The Ultimate Guide to Successful Digital Growth for Financial Institutions

Will your Financial Institution survive the next 10 years? We believe that without effective digital innovation

the answer is NO!

Introduction

Will your Financial Institution Survive The Next 10 Years?

Without a prominent and reputable digital presence, it's likely your bank or credit union won't survive over the next 10 years. A digital-first strategy has never been more imperative. Content Marketing is key to building trust online and growing your presence in the digital space.

With search engines like Google processing millions of search requests every minute, your financial institution should be actively working to build or improve inbound marketing and sales efforts. Consumers rely heavily on search results to educate themselves and make purchasing decisions. Gone are the days of checking multiple websites for information. In today’s marketplace, the winner of the search results race wins the business.

With machine learning performing better than ever, the content that will make it to the top of the search results will be helpful and relevant content from trusted providers. The content that makes it to the top will provide value to the consumer based on their shopping and purchasing habits, be appropriate for the specific stage of their Buyer’s Journey, and be developed with inbound methodologies at their core.

We can help you assess your current content strategy and get you prepared for success moving forward!

In this complete guide, you'll gain an understanding of what Inbound Marketing is, how to use it, and how to create educational content to increase revenue streams and member/customer growth for your Community Bank or Credit Union.

Send a free copy to your inbox now!

Getting Started

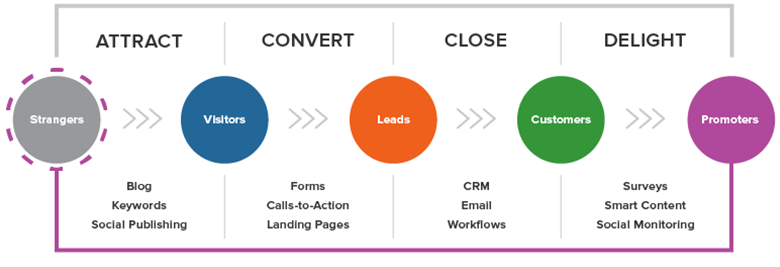

What is Inbound Marketing (via HubSpot)

"Inbound marketing is focused on attracting customers through relevant and helpful content and adding value at every stage in your customer's buying journey. With inbound marketing, potential customers find you through channels like blogs, search engines, and social media. By creating content designed to address the problems and needs of your ideal customers, you attract qualified prospects and build trust and credibility for your business."

-HubSpot

Let's dive deeper into what that means for community banks and credit unions, and how that's a shift in fundamental marketing practices from traditional marketing strategy.

Outbound Marketing vs. Inbound Marketing

Outbound marketing is an interruptive approach to positioning your message in front of a consumer. TV commercials, radio spots, social media ads, and video pre-roll ads, are all examples of inserting your content into a medium in which the consumer was there for a different purpose.

Over the years, outbound marketing tactics have evolved significantly. Today marketers are able to place ads with greater relevancy in front of potential consumers that may be 'in market' for their products and services. Through behavioral-based targeting algorithms, marketers are now able to place ads with the right message in front of the right person at the right time, thus increasing conversions.

The downfall of outbound marketing tactics is that the same tools that allow marketers to place these ads, also allow consumers to block them or more easily ignore them. Today's consumer can skip TV commercials, has access to ad-free music, can block ads on social media, and block display ads. The consumer has almost equal control in stopping ads as the marketer does in placing them.

It is not advisable to abandon outbound marketing tactics, as they do still work quite well. However, if outbound marketing is your only marketing strategy, your access to potential new customers and members is declining.

Inbound marketing starts with the consumer in mind. It is about being where the consumer is, with the answers they're looking for, when they're looking for them. It's about helping, not selling. Inbound marketing strategy embraces the way today's consumer shops. This type of marketing approach educates your target consumer and ultimately helps them make their purchasing decisions by providing valuable resources (as opposed to interruptive ads).

