Is Your Bank or Credit Union Appealing to UnBanked Millennials?

Don't Miss An Episode, Subscribe Now

Unbanked Millennials - That Way by Choice

Not all unbanked Americans are in that state due to poverty, a new study finds. Some are unbanked by choice.

A survey analysis performed for Packaged Facts finds that there is a general trend away from having checking and savings accounts at traditional banking institutions, especially among members of the millennial generation.

This is a choice many younger people are making, since many deem traditional banking services to be unnecessary – or at least things one might only occasionally use.

Packaged Facts points out that these findings challenge the traditional notion of the unbanked American as someone who is “shut out” of the system due to poverty, or a lack of access. Clearly, an increasing number of Americans are unbanked by choice.

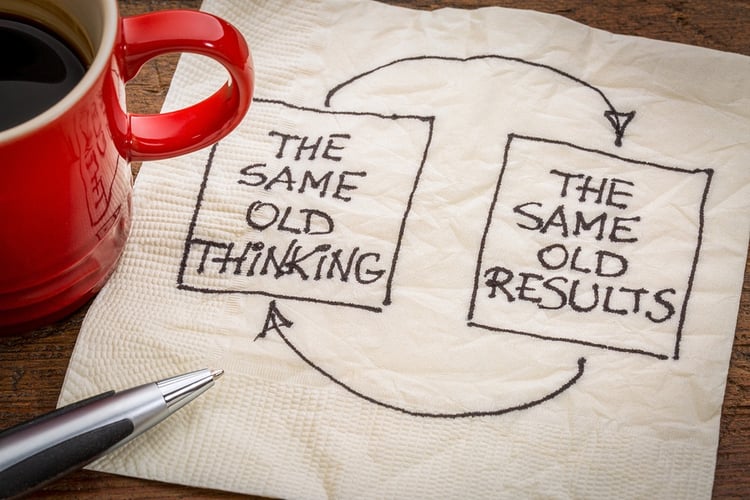

It also counters the traditional banking argument that checking and savings accounts are the foundation for lasting customer relationships.

Banks and credit unions need to compete with, or embrace, emerging banking models that are Internet and mobile-driven.

The growth of online-only financial institutions shouldn't be a surprise to anyone in this day and age. These options are continuing to expand for a few reasons.

According to Nerd Wallet "The best online banks have fewer fees and higher interest rates than traditional banks, in part because of the money they save by not operating branches."

To stay competitive more traditional FIs need to focus budgets into robust mobile apps and websites that are personalized and intuitive.

Blog comments