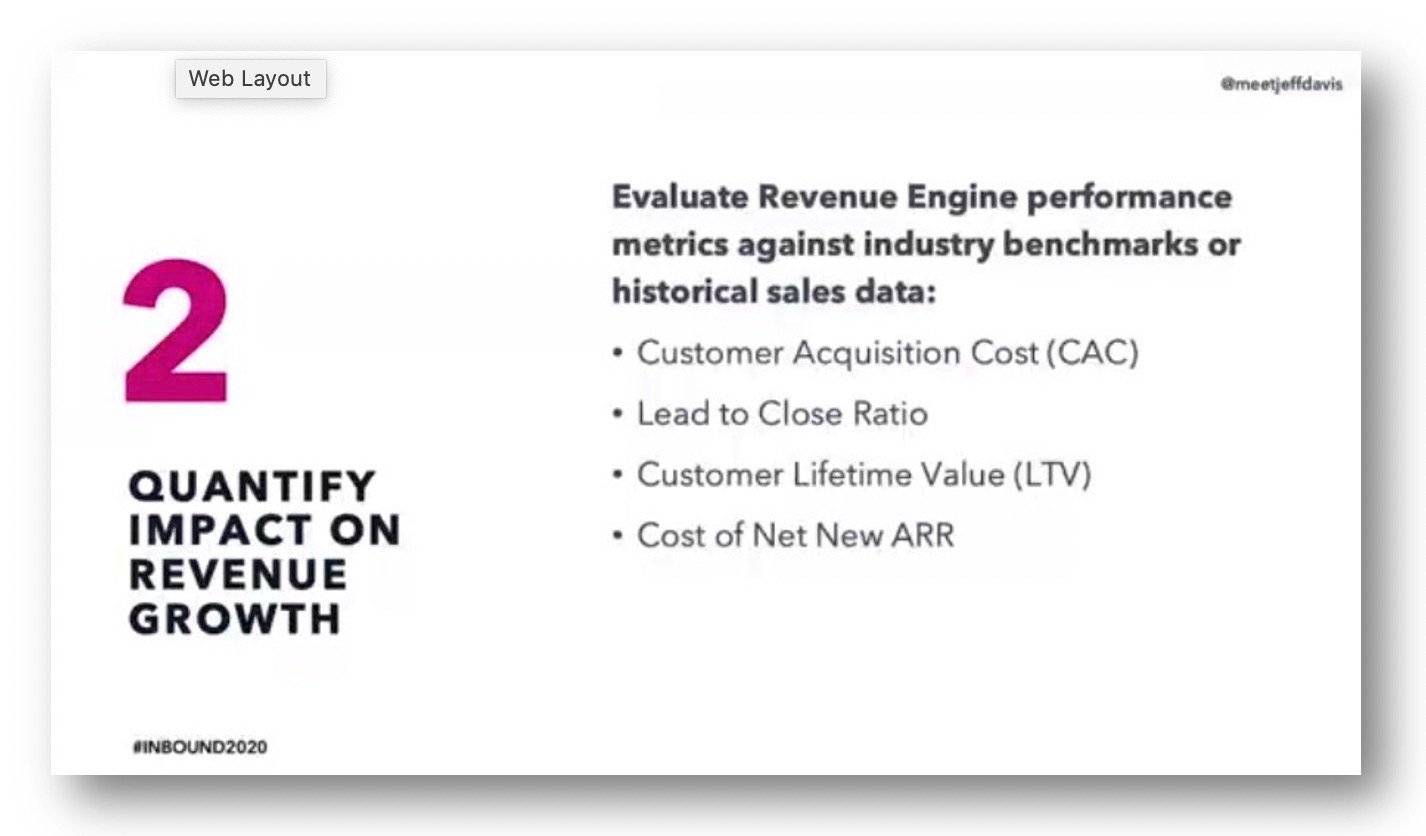

2. Quantify the Impact of Misalignment on Revenue Growth

Lead to close ratios should be getting better and the lifetime value of customers needs to be understood and should also be improving.

Many smaller financial institutions can't even accurately assess the lifetime value of a typical customer. This lack of data leads to less effective alignment between sales and marketing and certainly less profitable results over time.