Digital consumers typically begin their quest for a solution to a problem by turning to the internet or an internet-based virtual assistant. When Google's name became a verb around 2002 it was a moment of acceptance that online search was the new "go-to" medium for help, education, and information, and the start of the Buyer's Journey. (see Buyer's Journey below).

Inbound marketing aligns your Community Bank or Credit Union's products, services, knowledge, and expertise with the Buyer's Journey through the content found in an internet search. This content could be in the form of blog articles, eBooks, guides, white papers, videos, infographics, checklists, and more.

If you're like most community-based financial institutions, the idea that inbound marketing requires the production of content can seem daunting and unrealistic (it's not like you have people sitting around doing nothing, who are waiting to become bloggers). Resource restraints and restrictions are a common challenge for Community Banks and Credit Unions.

But this challenge of resources doesn't lessen the importance of inbound marketing and the role it should be playing in your overall growth strategy. We will discuss solutions to available resources below in the Inbound Marketing Agency or In-House Production section.

A good marketing strategy for any financial institution includes both outbound and inbound marketing tactics. Rather than thinking about Outbound Marketing vs. Inbound Marketing, you should be thinking about Outbound Marketing and Inbound Marketing. The key is to ask yourself... how can we utilize both approaches to meet our growth goals, reach our annual metrics, and maximize ROI? Read on for the answers!

Beyond The Basics

The Buyer's Journey: Inbound Methodology

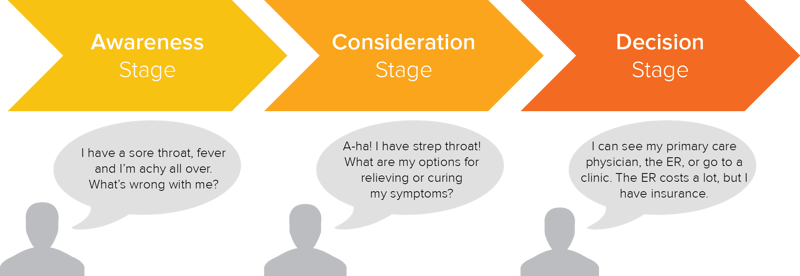

The Buyer's Journey consists of three stages: Awareness, Consideration, and Decision. Some Buyer’s Journeys can happen quickly, in a matter of seconds or minutes. Others can take days, weeks, months, or even years! It’s important to understand the average length of time a buyer takes to move through these stages for each of your product and service offerings.

The Buyer's Journey Simplified:

Inbound methodologies capitalize on the Buyer's Journey to deliver relevant content at the exact moment when the consumer is seeking help. Community banks and credit unions should not only have several sources of information available for each product and service line but they should also be positioned to deliver this relevant content for several months in advance of the actual conversion taking place.

The type of content available to a consumer must vary for each stage of the Buyer's Journey to be impactful. If a consumer is considering a new vehicle it's likely they'll search with a question like "should I buy or lease?" while in the consideration stage. Consideration stage content may be formatted as a blog post, infographic, video, or checklist, but it wouldn't include information from the Awareness stage such as 'saving for my first car' or the Decision stage like 'current car loan interest rates and application tips'.

Delivering the right information at the right time is imperative to ensuring visitors feel the content is valuable, therefore finding value in the institution that provided it.

Understanding the Buyer's Journey for each product and service is the foundation upon which successful content can be developed and full-circle reporting expectations should be refined. It is also crucial in providing an experience that demonstrates trustworthiness, advocacy, and intent to develop a meaningful relationship with your customers/members. Content that is structured correctly conveys the ideals and beliefs from which community-based financial institutions were derived.

