Should Financial Institutions Continue to Advertise During COVID-19?

Don't Miss An Episode, Subscribe Now

During times of crisis we often find ourselves pulled toward making the safest decisions we can to maintain our preferred status quo. In the case of COVID-19 this definitely holds true for so many people, and in fact making safe choices could actually be the difference between life or death.

Your financial institution is likely no different, and your team is probably reeling from all the unsettling news and changes happening to staff and customers right now.

If we are going to talk about making safe choices with regard to budgets, marketing and advertising costs, and long-term growth strategies, it may be time to pause for a moment and look closely at what kinds of changes need to take place, even during a global pandemic.

Should your financial institution continue to advertise products and services during COVID-19?

My short answer... YES. But let's unpack this a little more.

According to Ad Age (April, 2020), "A survey by agency lead generation firm RSW/US conducted last week found 9 percent of marketers have cut all spending, another 29 percent have “greatly reduced it” and another 31 percent have “somewhat reduced it.”

We have seen similar changes with banks and credit unions. At the very start of this crisis we paused ALL digital ads for our clients. We then worked with each financial institution's marketing and leadership team to determine the best path forward. As one client, Brent R., said so eloquently, "Now is not the time to take shelter and weather the storm. It’s time to lean in to our new reality and come out stronger than we went in."

Here's what we decided for multiple banks and credit unions in metro areas across the nation:

1. All Google PPC ad campaigns were turned back on. This was the decision of all our bank and credit union clients because if people are IN MARKET for a financial product or service these FIs want to continue to be considered.

When someone is online using Google and he/she searches for a loan or account product, this tells the search engine that they want to see a list of product or service specific information. Those resources are then shown to the user via search ads AND organic search results. We strongly believe that your institution needs to continue to try to show up in BOTH ways.

2. All Social Media ad campaigns would be adjusted to reflect the changing times facing our society right now. We updated wording of product specific ads to be more sensitive and relevant to the current health crisis and more mindful of the uncertain financial future for many people.

Angie A., AVP of Marketing and long-time FGS client, explained that "we need to let our members or potential members know that we are here for them in a variety of ways. Someone may need to buy a new car because their car just finally gave up, or they need a personal loan to get by, or just know about all our online services that are available. Even though we have a pandemic, people react in different ways and we don’t know what each individual’s situation is. There are so many variables and moving parts during this time that I don’t think you should just cut off all advertising."

Preliminary Results of New Ad Language

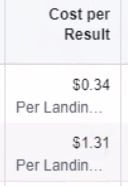

We are seeing very dramatic changes in results for clients who are continuing to advertise. In the last 14 days we have seen impressions and clicks with ads on social media costing less than HALF of what they have cost in recent months.

For example, with one set of auto loan ads we had previous social ads costing $1.31 per landing page view and after the COVID-19 updates to language these same landing page views are costing $0.34.

The reasons for these changes are a combination of increased users online and a decrease in competition due to many businesses cutting ad budgets. But regardless of the reason it's clear that banks and credit unions are offering products and services that people still need and should remain active online.

Here's what some of these new ads looked like and how they seem to be performing initially.

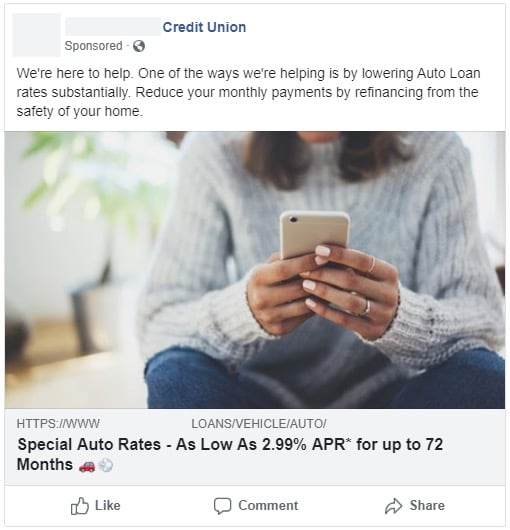

One mid-sized credit union in the Phoenix, Arizona area adjusted several of their loan product rates lower and they continued to promote auto loans with the ad below.

In just seven days, with a fairly small budget, these auto loan ads reached almost 11k people and generated 322 landing page views at an average cost of $0.40 each! These auto loans would typically cost closer to $1.50 per page view.

Another mid-sized credit union in the Dallas, Texas area ran the following Instagram story ad to promote the ways they are helping members during COVID-19. The ad linked to their disaster relief landing page with more resources for members.

In seven days this Instagram story placement ad reached 13,900 people and generated 105 Landing Page Views at and average cost of $0.98!

These ads are not only helping people but they are showing that these financial institutions truly care about their communities and want to be there for people during these challenging times.

Neil Patel explains that "Our clients, in general, have seen their ROI go from 31% to 53%. That's a 71% increase in ROI. If you haven't tried paid ads yet, you should consider it. If you do, consider ramping up as there is more excess inventory than there has been in years."

Jenn W., a credit union CMO in Phoenix, summarized their approach with this explanation:

"We are continuing to advertise, but we have completely adjusted our message focus. We understand that our products can help members and the community to save money and we understand how essential that is during this time. Our advertising messages share the products that can help, with a specific focus on cash back auto refinance and mortgage refinancing at a lower rate. We believe now more than ever that we should live “people helping people” and this is our guide for all advertising and marketing efforts."

But what if Your Financial Institution Decides NOT to Advertise During this Crisis?

We have had some clients pause social media ads a little longer than we would like. Typically their central worry is around the potential negative comments or reviews, should a customer be unhappy with options being provided. But this concern may be short-sighted.

According to Christian Polman, chief strategy officer of Ebiquity, "Brands that maintain their spending [during a recession] average a one-point share gain, while brands that cut spending during a recession average a 0.7-point share gain during the subsequent recovery."

Not being present and active through online channels during times of crisis doesn't remove your financial institution from being the topic of people's complaints. It only reduces your staff's ability to respond positively and address concerns in a timely manner.

Furthermore, this crisis will pass... and if you've stopped all digital advertising your team will have to work twice as hard to get back into people's search results and social media time lines.

Jeremy Balkin, Head of Innovation at HSBC explains that "I’ve got no doubt that on the back end of the crisis – depending on how long this goes for and what the economic outcomes are – there will be a ton of ‘transformation’ efforts. But if these are nothing more than cost-cutting initiatives, it builds more skepticism and cynicism from customers, employees and shareholders. The mission should be to build new, resilient, innovative businesses."

This is the time for banks and credit unions to step up to the plate and provide the advice and financial products and services so many people desperately need right now. Don't let your institution's voice go silent when our communities need to hear it now more than ever!

Blog comments