One Credit Union Uses Digital Marketing to Help Grow Auto Loans by 40% [Case Study]

![One Credit Union Uses Digital Marketing to Help Grow Auto Loans by 40% [Case Study]](https://www.figrow.com/hs-fs/hubfs/bigstock--145157051.jpg?width=950&name=bigstock--145157051.jpg)

Don't Miss An Episode, Subscribe Now

Last year we shared how one long time client, AERO Federal Credit Union, used digital marketing to help grow their Home Equity Loans by 93%.Today, we are excited to share another compelling case study from AERO focusing on auto loans, with equally impressive results!

As the summer season rolls around, AERO partnered with their team to craft a digital marketing email campaign aimed at promoting their auto loan products to current members. This initiative steered away from complex automation, instead opting for a genuine and helpful approach to connect with members as they navigated the market for both new and used vehicles.

First we sent members an email that simply linked to blogs on AERO's website about cars, auto loans and how to select the vehicle that is right for your family.

In the email, as you can see, we mention wanting to keep up with member requests and provide resources that members can use to make informed decisions.

With this email, AERO is trying to position themselves as a trusted advisor.

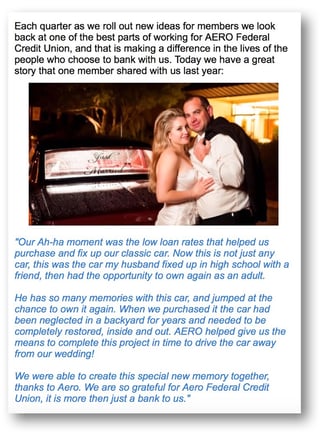

In the second email, we included a real member testimonial from last year about how an AERO auto loan helped a member's car-buying dreams come true. This testimonial is a true story, in the member's own words, with a photo included that the member provided.

By incorporating real member testimonials into their email campaign, AERO Federal Credit Union provided a personal touch that resonated with their audience on a deeper level. These authentic stories not only showcase the positive impact of AERO's auto loans but also helped to establish trust and reliability throughout the entire car-buying journey. Hearing directly from satisfied members who have benefitted from AERO's services added a human element to the Credit Union's message, making it more relatable and compelling for potential borrowers.

By incorporating real member testimonials into their email campaign, AERO Federal Credit Union provided a personal touch that resonated with their audience on a deeper level. These authentic stories not only showcase the positive impact of AERO's auto loans but also helped to establish trust and reliability throughout the entire car-buying journey. Hearing directly from satisfied members who have benefitted from AERO's services added a human element to the Credit Union's message, making it more relatable and compelling for potential borrowers.

Download: 12 Decisive Steps to Grow Your Business

Finally, we shared two more emails about the current auto loan offer, as well as a few other car-buying tips and extras that AERO includes with their loans. We also included an extra email to members who had interacted positively with AERO's auto loan email content, which further targeted the campaign to members likely to be interested in an auto loan.

The results weren't as strong as the previous Home Equity jump of 93%, but year-over-year the total auto loans did increase significantly.

In the year prior, from May to July, AERO closed $4.12 million worth of Auto Loans, but after this campaign, during the same three months AERO closed $5.78 million worth of Auto Loans. This was an increase of $1.65 million or 40%!

Not all of these new loans are directly attributable to this digital marketing email campaign, but there was a significant positive impact.

We had 11 members ask to be contacted about an auto loan and 169 members who clicked through to learn more about the promotion.

AERO also leveraged digital advertisements and social media platforms to amplify the reach of their auto loan campaign. Coupled with a strategically placed loan rate calculator and a partnership with enterprise car sales, these elements played a pivotal role in the success of AERO's Spring/Summer auto loan initiative, yielding exceptional outcomes.

Contact Us today for more information or to discuss how we can design a similar campaign for your Credit Union.

Blog comments