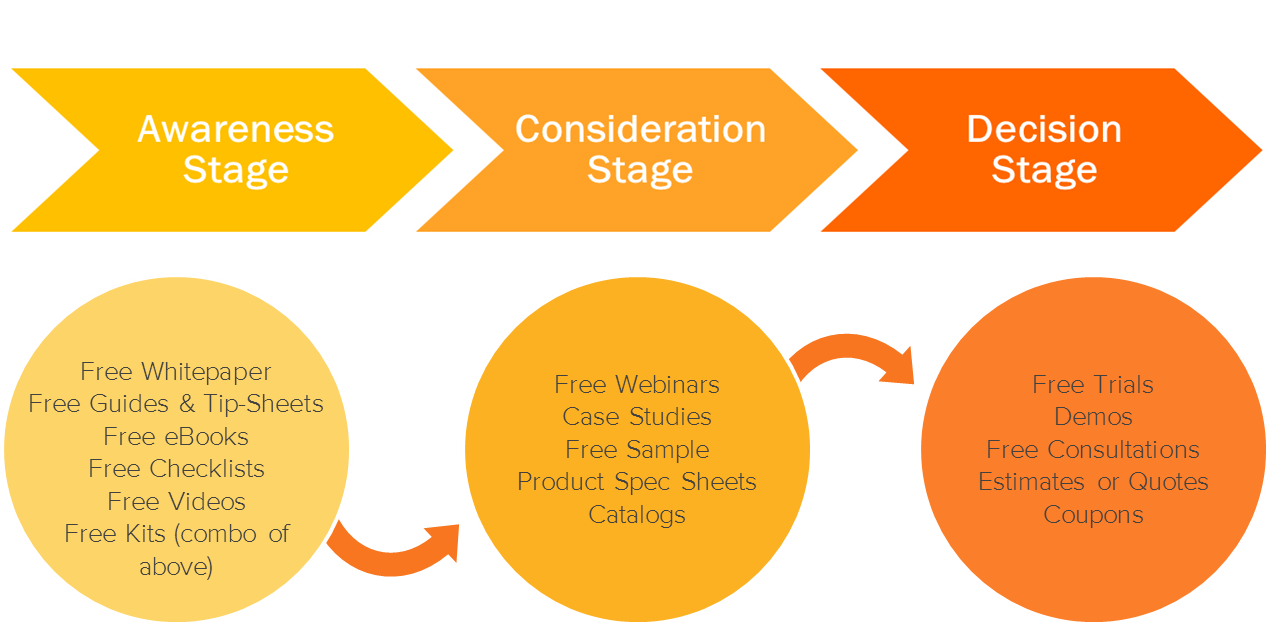

Types of content for each Buyer's Journey stage:

How Does Inbound Marketing Work

As we've said, Inbound Marketing is a way of attracting potential customers by way of providing helpful, valuable content and resources at the point in time in which they are looking to solve a problem or pain point. In order for this methodology to work well (or at all), there are two overarching elements that must be optimized: content and delivery channels.

Inbound content development: The format for inbound content varies, and a successful strategy doesn't have to include every format available. Inbound content can be produced as blog posts (most common), eBooks, videos, infographics, checklists, guides, reports, white papers, podcasts, comparisons, case studies, product demos, and more. The key aspect to planning great inbound content is that it must align with the Buyer's Journey, provide value to the recipient, and never be 'sales-y' in nature.

The context of the content should vary based on a product or service and be appropriate for the intended Buyer Persona. A minimum of three pieces of content for each stage of the Buyer's Journey for each Buyer Persona is recommended.

Inbound delivery channels: The primary delivery channel for inbound content is through Search Engine Results Pages (SERPs). Because consumers rely so heavily on internet search results for their information, inbound content must be fully optimized for search. This includes strong titles with keywords (based on keyword research) in both the title and meta descriptors. The body of the content should have appropriate, optimized headers throughout (H1, H2, H3 tags) and the content itself should be high quality.

Content should also be structured into content clusters. You can learn more about content clusters in this video from HubSpot.

The top secondary channel for inbound content is social media. Financial institutions struggle with social media when it comes to products and services because social media is primarily used for entertainment and networking with friends and family. The audience there, although they likely could benefit from your products and services, have little interest in hearing about them while on their social networks.

