How COVID Has Changed Digital Ad Results [The Good & Bad]

![How COVID Has Changed Digital Ad Results [The Good & Bad]](https://www.figrow.com/hs-fs/hubfs/Stock%20images/Hand%20holding%20tablet%20with%20global%20database%20concept.jpeg?width=950&name=Hand%20holding%20tablet%20with%20global%20database%20concept.jpeg)

Don't Miss An Episode, Subscribe Now

Here's How COVID-19 Has Changed Digital Ad Results for Banks and Credit Unions

There is no denying it, COVID has made a significant impact to many aspects of life. Consumer preference is shifting daily, but the need for financial product/services and advice has not ended. Here's what you need to know...

COVID-19 Changes to Digital Ads - The Good:

Social Media Ad Costs are Down

We have noticed that, for most of our clients, cost per result on social media has come down significantly, and in some cases it has decreased well over 50%. When this crisis began we paused all of our client's ads and decided to rework the language and graphics to be sure we acknowledged the current situation and ads didn't appear tone deaf.

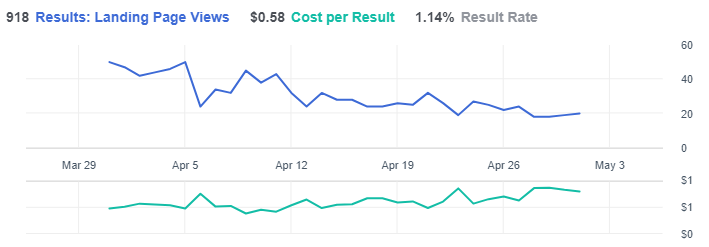

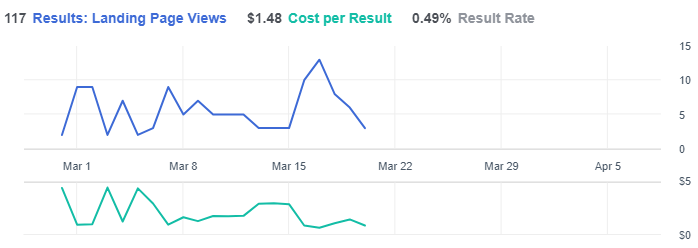

Many of our clients did not change the actual products/services they were promoting, so we just simply updated them to sound more appropriate for the times. For one client in Arizona, cost per click (CPC) went from $1.82 to $0.73 in just one month! This is a dramatic drop in cost. For another client in Massachusetts their CPC went from $1.48 to $0.58.

Massachusetts Client - April Results:

Massachusetts Client - March Results (before we paused and re-created ads):

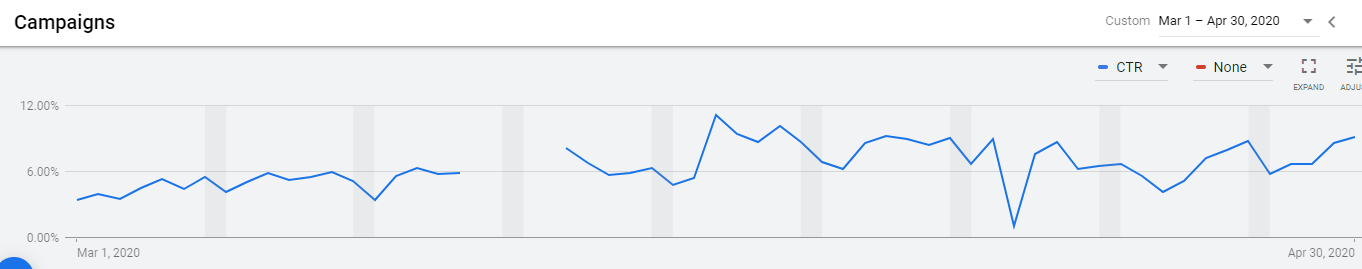

Google AdWords Pay-Per-Click (PPC)

For our PPC clients, we have noticed a huge jump in click through rates (CTR) for certain products.

Auto Refinance and Checking Account search ads have seen a significant increase in CTRs and a decrease in costs. We believe that is because of the developing economic impacts of this crisis. A lot of people are looking for ways to save money, and working from home gives them more time to shop around online for a better rate or lower cost account.

Website Visits Are Up

Across the board we have noticed a huge increase in website traffic in April vs. March. People have been forced to change the way they shop, and are moving their pre-shopping research even more online. This is great news for banks and credit unions with decreased foot traffic. If you can update your website with helpful resources you can try to capture some of these new visitors.

Download Our Free eBook: Winning with Social Media Marketing for Banks & Credit Unions

COVID Changes to Ads - The Bad:

Conversions Are Only Up Slightly

You would think with all of this increased traffic, the number of conversions would also be on the up-and-up, but that has not been the case. While conversion are up slightly, they have not increased in proportion to the increased impressions, visits and clicks.

We believe that people have more time now, so they may be window shopping more, but seem to be less likely to fill out a full application or lead capture form. Perhaps because of these uncertain times people may be more hesitant to actually pull the trigger when making big financial decisions.

Your financial institutions need to continue to strive to be a source of trusted advice and financial resources, as people navigate their new normal. When consumers are ready they will likely apply with the bank or credit union that was there for them when they most needed support. Make sure that's you!

Marketing Budgets Are Being Cut

Some of our clients have been forced to cut their digital ad budgets. The good news is a smaller budget seems to be going much further than it used to. However, it is important to keep ads running, as your members/customers and larger community are seeking advice about financial products and services. No matter what, try to keep digital ads running, even if it is half your usual spend!

New Searches & Keywords

According to a recent WordStream webinar, COVID-related searches are the most popular searches on Google, making up 1/4 of what is searched. This means 25% of searches have NEVER happened before!! Which is unprecedented.

Such a huge increase in new search terms means you need to take a deep dive into search terms related to your products and services. We looked at keywords in our client's campaigns to ensure we adjusted accordingly. If you don't look at new keywords in your industry, you risk missing out on these new search behavior, or worse, paying for impressions for keywords that just don't make sense.

Contact Us today to learn how we can help you grow!

Blog comments