Why Are Some Banks and Credit Unions STILL Unable to Commit to Digital Marketing?

Don't Miss An Episode, Subscribe Now

So many Community Banks and Credit Union that we come across are still hesitant to take the Social Media Marketing plunge.

Now, don't get me wrong, most of these FIs are on Facebook and might have a Twitter account or even a few videos on YouTube. They might even be posting daily, though that's much more rare. But just using these platforms, even daily, often does not bring any clear results. In fact, and I tell clients this regularly, simply using these networks does NOT equal a STRATEGY!

This is where many Credit Unions, Community Banks, and small to mid-sized businesses in general, completely miss the mark. But a lack of strategy is not the only problem. If you want your Financial Institution to find some real return via online marketing try these steps first:

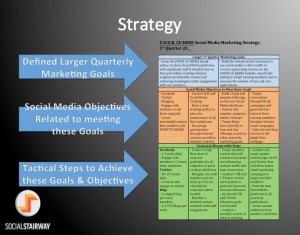

Step 1. Create a Strategy:

Ok, so I've said this one already, but let's talk about what that strategy should actually look like. It should have clear, concise, and measurable goals and objectives. And these should be tied to larger business growth goals that may have a bit of a longer time line.

So, for example, if your Credit Union or Bank wants to grow new customers look at it from this perspective... in the short term (3-6 months) you should focus on building an audience with current customers, and then you can more easily target online engagement with their FRIENDS.

This gives you some built-in credibility with those new potential members, the friends of current members. Kind of a round-about way to achieve personal or word-of-mouth recommendations through social media engagement.

THEN, after about 6 months, bring some of these new leads into an email automation campaign that will nurture them toward closing the deal and convert these new leads into new customers.

Obviously you won't close them all, but if after a year or so you can directly tie online efforts to a concrete number of new members or customers you'll actually have your clear ROI numbers!

PRO TIP: Time frames are crucial, and it's a marathon NOT a sprint. Online trust and relationship building takes months and years, not just days and weeks. If you try to rush people they will smell a rat and head for the hills!

Learn More: The Definitive Guide to Social Media Marketing for Banks & Credit Unions

Step 2. Find the Budget - It IS There if You Look Hard Enough:

Ok, this is one of my pet peeves for sure! Time and again we are scrimping and scraping with clients to find very nominal monthly ad budgets to support their online marketing efforts. Financial Institutions will spend 10s of thousands of dollars on larger media ad buys, but digital priorities are virtually non-existent!

Please consider this... all budgets are pretty basic and they just come down to priorities. If you want to reach the next generation of potential new members or customers you are going to have to find them ONLINE, and that reach is NOT going to be free! If you aren't there trust me when I say other institutions are online, and they WILL get the business you're leaving on the table.

Sadly, I'm not convinced that the sentiment to commit to digital marketing is truly there yet at most community-based Financial Institutions.

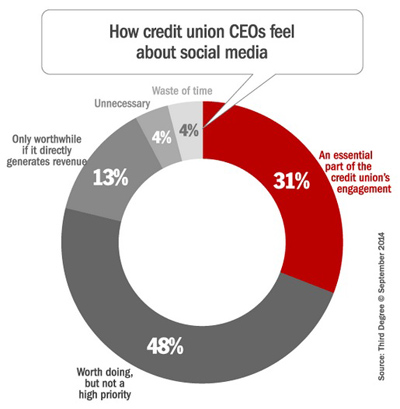

I just read a recent Financial Brand article about this very topic and I cannot resist sharing their graphic on how CEOs view Social Media Marketing.

By my calculation, according to this research, fully 69% of CEOs aren't really pressed to implement a Social Media Marketing campaign. And I'm at a loss about this. So many of these same execs want hard proof of revenue generation, but when have CUs EVER had that kind of data from other types of marketing efforts?

And riddle me this... when was the last time a direct mail or radio executive could tell you exactly the age, sex, hobbies, family size, borrowing potential and job title of the person that read or heard your marketing material or blog and interacted positively in some manner with your messaging? NEVER is the likely answer!

If FIs continue to hold out they will watch 'Simple' and other virtual FinTech banks scoop up all these valuable millennials who should be the next population of CU members. Our precious community banks will be history, while we are still be holding out for 'measurable ROI,' packing our boxes and looking for new job opportunities.

PRO TIP: Start small if you have to and work your way up. Try an ad budget for only ONE platform first (we recommend Facebook which can also place content on Instagram) and then see what kinds of reach and engagement results you get after just a few months. You can keep the budget small to start, maybe $300-500 per month.

Step 3. Get Some Help:

Now on this one you can call me out a bit, as our company IS an example of the kind of help that I truly believe most Credit Unions or Community Banks need to make this all happen. But bear with me for just a second...

When you have a problem that you've never handled before what do you usually do? Let's say your back aches for a month, or your car is making an annoying buzzing noise every time it starts, or you just can't seem to get to the bottom of your 2014 taxes, even when you did them yourself the past 17 years. What do you do?

You find a professional in the area of need to help you solve your problem.

Now, that doesn't mean you have to see that person every single day for the rest of your life. BUT, if you want to really understand your problem and get to the bottom of how to handle it now and perhaps again if it happens in the future, it's usually worth your time, effort, and money to bring in someone who really knows what they are doing.

And Social Media Marketing is no different! By some estimates over 85% of adults in the U.S. visit Facebook daily; but they aren't all experts on how to effectively market a business there! I drive my car every single day of the week... but I DO NOT know how to fix one! I leave that up to the experts because on that topic I am fairly ignorant.

So bring in help to get your campaigns and strategy going, provide your staff some high quality training, and help craft a future plan for success that will help your FI reach your larger marketing, sales and business growth goals and objectives.

Pro Tip: Change is hard for most people, but trust your instincts on this subject and just give it a shot. The "Branches and Broadcast" marketing strategies of the past are no longer going to bring in new members and increase your share of wallet. It's time to innovate and digital IS how to do it. But start SMALL if you need to. Don't be everywhere, just pick TWO platforms and start there. We recommend Facebook and blogging if at all possible to bring online traffic back to your website as often as possible.

For more information on how FI GROW can help your Credit Union or Bank find success online please contact us today!

Blog comments