Want Bank or Credit Union Growth? Ditch Direct Mail - Go 100% Digital

Don't Miss An Episode, Subscribe Now

As many of us know, the daily life of the average person has changed drastically in recent years. People are spending more time on their mobile devices and online than ever before. Sure, people still receive and check their actual physical mailboxes, but can direct mail really compete in this new digital world?

You might be interested in ways to grow and develop your bank or credit union... Here's why we recommend you should ditch direct mail and go 100% digital!

#1 - It's Expensive

In this boundless digital world, you no longer have to fight for physical space like you did with print advertising. The fact that space is unlimited means that the costs are low and Return on Investment (ROI) is high.

Many studies show that Direct Mail is in fact still effective, but the major problem is the COST. And we all know that financial institutions MUST watch their budgets very closely!

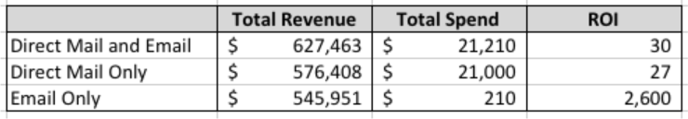

In a recent study by Hubspot, the response rate and the average order was in fact higher from the direct mail campaign. The direct mail campaign had a 24% response rate, and an average order of $68.62. The email campaign was slightly lower at a 23% response rate, and an average order of $67.82.

Direct mail did better, right? Well, the tables turn when you factor in the cost of the two campaigns. The ROI for every dollar spent on direct mail was $27. The return on investment on the email campaign was $2,600!! The email-only campaign performed 95 times better in terms of Return on Investment!

Here's the actual results:

Overall, the direct mail campaign seemed to be the better of the two. The direct mail generated (slightly) more revenue and had more responses. But it was the COST of each of these methods that made the difference. So YES direct mail is still effective, but not as cost effective as digital.

[DOWNLOAD NOW: 12 Steps to Grow Your Financial Institution]#2 - Not Segmented Like Digital

When you send out a direct mail, you often send everyone in an area the same piece of content. It's cost prohibitive to print and segment your messaging based on ages, gender, income, education level, or other important factors. But with digital you can easily change the visuals and messaging based on these factors and many, many others!

You can segment out your email list and customize the content with personalization tokens. Or you can build out a campaign on Facebook that a/b tests different headlines or images to drive the most results and retargets your website traffic.

Better yet, you can create a PPC campaign with responsive text ads and a solid keyword strategy to capture leads as they're actively searching for a product or service.

Show me a direct mail campaign that can change the messaging with ease.

I don't think it exists.

#3 - Results From Direct Mail Are Just Not There!

Regardless of the larger stats you might find on direct mail for Financial Institutions, we base our efforts on what we see actually working for Credit Union clients, and direct mail continuously disappoints.

For one large client in the Boston area we recently ran two simultaneous campaigns, one driven by Inbound digital methods (blogging, email, social media, adwords) and one driven by a huge direct mailing that went out to approximately 25,000 households in their geographic area.

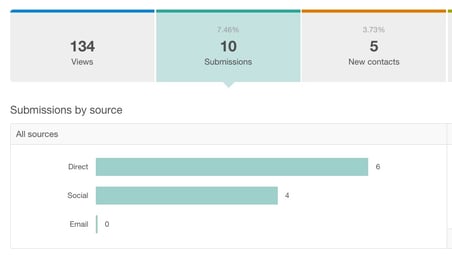

The results speak for themselves. From the direct mail driven iPhone giveaway campaign the  interest just wasn't there. Over the course of the campaign we had a measly 134 views of the landing page and only 10 submissions!!

interest just wasn't there. Over the course of the campaign we had a measly 134 views of the landing page and only 10 submissions!!

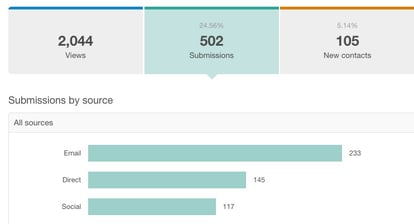

But from the e-Book campaign with NO giveaway, where we simply gave away a free e-book we have over 2,000 views and 500+ submissions, and the entries continue to come in each day, even though we are not actively promoting the campaign any longer.

We also grew the CU's email list by 105 new contacts, and these are people we will now nurture over time in hopes that we will eventually convert them to new members as their relationship with the CU grows and we build more trust with them.

In the end it is important for your Credit Union or Bank to weigh the pros and cons of digital vs. direct mail and make a careful decision. If you do use direct mail we recommend creating a very specific buyers journey from these print efforts so that you can carefully track results back to their original sources, and then measure your cost versus results to inform future efforts.

Interested in more suggestions for the growth and development of your bank or credit union? Contact us today!

Blog comments