Digital Marketing Helps Boost Loan Growth by 93% for Banks and Credit Unions [Case Study]

![Digital Marketing Helps Boost Loan Growth by 93% for Banks and Credit Unions [Case Study]](https://www.figrow.com/hs-fs/hubfs/Business-owners-collaborate-on-digital-marketing-results..jpg?width=950&name=Business-owners-collaborate-on-digital-marketing-results..jpg)

Don't Miss An Episode, Subscribe Now

Long-Standing Client, AERO FCU, Sees a 93% Jump in Home Equity Loans

One of the biggest challenges in any industry is trying to connect marketing, ads and online engagement with real results through sales! We are constantly helping clients do just this, by 'closing the loop' and demonstrating how good quality, strategic marketing campaigns can impact bottom-line revenue.

AERO's AVP of Marketing, Angie Avers, reviewed some home equity loan growth statistics with us, and the results were worth noting! This case study continues to prove why bank and credit union digital marketing cannot be beat!

During the first quarter of 2016 we assisted this Credit Union's staff with an email nurture campaign consisting of 5 emails sent to their members about a new home equity promotion. These emails didn't just blast out the promotion details, we designed the campaign and messaging to be much more authentic and trackable.

Here's how the home equity loan campaign progressed to boost loan growth:

Email #1:

This first communication never mentioned any advertising or products, but instead linked to four blogs on the Credit Union's website that might be useful to members considering doing work on their homes. It promoted the member service nature of the Credit Union and shared useful and educational content. That's all!

Email #2:

After waiting SIX days we sent the entire list the next communication, a member testimonial email including a photo of the credit union member giving his review. See the screenshot below.

This second email linked to the promotion but centered mainly on the member service aspect of the Credit Union and its mission. The testimonial is strong and was chosen to help support the ongoing Home Equity promotion. The testimonial also included an authentic image of the member, which provides more credibility to the content.

DOWNLOAD NOW: The Ultimate Guide to Successful Digital Growth for Financial Institutions

Email #3:

Nine days after the second email we sent the first real promotional email, with the subject line: "We Have Something Designed Just for You!"

This was the first email that included product information but also referenced a recent award the Credit Union received for competitive rates and member service. All images were linked to various locations that provided promotion details, and all clicks were tracked automatically through the campaign email tool.

Email #4:

Nine days after the third email we sent our final 'blast' email to members on the list who had not acted on any of the Calls to Action (CTAs). Again stressing the member service mission, while also sharing the promotional details.

During the campaign, if a contact clicked through to learn more they were tagged. They were also given the option to ask to be contacted regarding the promotion, which also tagged them. We used both of these kinds of interactions to compile lists for member service/sales follow-up.

Email #5:

Our last and final email was sent about seven days later to ONLY those contacts who had clicked through to learn more about the promotion or had indicated in past emails or via past surveys had indicated they were considering doing work on their homes. This segmented the list was much smaller and thus the engagement with it was more effective, it had a 39% open rate!

UPDATE: In campaigns similar to the one outlined above, we've seen email open rates skyrocket to over 60% when segmented to people who have previously opened an email earlier in the campaign or clicked a link related to a specific product or service mentioned in other content. So with highly targeted and segmented campaigns the results continue to be proven out.

Final Home Equity Loan Results Are In!:

By the end of May, compared to the same period in 2015, the credit union's Home Equity loans jumped by 93%. Additionally, for every additional dollar spent on marketing the CU received $72 in new loans!

Now, not all of these results were tied directly to this email nurture campaign, as the promotion also included some online display ads, direct mail, press releases and in-branch materials, but clearly the campaign was a success by any measure.

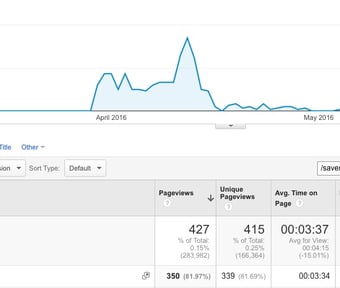

We do know the entire campaign drove 427 visits to a landing page designed specifically for this Home Equity campaign, where visitors spent on average 3+ minutes considering the promotion, all of which clearly impacted applications and loan revenue numbers.

We do know the entire campaign drove 427 visits to a landing page designed specifically for this Home Equity campaign, where visitors spent on average 3+ minutes considering the promotion, all of which clearly impacted applications and loan revenue numbers.

Through the email nurture campaign alone, we sent 100 credit union members to this webpage, 255 members indicated they were planning to do work on their homes in 2016, and 14 members asked to be contacted directly regarding the Home Equity promotion. We also drove 26 visitors from Facebook to the same Home Equity page landing page.

Though this kind of web traffic might sound nominal, when efforts are highly targeted they are often more effective, even with smaller overall traffic numbers. And the revenue growth of $1.3 million is a testament to this being the case!

At the end of the campaign what we can say for certain is that the right credit union members were made aware of a great opportunity to leverage the equity in their home through a high quality marketing campaign, but the message was delivered in a more authentic way, with content that also focused on beneficial information and their experiences as members of the CU.

You Can Get These Results For Your Bank or Credit Union!

You can do this for your bank or credit union as well, and we can help. Contact us today to discuss how to revamp your digital marketing strategy to boost your overall loan growth and membership numbers for your bank or credit union!

Blog comments