The Big Banks ARE Your Competitor, The Stats Prove It

Don't Miss An Episode, Subscribe Now

As a credit union or community bank, you may find yourself saying (and believing) that the big banks are not your competition. Studies show that's actually not true.

Each year HubSpot has a major international conference called INBOUND (we highly recommend you check it out and attend!). During the 2021 INBOUND conference one of the sessions on driving sustainable growth included the following slide:

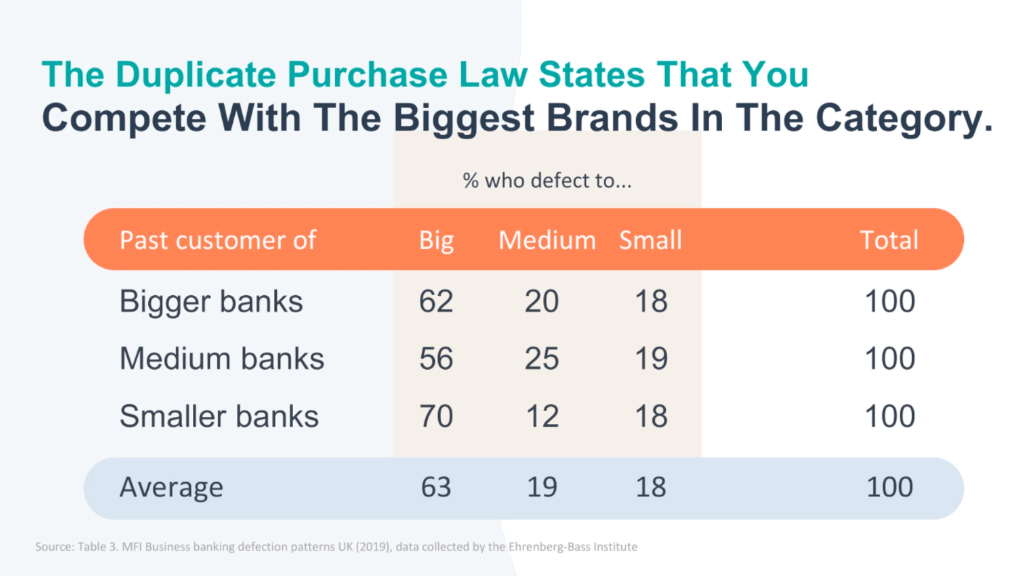

What this slide illustrates is that of the total number of people who left a big bank 62% went to another big bank, 20% went to a medium-sized bank, and 18% went to a small bank.

More importantly, it illustrates that of the people who left small banks 70% went to a big bank and the average number of people who leave big, medium, or small-sized banks that choose a small bank as their next financial institution is only 18%, ouch!

Simply saying that big banks are not your competition doesn't make it true. Since choosing to ignore facts doesn't mean they cease to exist (drat!) you need to dig deeper to differentiate yourself from your (BIG) competition.

How To Compete With Big Banks

There are many ways to compete with big banks so the key is to find the way that works best for you. Likely, you're not going to be able to outspend them in the digital space and outbid them for top ad spots in search results or build a propriety online application and/or online banking system that will compete with a more streamlined and intuitive user experience than they're able to deliver. So what can you do right now without a substantial financial investment?

Two key areas that you have the ability to influence in an impactful way are perception and branding.

It's all about perception.

It's all about perception.

There's a universal perception that smaller institutions can't provide the same level of services (I'm not talking about happy, smiling people in the branch, I'm talking about online DIY services) as big banks and those smaller institutions don't always have the funds or policies in place to take risks on helping their members and customers who don't neatly fit into a box labeled "normal average member."

Storytelling is one of the best ways to debunk this negative perception and create a new positive perception for your institution. If you help startups and small businesses, be sure you're sharing those stories in your blog, with video content on your social channels, and that you're utilizing PR opportunities to make it known.

Expand your definition of PR to include video interviews and content on the social media channels of your business members, local podcasts, regional publications that other business owners likely receive or follow, etc. Find tangible ways to make your participation in growing local businesses seen and known.

For example, give your business members window decals to display at their location(s) to demonstrate to everyone who walks through their door that you are part of that business' success story.

Share stories from members about how you helped them reach their personal goals. Share stories from employees who love their jobs. Enter your institution into programs to earn awards like "Best Place To Work" and share those awards to show that not only are you helping individuals and businesses in the community, you're a fantastic employer too!

Share these stories obsessively to help people understand who you are and the impact you're having in the world. This will help to change the perception about limited capabilities in an institution your size.

When it comes to branding, my favorite definition of a brand is: your brand is what people say about you when you're not in the room. I find this to be the most accurate definition that helps non-marketers think beyond brand identity and the use of imagery and colors and truly start to understand what a brand is.

There's no surprise that brand and perception go hand-in-hand as your brand influences the perception of your organization. It's important that you understand that while brand influences perception, it's NOT the MOST influential force on perception. Third-party word of mouth is the most influential force on the perception of your organization in the marketplace, but your brand voice is YOUR most influential tool which is why it's so important that you're doing it well.

When you produce marketing campaigns, social media content, blog content, etc. it's imperative that you highlight the mission of your institution and core values of your brand consistently.

If your mission is something like providing excellent customer service you may want to revisit your vision and mission as that's not going to resonate too deeply with the general consumer unless your in-person, online, app, and telephone support and services are truly all outstanding and worthy of talking about. Everyone promises great service so service standards as a mission aren't as trusted as they once were.

[Related Article: Mission-Based SEO is TODAY's SEO ]

As you put your marketing campaigns together, consider the tone of your [printed/digital] voice. A campaign that is asking for business boasting a low rate doesn't make you look any different than a big bank which makes consumers wonder what the advantage is of choosing you is.

If the big banks look like apples, make sure you look like an orange! Your message should clearly state why your mission, vision, impact, values, or other brand characteristic makes you the best choice for that product or service in the eye of the consumer.

Key Takeaways:

- Big banks are your competitors.

- Your brand voice is YOUR most influential tool to influence the perception of your bank or credit union.

- Your vision, mission, values, and unique characteristics are going to make you stand out.

- Storytelling is the best way to debunk myths and negative perceptions about small financial institutions.

Next Steps:

- Team up and discuss your messaging with key stakeholders in your bank or credit union.

- Expand into new channels to share your content/stories. Videos on social media are fantastic!

- Track overall lift to measure your success.

Blog comments