Financial Marketing Must Change Now, Not Next Month or Next Year

Don't Miss An Episode, Subscribe Now

Looking for some marketing motivation? Here's the top three reasons your Bank or Credit Union Marketing & Sales strategy should change NOW!

1. The Returns are Compounding, so the Sooner You Begin the Better Your Results will be in the years to come...

According to Digital Distillers "Inbound marketing is a strategy that offers continuous and compounding benefits. Unlike traditional marketing (magazine advert) your inbound content assets (a blog) will continue to generate awareness, website traffic, and position you as a thought leader over time. They're continuously working for you, no matter how long ago you created them."

And in one well-regarded digital marketing study the author found that more than half of his top performing blogs charted for the study had the majority of page views one or more days AFTER the content was published.

Even more impressive is that his readership increased 8% per month! So total page views were going LONG after content was initially published, and his blog audience was growing month over month as well!

And the value of a well-developed Inbound Marketing campaign doesn't stop there!

Online content helps position Credit Unions and community Banks as trusted advisors to their customers and potential new customers. A good financially-minded blog that is maintained and updated weekly demonstrates thought leadership and can position your CU staff as the experts they clearly are.

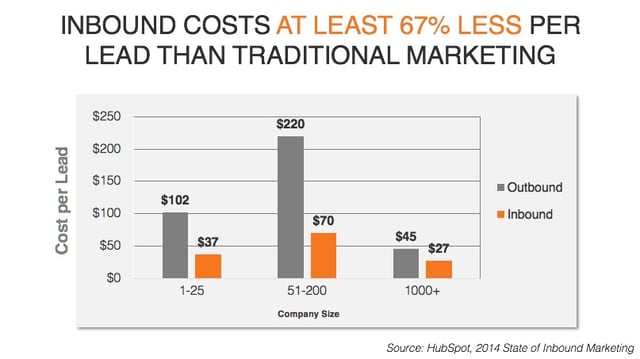

2. It's Cheaper than Traditional Marketing, Period.

According to HubSpot's recent study Inbound Marketing (ie. blogging, social media, content marketing, email, etc) costs 67% less per lead than traditional marketing!!

But aside from the cost difference, it's just so much easier to actually track your results with properly designed digital campaigns. So with lower costs and the ability to tie real leads to marketing efforts this is a no-brainer shift in priorities and approach. Why wait??

3. People are Shopping Online for Banking Products & Services NOW!

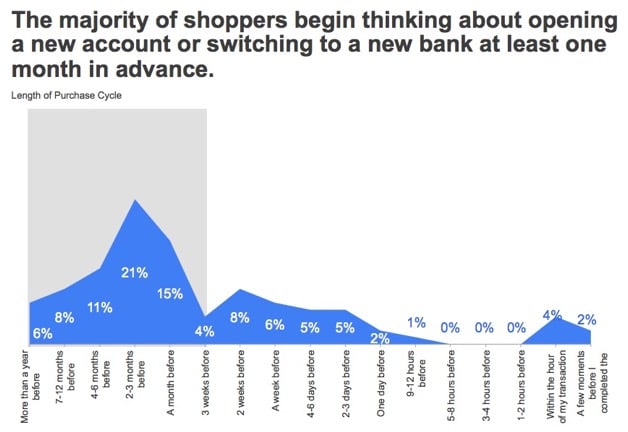

According to Google's 2011 Zero Moment of Truth survey, people are consulting on average 8.9 sources of information to help them make their purchase decision, and the majority of these shoppers begin this research at least one MONTH prior to making a decision.

If your bank or credit union doesn't get in front of these digital shoppers NOW they will have made their purchase decisions before your institution finally decides to get into this game! Waiting is simply not an option anymore.

We see so many banks and credit unions putting off action, and of course the status quo is always an easy path to stay on, but people are shopping for banking options online today, so waiting means you are leaving money and new customers on the table.

Need help understanding how to get started? Contact Us today!

Blog comments