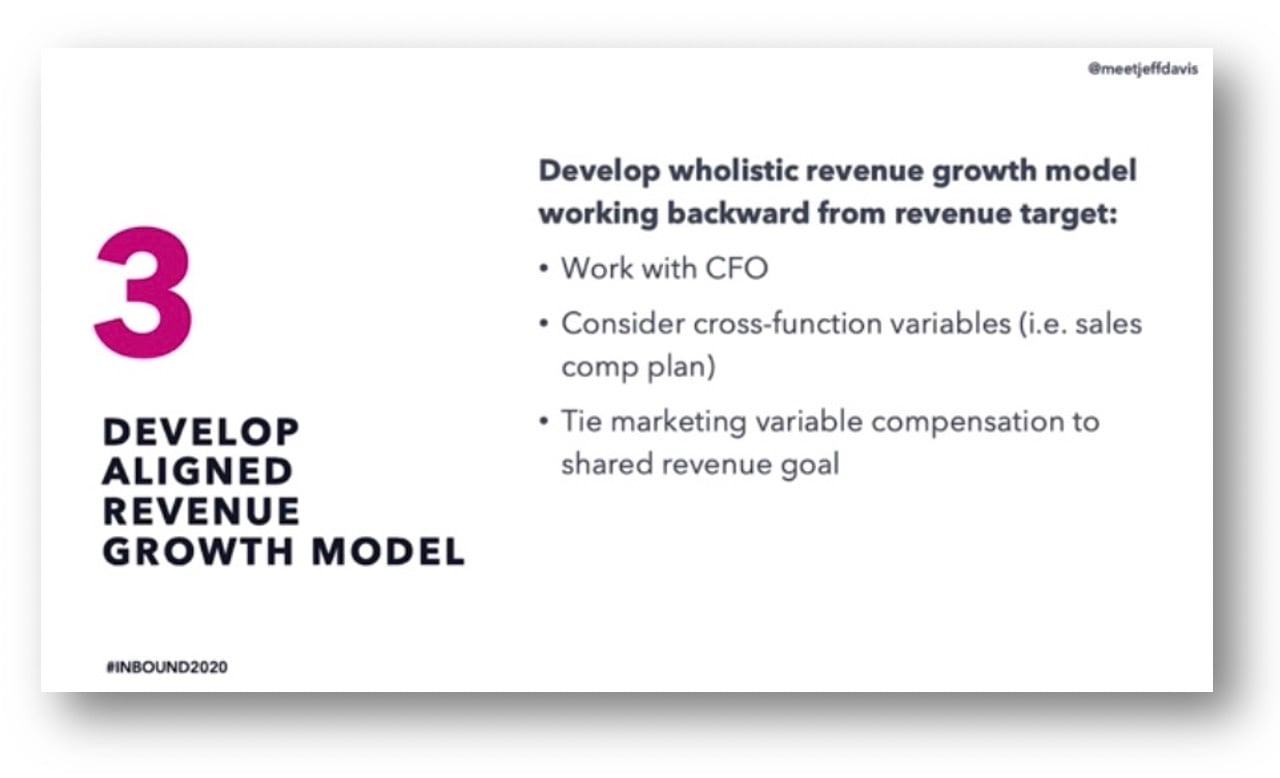

3. Develop Aligned Revenue Growth Model - Will Show What the Future Can and Should Look Like

But changes can sometimes lead to concern. For example, if you say you're going to get better at targeting a new, more specific audience, this might decrease the volume of leads, but INCREASE the quality and close rates of those leads. Make sure to manage expectations around these kinds of shifts in key progress indicators.

Some of the next steps Davis also mentions include...

- Secure Sponsorship of CEO

- Share Data Between Departments

- Develop a Cohesive End-to-End Process

- Collaborate

Davis discusses these steps in detail in his new book "Create Togetherness."

A few final take-a-ways for leaders at banks and credit unions:

1. FAQs Can Indicate Interest - Talking to member or customer service teams is often the BEST way to decide on new topics that marketing should create content around.

If you use frequently asked questions to drive new blogs or email tips/tricks you'll find these topics will likely drive increased engagement and higher click-through-rates won't be far behind. And that traffic, when well-nurtured, can turn into new customer leads and eventually new accounts or loan growth.

2. Past Purchases Can Predict Future Growth - This is just logical. If someone has purchased from you already they are much more likely to increase their relationship, especially if they've just had a positive experience.

Better alignment between sales and marketing can lead to robust new customer on-boarding programs, which will include elements from marketing AND customer service.

Contact us to discuss how we can help your team better align marketing and sales for long-term growth.

Blog comments