So then why does inbound content perform so well on social channels for Community Banks and Credit Unions? Because it's helpful! While product and service ads are typically ignored on social platforms, an article sharing tips about how someone saved hundreds on their car purchase or the top 5 mistakes people make buying a home are interesting and provide value. These are titles that people click on to learn more and share with others if they find the information to be helpful.

Other channels for inbound content placement include newsletters to existing customers/members, the financial institution's website, video platforms like YouTube channels, and blogs.

Inbound Marketing Strategies

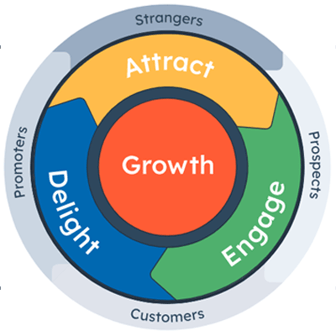

When the right content is developed, optimized, and published for the right stage of the Buyer's Journey and it's shared across the appropriate channels, the first step of the inbound methodology is complete. This step is known as the Attract stage of the inbound methodology. Your goal of attracting the right people to your website, with the right helpful content, at the right time exactly when they need it, will help you build authority in the search results for the topics that matter most to your customers and members.

The next step is the Engage stage. This stage is important to demonstrate to your prospective customer or member that your entire organization communicates and engages in a way that makes them want to build a long-term relationship with your Community Bank or Credit Union. When you are engaging properly, you are providing them with useful information and helpful tips no matter what form of communication the prospective member or customer prefers (email, live chat, bots, messaging apps). This includes not just the marketing department, but the front-line staff, call center, and especially your sales team. The goal is always to sell a solution, rather than a product. Using CTAs, forms, landing pages, and workflows, you can capture useful information to customize their message and experience.

The next step is the Engage stage. This stage is important to demonstrate to your prospective customer or member that your entire organization communicates and engages in a way that makes them want to build a long-term relationship with your Community Bank or Credit Union. When you are engaging properly, you are providing them with useful information and helpful tips no matter what form of communication the prospective member or customer prefers (email, live chat, bots, messaging apps). This includes not just the marketing department, but the front-line staff, call center, and especially your sales team. The goal is always to sell a solution, rather than a product. Using CTAs, forms, landing pages, and workflows, you can capture useful information to customize their message and experience.

The Delight stage is the final step to the Inbound Marketing Strategy that ensures your members and customers are content, supported, and thrilled when remembering the experience of working with you long after they make a purchase or become a member. Delighted customers and members become your best brand advocates, so you can be certain this step is worth the effort. In order to delight, you must continue to incorporate thoughtful, well-timed solutions to assist and support your customers. Some tools include chatbots, surveys, customized smart content, and social media listening.

The Right CRM Is Essential

Having the right Customer Relationship Management (CRM) tool is crucial for capturing and nurturing leads.

The right CRM will capture leads and allow for successful marketing follow-up via nurture campaigns and successful sales follow-up utilizing customer data such as browsing history, entry source, pages viewed, and contact details just to name a few. Makeshift processes that include website contact forms hosted with an external vendor passing information to an internal record-keeping source (such as an excel document) make it extremely difficult to succeed in moving a customer from the Convert stage to the Close stage, and nearly impossible to Delight the customer into becoming an advocate or promoter of our institution.

One common mistake is asking the visitor to provide too much information about themselves on a download form. At some point, the information being requested won't be worth the value of the content they wanted. Instead, using dynamic forms will capture a new piece of information about the visitor each time they download a new piece of content. By hosting all of the visitor's activities in the same place it becomes easier to piece together what the visitor is interested in and which stage of the Buyer's Journey they're in, without asking excessive questions.

