Fueling Growth by Changing How You Measure Marketing Results

Don't Miss An Episode, Subscribe Now

Again I'm back at one of my favorite events of the year, INBOUND in Boston. This morning I attended a session that inspired to me to write a blog about how to better connect marketing, sales and ads in your Financial Institution.

Live Blog from Inbound19: Based on the session presented by Sahil Jain, CEO & Co-Founder of AdStage

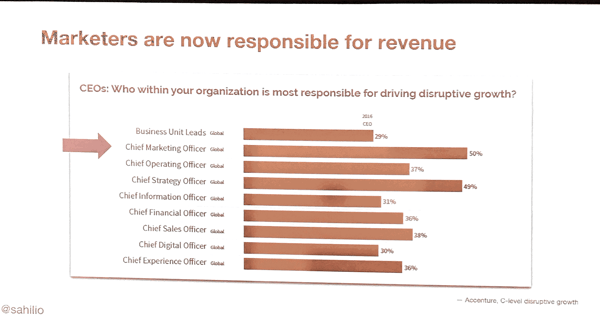

Over the last five years the CMO role has changed dramatically in every industry, and this is also happening at Financial Institutions. Rather than thinking of marketing strictly as a cost center, CMOs and marketers are now tasked with driving revenue growth.

In fact 50% of CEOs say that CMOs are the most responsible for driving revenue impacts.

Discover even more about growing your financial institution with Inbound Marketing.

But marketers are struggling to align their efforts with their internal sales teams. And according to a study by MarketingSherpa , 79% of leads will never convert, and of the leads that are passed on to sales, 73% are never even contacted!

But when they do revenue grows! According to HubSpot by as much as 208%!!

So what should your bank or credit union do? - Well we suggestion creating a SIM squad - Sales Inbound Marketing Team. Jain agrees, but calls it by a different term...

Create a 'SMARKETING' TEAM

Consider melding sales and marketing teams to remove the disconnect and help align lead generation with lead follow up. When you do this you will also need a Service Level Agreement (SLA) between the members of the team.

I've written about why it's important for credit unions and banks to create these kinds of agreements between marketing and sales in the past.

A high quality SLA will ensure that the marketing team at your bank or credit union will understand exactly how many leads they need to generate each week/month/quarter/year, and they will also consistently know when to hand these leads off to the sales team members.

And a well-crafted SLA with your sales or member service team members will provide clarity to all involved regarding the level of follow up that is expected, once leads are sent on for sales follow-up.

Your 'SMARKETING' team should be meeting weekly and this group of professionals should be encouraged to interact daily via email or chat. When you start your new SIM Squad we recommend you schedule the meetings to reoccur each and every week, without an end date. This way you won't start strong and then trail off after just a month or two.

Once you have your team you'll need some data to help them improve their results.

Using Digital Ad Data to Help Drive Results

Marketers in all industries need to stop focusing on top-of-funnel results like impressions, leads, and clicks. This is all too true for marketing at banks and credit unions. Instead you need to find ways to track actual new customers back to your digital marketing campaigns.

One of the ways Jain explains you can do this is UTM codes or other tools to track specific ad campaigns all the way to revenue generation.

He detailed that the first and most technical step in this process is for your team to add UTM code to your lead capture forms so that you can track the ad source for every single contact who converts. If you are able to do this and then combine that data with conversions you'll see exactly which ads and campaigns are driving your leads as they convert.

A tool like HubSpot or Salesforce integrates with these various ad platforms making tracking much less manual.

In addition, you should consider using your internal lead lists from various stages of your sales funnel to target people who are similar to current leads or customers and retarget leads who haven't yet converted. You can do this with Facebook Ads by building website custom audiences and lookalike audiences to expand these size of your audiences.

With this approach you can target leads as they are in the midst of considering your products or services, and you can also target other people who are demographically similar to the people who have already converted to new leads or sdcustomers.

Google AdWords also offers conversion tracking that you can connect with many CRMs to create closed-loop reporting so that you can measure exactly which specific digital ads are driving which new customers and how the value of these new accounts or loans lines up with your spend to acquire them.

HubSpot is also rolling out an attribution report that will help users see the original sources for new leads and contacts. This may also be helpful to prove the value and revenue impacts of specific ad campaigns.

.jpg?height=500&name=File%20(6).jpg)

Blog comments