Have You Seen Your Google Search Rankings Lately? [5 Reasons They Matter]

![Have You Seen Your Google Search Rankings Lately? [5 Reasons They Matter]](https://www.figrow.com/hs-fs/hubfs/Screen%20Shot%202018-02-12%20at%202.11.30%20PM.jpg?width=950&name=Screen%20Shot%202018-02-12%20at%202.11.30%20PM.jpg)

Don't Miss An Episode, Subscribe Now

One of the ways an improved digital presence can help your financial institution is by positively impacting your Google search rankings and local listing results.

Even during uncertain times in the economy people will continue to use search engines to find financial solutions online. Now more than ever your bank or credit union needs to be ranking in the Search Engine Results Pages (SERPs).

Here’s five reasons those search results really do still matter, and a few pro tips to help you improve those rankings!

1. Google Search Ranking is Key to Banking Account Decision Making

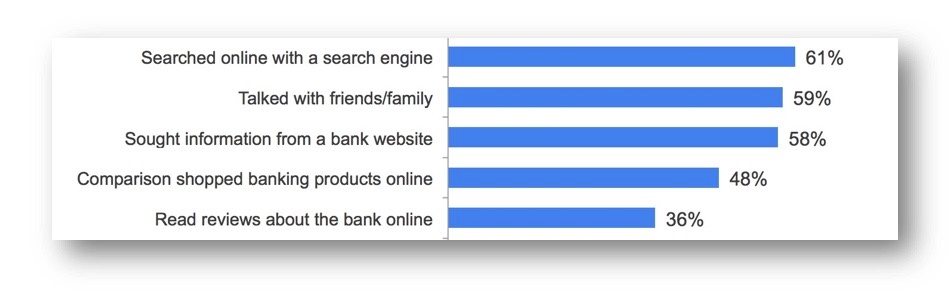

According to Google’s Zero M

oment of Truth study, search is a huge factor with consumers considering a new banking product or service. They asked the question: “Q2 When you were considering purchasing [PRODUCT], what sources of information did you seek out to help with your decision?” As you can see from the results, 61% of those surveyed used search in their buying process.

PRO TIP: Make sure you update your website content with meaningful, keyword optimized content 1-2 times per week, or more if possible, as the ‘recency’ of content on your website is a key factor in SEO.

2. Branch Location Information is Key Reason for Search in the First Place!

According to the same Google study cited above, the top three reasons for banking shoppers to consult the internet were:

- Find locations of the financial institution

- Get information on a particular bank location (hours, parking, etc)

- Call a financial institution (from number provided online)

So, if your branch details are not accurate 100% of the time when a user searches online, your institution is going to have unhappy customers, complaints, or perhaps no new enquiries to begin with!

PRO TIP: Use an automated tool of some kind to consistently monitor ALL branch location information to ensure all details are accurate and any duplicate listings are removed. Test how your branches are showing up online today with our free tool.

Looking for where to start? Try Our Ultimate Guide to Successful Inbound Marketing for Financial Institutions

3. The Consumer Purchase Journey Has Permanently Changed

Some people in long-established industries like financial services have seen many ‘hot new trends’ come and go, and are often resistant to change. After all, who wants to re-tool their entire marketing or sales approach only to have to do it all over again two or three years later?

But times have truly changed and are showing no signs of returning to the old days of branch visits and broadcast messaging.

According to the Financial Brand, “Consumer visits to retail bank branches are set to drop 36% between 2017 and 2022, with mobile transactions rising 121% in the same period,” and this is NOT a new trend. It’s time for credit unions and community banks to pay attention to this new normal and recognize that multi-channel, mobile first, personalized messaging is going to be central to driving growth and retention for years to come.

PRO TIP: A responsive website is a MUST, but also consider designing for mobile FIRST when you create your online user experience. With 60% or more of traffic coming from a mobile device, desktop use is down and will likely continue to decline.

Test Your Google Search Results NOW: Use Our FREE Local Listing Search Tool

4. Meaningful Content is Key to Google Search Rankings

As mentioned above, we recommend updating a bank or credit union website 1-2 times a week, at a minimum. But this isn’t with just small changes. We are talking about useful and informative content pieces that are significant in length and impact. We mean content that is helpful and addresses the pain points in your member’s lives. This is the type of content that positively impacts search and helps build rapport with your readers.

According to Inc.com “Digital marketing, or more specifically, content marketing, is how businesses build communities, develop brand advocates, lower acquisition costs, increase conversion rates and increase customer lifetime value―all of which signal a healthy, sustainable business built to thrive in our digital-first world.”

PRO TIP: Develop 2-3 buyer personas to build your content strategy around. This will help your team see your target marketing as people and then better develop useful content for those populations.

5. Website Speed Impacts Search Rankings AND Overall Success

According to Google, roughly half of website traffic can be lost due to slow load times, and this is only going to continue as we all use smart phones more.

Think about it, how often have you clicked a link in a search result list, only to have it spin for too long and then hit the back button and try the next one? Well, you’re not alone!

In the financial industry a load time of 18 seconds can cause you to lose and estimated 34% or more of your visitors!

PRO TIP: Test your website with the free Google mobile speed tool and pass on the findings to your IT and web development teams. Ask them to work on any fixes that are possible and then check progress and continually re-test. We recommend a load time of 4-6 seconds is a great target for the finance industry.

Email us today to discuss your specific needs and how we might be able to help you improve your site performance!

This Guest Blog was Originally Posted on CUInsight

Blog comments