Between the Convert and Close stages is when a contact, or Lead, is classified as a Marketing Qualified Lead (MQL) and a Sales Qualified Lead (SQL). The point in time in which an MQL becomes an SQL varies for each product and service, based on the average length of the Buyer's Journey for that product. A Credit Card Lead will become an MQL and then an SQL much more quickly than a Mortgage Lead, as the depth of nurturing required to move a contact along the Mortgage Buyer's Journey is greater. It's simply a longer process to apply for a home loan than for a new credit card, and a successful content strategy must reflect that difference.

Guide Continued Below ⇓

Send a free copy to your inbox now!

Ready To Grow

Inbound for Deposit, Loan, and Membership Growth

Deposit Growth

Inbound methodologies are built around one concept, helping people. Delivering the right content, at the right time, when someone is searching the internet for solutions.

If a consumer is specifically searching 'CDs' or 'Money Market Accounts' they're already at the consideration or decision stage of their Buyer's Journey and are looking for product-specific information. A well-optimized website product page would be most likely to appear in the search results rather than an eBook for download on Certificates or Money Market Accounts.

Inbound campaigns are better served for search results for terms like 'investing', 'financial planning', 'budgeting', or 'wealth management'. These are the topics pillar pages should be focused on (see more on pillar pages below). Once the guide or eBook has been created on the broader topic, nurture content delivered after the initial download of the pillar page content can position core deposit products as solutions. For example, the nurture campaign for an investment pillar page could include blogs with titles like How to Layer Certificate Terms for Maximum Return, or Starting an Investment Portfolio with Money Markets and CDs. The nurture content should also be helpful in nature, not sales-y.

Loan Growth

This is where inbound can have the greatest impact for most financial institutions. Not everyone has money to deposit, but most have a need to borrow.

Loan products and solutions require a significant amount of research during a Buyer's Journey. From car-buying to credit cards and home loans, the volume of questions asked by consumers is almost endless, which means there are many opportunities for financial institutions to position themselves as experts and help during the Buyer's Journey.

When developing content for loan campaigns, reach outside of the four walls of your institution and help answer common questions related to the purchase, not just features, and benefits of the products available at your Community Bank or Credit Union.

A common search term for auto buying is 'lease vs buy car?' This question isn't just for a car dealership to answer. And, when answered by a financial institution it can lead to additional content such as Things to Watch Out for at the Dealership and Don't Get Suckered Into More Car Than You Can Afford.

First-time home buyers are an endless source of questions. By offering helpful content that covers a span of questions from 'which school districts are the best?' and 'crime rates by city', to 'what is PMI?' and 'can I afford a house?' it positions your institution as experts in the area of homeownership. Consumers want to feel like they have an advocate when it comes to homeownership, not just getting a home loan.

Building trust and rapport through helpful, meaningful, engaging content that's consumer-centric will lead to deeper relationships and more success in increasing loan portfolios.

Membership Growth

Because it's not reasonable to think someone would download an entire eBook about your financial institution filled with all the reasons you think they should develop a relationship with you, you'll need to find a different tactic to attract new members/customers to your institution through inbound. Below are a couple of options that are effective in attracting new prospects to your institution.

A vs. B: Searches with the terms "best" and "near me" are at an all-time high. Consumers want the best that's available and options that are geographically near them. To compete against major FinTech online brands, capitalizing on this desire for physical locations (whether they'll use them or not), is a strategic advantage for Community Banks and Credit Unions.

Content offers that compare products and services between financial institutions and/or geographic locations are helpful downloads for consumers. Pros versus cons lists, checklists, and infographics that compare credit cards (rewards and rates), auto loans (features and rates), and even complete financial relationships (Online Bank vs. Community Bank or National Bank vs. Credit Union) provide value. Titles such as The Best Home Loans in XYZ County also have great click-through rates.

When doing the research for these types of content you'll learn a lot about your competition that can help shape future product and service development. If you choose to go this route, be honest in your comparisons and in the information you provide. You're not going to be the best in every category and when you show that others may perform better than you you're demonstrating to consumers you are trustworthy and have their best interests in mind.  Lifestyle Content: Every product and service provided by financial institutions serve the same purpose. They allow consumers to live the lifestyle they have chosen (or the ones they've found themselves in) and/or the lifestyle they're planning for.

