6 Steps to Creating a Perfect Social Media Response Plan

Don't Miss An Episode, Subscribe Now

We all want to put our best foot forward, even online! So, every business needs an online response plan, and in the case of Credit Unions and Community Banks the regulators actually require that you have one!

So here are the basics on how to get social media marketing for Banks and Credit Unions done correctly and efficiently.

Step 1: Assess the Competition

The easiest way to get a sense for what kinds of interactions you need to be ready to handle is to take a look at your competition. What are fans/followers posting on their social media and how are they responding? This will give you a sense for what issues you might run into.

Look at regional and national banks and other Credit Unions that are known for good member service.

Step 2: Complete a Social Media Self-Assessment

This should involve determining what kind of staff you can allocate to social media marketing and what kind of budget you have at your disposal.

If you have the room in your budget you will probably want to outsource some of your social media responsibilities to a company like ours, so that your internal staff don't have to be on-call 24/7. In this assessment you should also consider brand voice and mission.

Perhaps it's time to develop some brand guidelines for how you want your staff to represent your Credit Union online, if you haven't done so already. Think about questions like... Are you interested in being funny and entertaining, or would you rather remain more serious and focus solely on member satisfaction? Maybe there is a nice middle ground you are trying to achieve?

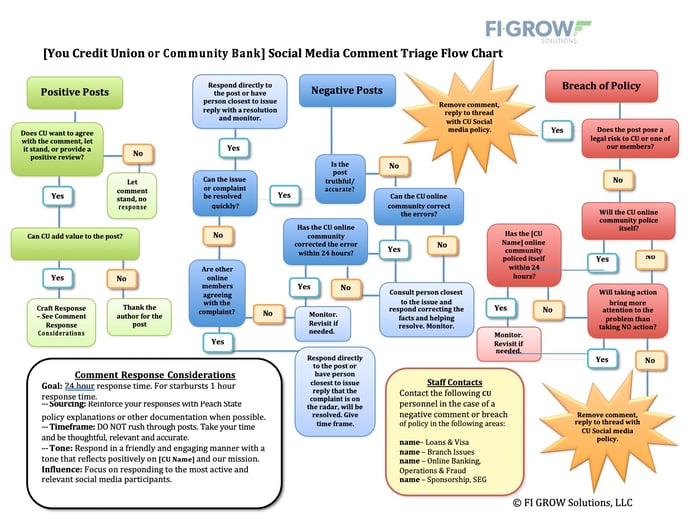

Step 3: Create a Response Plan Flow Chart

This is basically a concise flow chart or visual depiction of how staff should respond in different kinds of scenarios online. So, for example, if a customer or member posts their account number with a question on your Facebook page, you should have a very clear response plan to handle this breach of policy. We recommend removal of the post immediately and then having a member service representative contact the member via email or phone as soon as possible to resolve their issue.

In this response plan you should also designate which staff members should be contacted for various kinds of customer inquiries. If there is a problem with a branch then which staff member handles that? If there is a loan inquiry then who will respond? This cuts down on response time as whoever is on-call can just forward the question on to the correct person immediately rather than having to determine who to contact and THEN forward the question.

Step 4: Help Staff Pick Their Words Carefully

In addition to a response plan flow chart, we also provide clients with sample response language that they can copy and paste and then customize to any specific situation. This is not meant to make every response identical, but it is important that your financial institution responds with consistent and high quality customer service in mind. Sometimes staff will need guidance on the best wording for different kinds of scenarios.

This is especially important in the case of a serious complaint. Staff need to remain positive and always acknowledge the customer's perspective, even if they are clearly in the wrong.

Step 5: Create an On-Call Calendar

Because social media is never off, we recommend to all our clients that someone should be on-call 24/7.

This doesn't necessarily mean they need to be at their desk checking the company Facebook page every 20 minutes. But we do suggest having a designated person check platforms 1-2 times per day during off hours, just in case there is a post that would need to be addressed immediately (like the example above). These kinds of problems are rare, but it's important to be prepared.

Step 6: Assess Your Efforts on a Regular Basis

In your monthly ROI report you should be tracking online engagement, and if you have a serious issue one month make sure you document these and reflect on how the problem was handled. If there were mistakes made don't waste time with looking back and playing the blame game, simply take note and use these as learning experiences to better prepare for how to deal with future online interactions.

If you'd like more help with your own Credit Union or Bank social media response plan download our easy to implement guide below!

Or contact us today for more information about how we can help you with your online marketing efforts!

Blog comments