Planning for 2021: Bank and Credit Union Marketing

Don't Miss An Episode, Subscribe Now

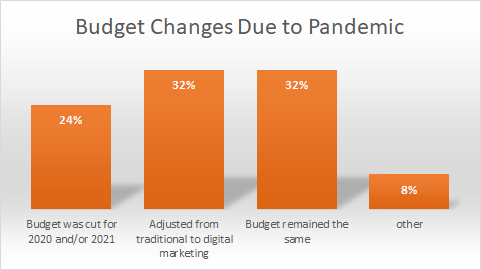

We recently conducted a survey to discover how the pandemic impacted bank and credit union marketing budgets. We discovered that 56% of organizations had some sort of impact on their budget due to the pandemic, out of which 24% had their budget cut for the year 2020 and/or 2021.

Likely because the financial industry is considered essential, there were 32% of organizations that had their budgets remain the same.

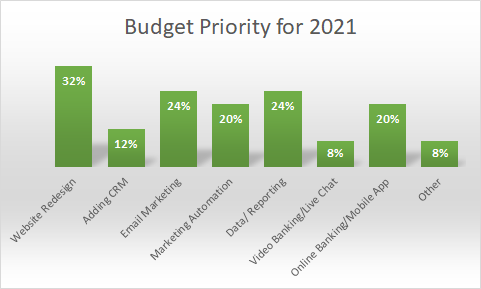

Regardless of whether your budget was impacted by the pandemic or not, one thing is for sure... You will likely need to jumpstart or boost your digital marketing and reporting strategy. According to our survey, redesigning websites was one of the primary goals for 2021, followed by email marketing and better reporting for marketing as a close second.

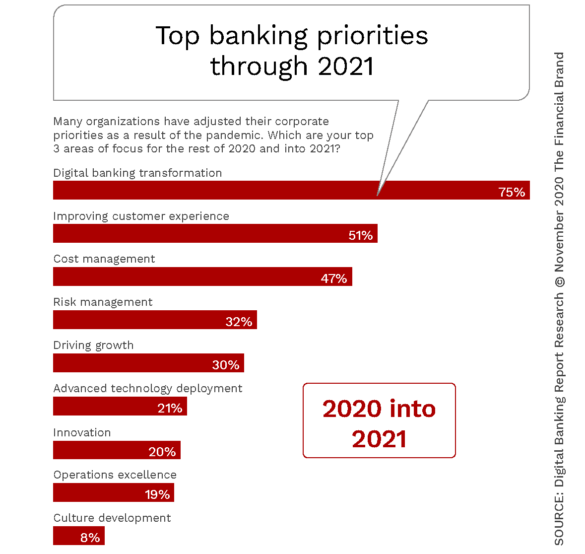

This information is mirrored in the Digital Banking Report with 75% focusing on digital banking transformation.

Here is a list of 5 things we recommend including in your Strategic Plan for 2021:

1. Re-emphasize your organization's mission

If your organization has struggled in 2020 to thrive and keep a positive attitude and motivate your employees, it is time you take a look at your organization's mission and how it is implemented throughout each team member's daily practices.

Your mission is not just a wordy statement painted on your branch walls, but rather it should be a living and breathing mission statement that aligns your whole organization and builds energy to succeed.

We recommend following the Story Brand concept of Mission Made Simple philosophy which dictates that the mission is comprised of three major components:

A. Define a conflict/challenge your organization wants to overcome.

B. Determine the destination or what the world will look like once you overcome your challenge.

C. Foreshadow the stakes of what would be won or lost when you do not accomplish the mission.

2. Assess your current business development, sales and marketing processes

Is your team still managing all new leads that come through your branches or events on excel sheets and paper documents with no accountability, lack of productivity and no consistent follow-ups? If so, it is time to invest in a Customer Relationship Management (CRM) System that allows your sales and business development teams to easily keep track of the leads that they generate and encourages marketing and sales to work together.

Here at FI GROW Solutions, being a HubSpot Agency, we are able to set up the workflows and automated process that help measure the success of your sales and marketing efforts working cohesively together.

3. Assess your organization's digital footprint

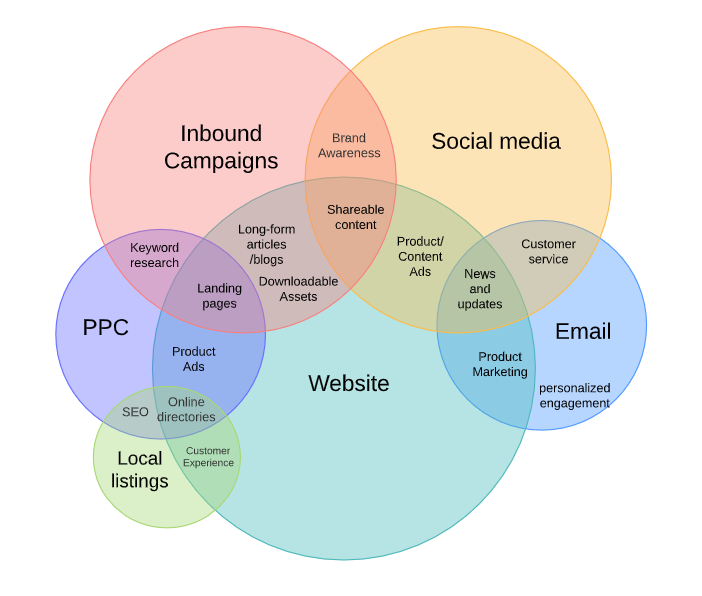

You may just identify your institution's digital branch as your online/mobile banking platforms, but at FI GROW we challenge you to switch your website from an online brochure to an interactive humanized digital branch. Below is a visual of how all online interactions and experiences relate back to your website and show the importance of assessing your digital footprint.

4. Build Your Digital Marketing Plan

Using what you have learned from assessing your company culture and mission, your existing processes and digital footprint build a cohesive plan that answers some of the following questions:

- What makes us unique as an organization and how can we make our product offering more differentiated?

- What do we stand for as an organization and how will the mission motivate our employees and customers?

- How is our website currently being used and does it need to be upgraded to serve as an interactive digital branch?

- What does our sales process look like? If it is manual then how can we use a CRM to report on our marketing and sales efforts

- What channels and media partnerships do we have in place and how can we incorporate digital marketing in the mix?

Make sure to incorporate the following in your digital marketing:

Social Media Strategy - Creating organic, engaging content and humanizing your organization.

Paid Ads Strategy - Using social media ads and pay-per-click ads to successfully drive leads through your digital branch a.k.a. your website.

Content Strategy - SEO optimized content for your website pages and blog content to generate organic traffic and build your domain authority.

Inbound Campaigns - Using your SEO optimized content, paid ads and social media channels to direct qualified leads to your sales team.

Process Campaigns - Automating your processes to deepen relationships and cross-sell. These include: Onboarding, Re-boarding, Generating Reviews, Referrals, etc.

Email Marketing - Make sure to have a consistent email schedule to engage your members/customers either by sharing financial resources or promotions. Have a good mix of automated emails setup with your inbound campaigns.

5. Create Metrics for Reporting to Measure the Success

Usually all the energy is spent planning and implementing strategic and marketing initiatives, but less thought is given to measuring success and report on it.

Having the right tools in place to start off with are important to set your organization for success. Make sure keep metrics for reporting as a deciding factor for what you decide to invest in for marketing in your 2021 plan.

Blog comments