Lifestyle Content: Every product and service provided by financial institutions serve the same purpose. They allow consumers to live the lifestyle they have chosen (or the ones they've found themselves in) and/or the lifestyle they're planning for.

Developing content around lifestyle choices and desires is not only relevant and helpful, but it can also be a lot of fun for staff.

Lifestyle content can range from a downloadable collection of checklists that help you organize "everything" in your life, to picking out the right camper for your growing family. Topics like 'how to pick the right retirement community' to 'fun school lunches that don't cost a fortune' are all topics that your current and potential customers think about on a daily basis.

An inbound strategy that focuses on content that solves everyday questions shows potential customers that you 'get' them. It shows that you understand what's happening in their lives every day and you're working to make life easier for them. Covering such a wide range of topics also allows the opportunity to present more of your products and services as solutions throughout the nurture campaign.

For example, someone that's interested in how to pick out a camper for their family will likely need a loan for the camper. If it's a tow behind, they may need a new vehicle to tow it. They'll be traveling a lot so added benefits like GAP and MBP can provide value as well as a credit card and debit card that will give them the ability to make purchases and access cash from many different locations. ATM and shared branching networks will be very important to them. And you'll know they have children which makes youth savings accounts relevant, as well as checking accounts and car loans as they grow older. Retirement planning will also be a future need for the parents.

When a visitor shows interest in something like a camper for a growing family, that's equivalent to having a lead that's waiting to be nurtured for potentially 10+ products and services.

Advanced Inbound Marketing Strategy and Tactics

Product Pillar Pages: If you're an advanced inbound marketer you're probably familiar with content clusters and pillar pages. If you're not, or need a review, refer to this content cluster video from HubSpot.

If your website is not currently on HubSpot, well-constructed pillar pages that are hosted on subdomains (ex. info.yourdomain.com) will increase the domain authority of the subdomain substantially however there will be little impact on the root domain.

To ensure all content is building authority for the root domain, feature Pillar Page content on product pages as a download option and ensure the content is added in full to the website as its own landing page. This works best if your site is hosted on the HubSpot platform so all the components are hosted in the same place.

"Choose Your Own Adventure" Nurture Campaigns: Digital marketing and sales tracking aren't without their flaws. Have you ever purchased a gift online for a family member or friend and received endless emails from the company promoting their products even though they were completely irrelevant to you?

When providing educational content about finances, it will be inevitable that a percentage of the new contacts created were downloading the content for a family member or friend; often parents download material to share with their children about budgeting, how to buy a car, how to manage a credit card, etc.

Beginning a nurture campaign with an email that provides a few (2-4) options that allow the contact to indicate their buying intent can substantially increase the success rate of the campaign they'll be enrolled in.

For example, the first email for a download of an eBook titled "The Ultimate Guide to Buying the Right Car for You" could offer the following options:

-

I'm Looking to Buy a Car ASAP

-

I'm Not Sure if I Want to Lease or Buy

-

I'm Not Buying Any Time Soon, or

-

I Got This eBook for Someone Else

Offering these choices in the first email rather than on the download form keeps the initial lead capture form simple, which increases submissions and gives the contact transparent control over what they're about to receive. Wording and graphics are also important for these emails. Keep them clear and concise, and include 2-3 links to whatever next steps you would like to see the reader take.

