Credit Card Promotion Ideas To Drive Card Portfolio Growth

Don't Miss An Episode, Subscribe Now

It's no surprise that as our members and customers cope with uncertainty, their spending habits and desire to open a new credit card may be less than typical. That being said, we need to remember that even through the chaos, our members and customers still use credit cards.

How can your Credit Union or Bank stay competitive among the overwhelming credit card offers flooding in from the competition? Here are a few effective credit card marketing ideas you can implement today to boost card placement.

Credit Card Marketing Ideas For Indirect Members and Customers

Indirect loan holders, or "Rate Shoppers," may come off as an impossible target for a credit card cross-sell. Is it possible for your Credit Union or Bank staff to deepen the relationship with these indirect loan holders? Absolutely! These types of consumers are ideal candidates for a credit card cross-sell offer because all you have to do is beat their current offer and they will switch! After all, isn't that how you acquired them in the first place?

While you still have their credit report in front of you, approve them for your credit card and make the offer. Notice I didn't say "pre-approve", or "pre-qualify". Simply approve them. If you've just approved them for a multi-thousand dollar indirect auto loan or boat loan, there shouldn't be any reason why you wouldn’t approve them for a credit card.

While you still have their credit report in front of you, approve them for your credit card and make the offer. Notice I didn't say "pre-approve", or "pre-qualify". Simply approve them. If you've just approved them for a multi-thousand dollar indirect auto loan or boat loan, there shouldn't be any reason why you wouldn’t approve them for a credit card.

Reach out via email or phone, and let them know they're already approved.

This strategy works not only for indirect loans, it's perfect for all members or customers getting a loan who don't have a credit card with you.

If it isn't a standard part of your loan process, it should be!

No Credit Card Rewards or Points For a Promotion? No Problem!

OK, so your card doesn't offer fancy rewards and points. Where do you go from here?

Marketing Idea 1: Promote What the Big Credit Card Companies Don’t Have

Promote your amazing service and commitment to helping your members and customers succeed. Promote your local success stories that happen with your members and customers each and every day. Without getting too personal, you can share success stories on your social channels and communication channels that are relatable! Demonstrate all that can be accomplished with your local credit card.

A member consolidating their last outstanding debt onto a low rate credit card, a customer's first credit card being used to responsibly build credit, a young adult who is saving $96/month in interest charges by switching to your local credit card, a business's successful delivery due to the help of their local financial institution's credit card. These stories show the impact your local credit card has on friends and neighbors in the local community.

Promote your local benefits. Remind your members what happens when they support your local financial institution by opening your credit card. As part of a promotion, you can offer your customers or members the opportunity to select one of the top 5 local charities in their area to receive a small donation for every credit card that is opened. While there are many credit card options available, only certain ones can pull on the heartstrings.

Why do testimonials and success stories matter? Because according to Statista.com, 70% of online shoppers typically read between one and six reviews before making a decision and moving forward with a product. Posting these success stories of community members and organizations benefiting from your local credit union or bank reminds people of your commitment to them and gently reminds them of your credit card options.

Marketing Idea 2: Position your Low Rate Credit Card as the End Goal

Educate your Credit Union members and Bank customers that the end goal for financial freedom is to be in control of their credit card spending. Advise them to consolidate their competitor's credit cards onto your low rate credit card and pay no balance transfer fee.

Educate your Credit Union members and Bank customers that the end goal for financial freedom is to be in control of their credit card spending. Advise them to consolidate their competitor's credit cards onto your low rate credit card and pay no balance transfer fee.

Illustrate how that's a financially savvy money management technique, making them feel smart for their decision. Enroll them in an educational onboarding workflow that includes articles and guides explaining debt-to-income factors and what over-extended lines of credit do to their credit score so they can make adjustments to how they manage their spending.

You are there for guidance and to get them closer to their financial goals. Never feel bad about offering them a product to help them achieve success faster.

Have Credit Card Rewards and Points For a Promotion?

Use FOMO to Boost Conversions!

It is a fact that people will work harder to not lose something than they will to gain it.

People will work harder to not lose something than they will to gain it.

That's why the fear of missing out (FOMO) is such a powerful motivator.

If you have a rewards/points program for your credit card, you'll need to point out to people what they're missing out on to inspire them to take action. Notifying them that last quarter they missed out on X dollars or points by not having your card will be more of a motivator than trying to coerce them into adding another rewards card to their wallet by promoting its features.

If you don't have an exact number for the individual, talk about the average rewards earned by others for the last quarter and emphasize that they're missing out on the action!

Related: The Ultimate Guide to Successful Digital Growth for Financial Institutions [FREE eBook]

Credit Card Promotions Won't Work With Barriers To Entry

No matter which promotion you're running, if applying for your card is a lengthy or cumbersome process you'll have limited success. Plain and simple, you must remove any unnecessary barriers in the application and approval process. Because your competitors are approving credit cards in seconds from every device type, the consumer is now expecting this experience and considering it to be the norm. Strive to deliver a seamless, experience that makes getting your card easy.

While you may feel your hands are tied when it comes to the credit card application, you still may be able to streamline the overall process and collect solid leads. Make sure that your credit card product page features a form allowing users to start their application near the top of the page near or in the hero module. We typically recommend collecting a first name, last name, email, and phone number. Once users complete these fields, they will select the "next" button which brings them directly to the loan application. By collecting their information you can now have a team member follow up with the leads of interested users that didn't convert.

Promote Your Credit Card Program...Over and Over

Your customers and members are seeing a lot of credit card offers right now. It can be a tricky balance trying to figure out the perfect marketing budget and strategy to hit your strategic goals, but if credit cards are on your list of products to grow, repetition is key.

The general rule is that prospective buyers typically need to hear or see your marketing message AT LEAST seven times before they even consider taking action.

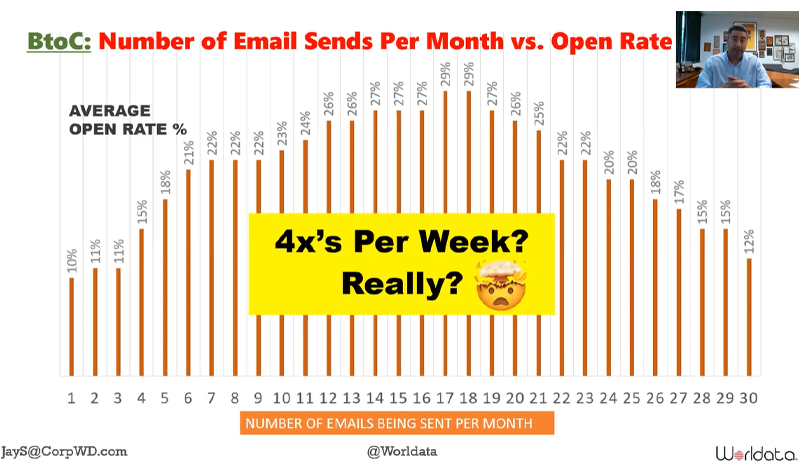

Take email marketing for example. Some of us are shy about sending one or two emails per week but check out these stats from Jay Schwedelson’s presentation “Do This, Not That: All New Email Tips for Q2” from Worldata.com.

The data shows that sending about 4 emails per week is the sweet spot when it comes to getting the highest open rates.

Keep this in mind as you develop plans for promoting your credit card marketing ideas, and if you need some help planning your digital marketing strategy do not hesitate to reach out!

Blog comments