Financial Institution Best Practice: How to Respond to Comments on Social Media

Don't Miss An Episode, Subscribe Now

In today's digital-first world, maintaining an active social media presence is crucial for financial institutions to stay connected with their clients and attract new prospects. Engaging regularly on platforms like Facebook, Instagram, and LinkedIn enhances visibility and reinforces trust and credibility. Equally important is the art of responding to comments. Whether positive or negative, each interaction is an opportunity to demonstrate responsiveness, empathy, and a commitment to customer service. Mastering these interactions can significantly enhance a financial institution's reputation and foster stronger relationships with its audience.

Having a social media presence and good content is only half the battle. Your credit union should also be utilizing social media marketing for Financial Institutions as a way to connect and interact with your members. Here are a few instances showcasing how your credit union can effectively engage with comments on social media!

1. Answer Questions As Soon as Possible and Thoroughly

What differentiates your financial institution is your customer service and willingness to help. Millions of people are on social media on a daily basis and some even use it as a primary way of communicating. If you're not actively monitoring it, you can be missing out on questions from your members.

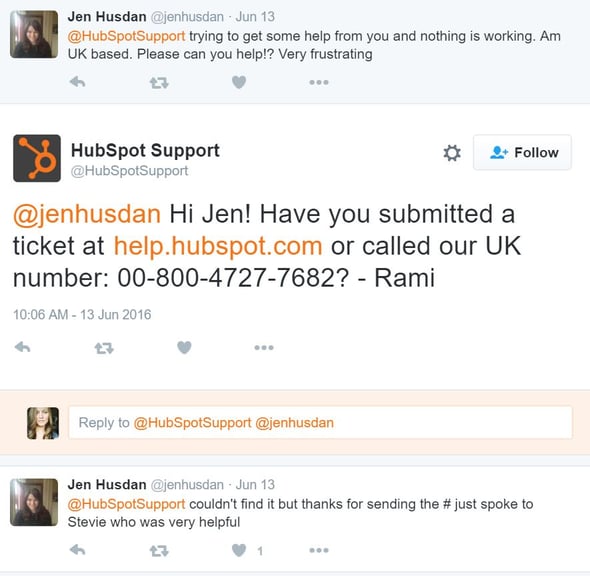

Hubspot is a perfect example of awesome social media support. In this case, a user was unable to reach support on their website, so she turned to social media. Hubspot replied with several ways to contact support, and within 20 minutes her problem was resolved! Now that's customer service!

2. Respond to Everything Sincerely and Make it Personal

People love to voice their opinions on social media - good and bad. Of course you need to address any questions, concerns or complaints, but it is just as important to respond if someone says something good about your bank or credit union. When someone takes the time to tell you about a great experience, you should respond with a personalized thank you.

It is so important not to post "cookie cutter" responses. Your customer/members want to talk to a person, not a robot. A lot of companies have been called out in the past for saying the same thing over and over again in responses. Give your employees the right to respond freely, but make sure you have a Social Media Staff Policies and Procedures to ensure consistent and appropriate responses.

3. Don't Be Afraid to be Silly

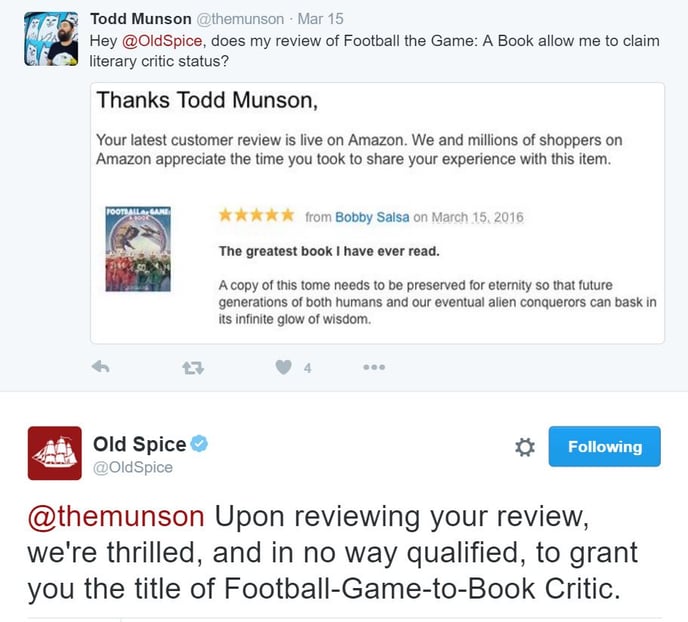

Social Media is supposed to be a place to have fun and let your personality shine! If someone posts something a little silly, throw it back at them! Your members will appreciate the effort. It is fun conversations like these that build brand awareness and strengthen relationships.

Old Spice is known for having silly commercials that you can't help but laugh at. They use humor to grab and keep their audience's attention, and it works! They're consistently "happy go lucky" and that has helped them create a loyal following. Have you ever not liked someone because they made you laugh?

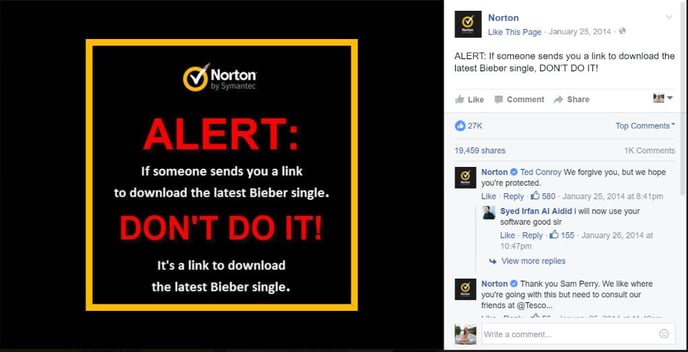

Just in case you think banks are not a laughing matter, and people would not appreciate something as "serious" as a financial institution cracking a joke, here a Facebook post by Norton (yes the internet security company, which is VERY serious) to prove being fun is for everyone!

Norton posted this in early 2014 when Justin Bieber announced that his fans can download his newest release for free. This post went viral and to this day is continuing to be engaged with!

Embracing social media and engaging effectively with comments are more than just digital strategies; they are essential components of modern customer service for financial institutions. By fostering open communication and showing genuine interest in client feedback, banks and credit unions can build a community of loyal followers, enhance their brand image, and stay ahead in a competitive marketplace. As we continue to navigate a world where digital interactions are the norm, financial institutions that prioritize thoughtful online engagement will undoubtedly thrive.

Blog comments