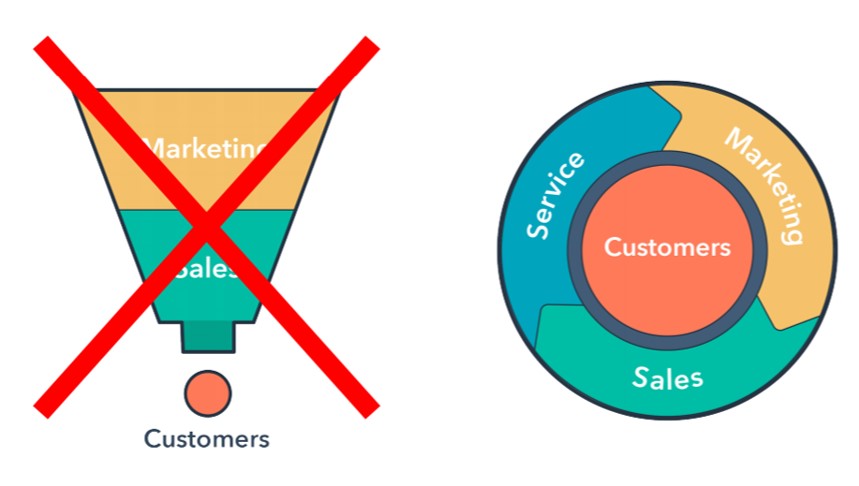

Ditch the Funnel: Continued development in inbound methodologies has clearly shown that the more traditional, static marketing funnel approach to generating leads and creating customers will become a thing of the past.

The funnel will be replaced by a consumer-centric flywheel approach. When the customer is at the center of your planning, rather than a product of a systematic process, strategy around marketing, sales, and service begin to change.

The majority of new banking customers become customers through marketing, however, some become customers through other forms of sales (indirect car dealer loans for example) and even some through services (wealth management and financial planning needs). Once a customer, they are surrounded by marketing, sales, and service for the length of time in which they continue their relationship with your institution. Aligning strategy, and resources, to support the flywheel approach will increase the success of inbound in your institution.

Change Workflow Speed Based on Engagement: Utilizing if/then branching logic in email marketing workflows provides the ability to decrease the time between email sends for contacts that are actively engaging with content. When a contact is opening and clicking within emails shortly after they're being delivered, it's likely they are on an accelerated Buyer's Journey. Change the frequency of the workflow to send emails more often and assign the contact to the sales department faster.

Fuel Your CRM with Data: Importing customer data into the CRM increases the effectiveness of inbound efforts and garners greater positive revenue impacts. Setting workflows to trigger nurture campaigns based on products and services a customer does or doesn't have, and their engagement with email campaigns and/or content on the website, increases the accuracy of the messaging they receive and the preciseness of the communication timing. All of this increases conversions, which means more loans and new accounts for your FI.

Many financial institutions hesitate at the idea of uploading customer data into a CRM tool; this concern is valid. Proper due diligence will alleviate worry about the security of the tool being considered. A CRM software provider should be forthcoming with any and all information requested during the due diligence process. As an example, HubSpot makes its information readily available on its website.

Additionally, there is NO reason to upload sensitive information such as social security numbers or customer/member numbers into a CRM. Furthermore, data can be loaded according to a key that only makes sense to the appropriate staff at the financial institution, so there are easy ways to safeguard details while being able to run campaigns effectively.

Including customer data in your personalized campaigns allows financial institutions to run effective onboarding campaigns and up-sell campaigns (i.e. if a customer took out an auto loan and 15 days later still doesn't show signs of GAP or MBP coverage the CRM could trigger a workflow to send information about those services). This makes it significantly easier for departments other than marketing to be involved in communications.

Back office operations may want to send a series of custom emails for late or missing payments, mortgages may want to send escrow change notices, and lending may want to send credit card information to indirect members who recently obtained a car loan with good credit. Ideas from every area of operation can be developed and then the system will do the work. Fear of over-communicating? A good CRM makes it possible to prioritize these notifications to prevent too many, or conflicting correspondences from sending at one time.

Decision Makers

Choosing the Right CRM for Your Financial Institution

It's obvious we favor the HubSpot tool for our clients. The reason is that we've found it to be the most reliable, secure, and agile tool that works for the heavily regulated financial industry.

Changing templates or content is easy for marketers and the level of data security provided by HubSpot checks all the boxes. It's a robust and responsive tool for managing contact data that syncs efforts between marketing and sales teams, producing a personalized customer experience that leads to an increased share of wallet. Financial institutions also require this level of functionality in a CRM to ensure that regulatory and compliance guidelines are adhered to.

Besides the tool logistics, we find that HubSpot's continuous improvement approach to doing business keeps our clients on the cutting edge of marketing and sales intelligence, progress, and success. The software, educational material, training, and ideologies are in a constant state of evolution and improvement.

There are many inbound marketing solutions and tools available, but when it comes to finding the right CRM, consider the following to ensure it'll meet your needs:

-

Security of Data

-

Ease of Use

-

Educational Courses, Materials, and Certifications Provided

-

Support Systems Provided (technical, strategic, account management)

-

Ability for Customization and Development

-

The Way in Which it Brings Sales and Marketing Together as a Growth Team

-

Reporting and Metric Capability

-

Integration with Current Platforms (website, social media, API availability)

-

If the Company is OK with Status Quo or Constantly Improving

-

You Get What You Pay For - Don't Let Budget Guide the Process

Inbound Marketing Agency vs. In-House Production

Many Community Banks and Credit Unions are running successful inbound campaigns in-house. If the resources are available to fully train both sales and marketing teams to become fluent in using a CRM, and the time is available for these staff members to execute campaigns, then managing inbound efforts in-house may be a great option. Typically this is most successful with larger marketing and sales teams as 2-3 people simply don't have the capacity to take on inbound. In some cases even teams of 5-6 will benefit from outside assistance when managing inbound efforts; every financial institution is different.

But the value driven by high-quality and well-implemented inbound marketing and sales campaigns far exceeds the cost!

There are many advantages to working with the right agency. The right agency will primarily focus on financial institutions and be fluent in product and services options as well as industry news and highlights. The right agency will protect the integrity of your brand and will respect the compliance and regulatory intricacies of the financial industry.

One of the biggest benefits of working with an agency that specializes in financial institutions is that they contain a wealth of knowledge and experience within your area of products and services. They can help execute successful campaigns because they've seen what does and doesn't work. They can also implement effective tactics between clients so you will benefit from the success of other institutions.

For this reason, you'll want to ask how an agency handles clients in competitive marketplaces to ensure your competitor won't be executing the same campaign tactics you are.

Although inbound is not a "set it and forget it" approach to marketing and sales, working with an agency allows internal staff to stay focused on immediate needs while the agency builds out campaign elements for future launches. We have found that most institutions that try to implement inbound on their own lose momentum when the organization's next big product or software launch or upgrade comes along.

An agency gives you a team of experienced people at a fraction of the cost of hiring a new employee to keep inbound campaigns on target and on schedule.

Choosing the right agency: FI GROW Solutions is a teaching agency. That means we train Community Bank and Credit Union employees to use the same tools and understand the same methodologies we're using. We strive to empower staff to be able to run an effective campaign any time they would like to, with or without our support. We're not an agency that keeps all the secrets to ourselves and only allows restricted access to the software. We're fully transparent and it's our goal to become a trusted partner at your financial institution.

Our proven process is: Assessment > Strategy > Training > Implementation > Measure > Start Again. You'll notice that training comes before implementation. That's because we want to ensure that your staff is fully aware of what we're doing, and why we're doing it before anything goes to market. This is different than most agency partners.

When choosing the right agency for your FI be sure you find an agency whose values align with yours. Make sure their process works with your internal process and that your staff will grow and learn from the relationship.

Inbound takes time to launch and it takes time for your sales team to find a rhythm that works for them. You'll likely be in a fairly long-term agreement with the agency you choose, so due diligence will be very important.

Download The Guide For Free

Send a free copy to your inbox now!

Work With Us

FI GROW Solutions helps banks and credit unions with marketing and sales strategy from individual campaigns to mergers and full rebrands. We also build new websites into fully functioning and robust digital branches.