[Live from #INBOUND18] Retention Marketing for Growth

![[Live from #INBOUND18] Retention Marketing for Growth](https://www.figrow.com/hs-fs/hubfs/IMG_4886.jpg?width=950&name=IMG_4886.jpg)

Don't Miss An Episode, Subscribe Now

We're having a blast at #INBOUND18. If you're not familiar with this amazing conference put on by HubSpot, check it out at inbound.com.

Here's a "live blog" from a session here at #INBOUND18 about Retention Marketing. Please excuse any typos as it is "live"!

Retention Marketing is Verb

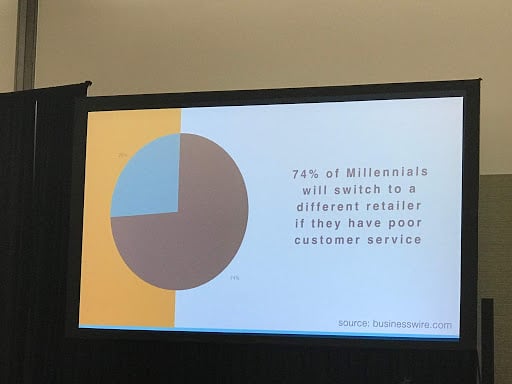

It's important to understand that retention marketing is an active process. Making customers happy at a point of contact is a secluded event. Retention marketing is an active process that is diligently focused on keeping customers.

Managing Expectations

If you've ever traveled you know the difference between a budget airline and a top-of-the-line airline with an amazing first class experience. However, there's a large number of people who will fly a budget airline to save a few bucks, and then leave negative reviews and feedback because they didn't have the experience they wanted.

What should you glean from this information and be asking yourself so you don't find your institution in a place of receiving negative reviews from people that just weren't a good fit?

- Are you clear in your value proposition statement, and with your language so potential members know what to expect from your credit union or community bank?

- Are you telling potential customers what your community bank or credit union values and where you focus your growth and development efforts in their communities?

- Are you clear in conveying what your ideal persona should expect from you, and is it clear when someone isn't your ideal persona and won't be happy using your financial institution?

Being clear about what people can expect from your institution will help you attract the right customers (hopefully lowering the negative reviews) and help you KEEP the right customers.

It also helps you focus on making the experience (and products and services) better for the right people, your ideal persona, making retention efforts more effective.

Reputation Management

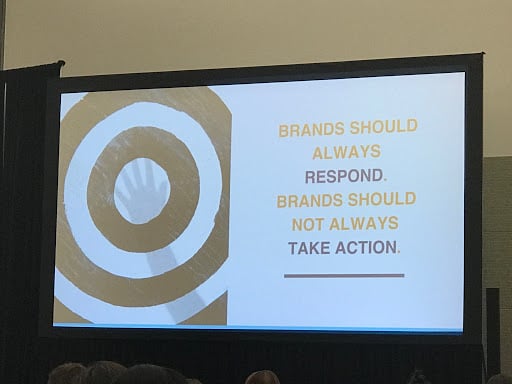

You should absolutely listen to all your customers and take all feedback seriously and never delete a negative review. Brands should always respond, but should not always take action. Don't change policy and procedure based on feedback from a person, or people, who are not your ideal persona. If you try to be all things to all people you will not be able to develop an effective retention strategy.

Now that we've talked about how to set the right expectations, which is the foundation for which retention marketing program thrive, lets talk about what retention marketing looks like.

Loyalty, Ownership and Belonging

Make your customer feel like they own your brand. When they feel like they belong to something bigger than themselves, like they're part of a community, you have created an environment where successful retention strategies thrive.

For credit unions this should be natural because your members do in fact own your institution. But do they know this? Do they feel like they own it? Are they proud to belong to your institution?

Giving people a space where they belong, where their needs are met and service truly is exceptional is an important part of retention. However, you can't claim to have the best service and then 'set-it-and-forget-it' as your retention strategy. Lip service is not a retention strategy.

Adopting a culture in which it's the responsibility of every employee to truly delight your customer and continuously build a better relationship at every touch point is a solid retention strategy.

Tactically, make the changes necessary to demonstrate the importance of keeping your existing customers satisfied. Add it to job descriptions, every job description. Develop a training program around these ideals that all employees must participate in. And make delighting your customers your #1 priority.

Find the Right Tools

Align your institution with the right tools for success. You'll need a CRM with the ability to send personalized, dynamic messages to not only your members, but to your employees working with your members.

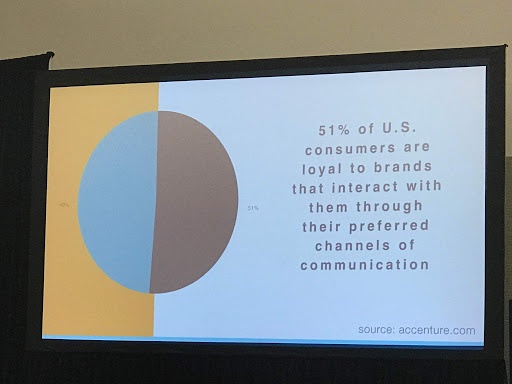

When communicating with your members, it has to be through their preferred communication channel(s). So make sure you take the time to collect the right data to find out which channels your ideal persona prefers to communicate through.

Retention Marketing Budget

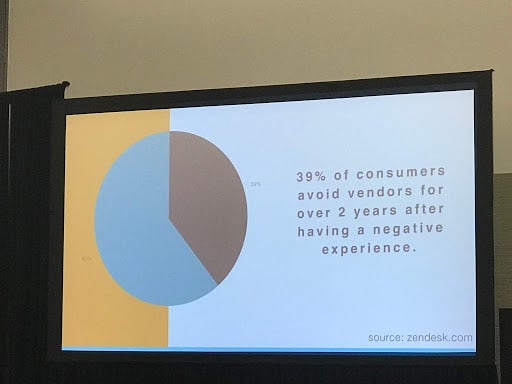

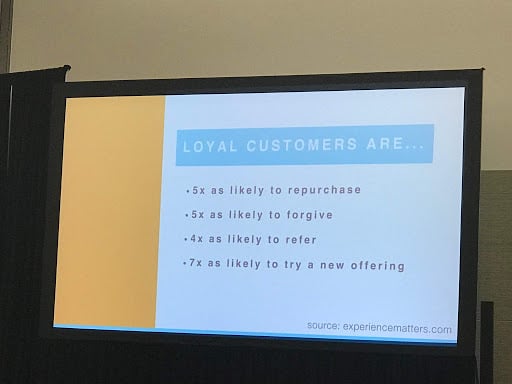

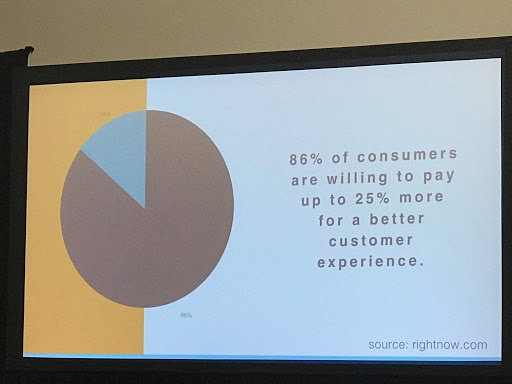

Retention marketing does require budget, however, it's significantly cheaper to retain happy, loyal members than it is to acquire new customers. Developing a budget, team, and a strategy around retention is a smart business decision because it will ultimately save you money and contribute to your overall growth.

If you need help with a retention strategy and aligning your financial institution with the right tools to make it a reality, don't hesitate to contact us at FI GROW Solutions!

.jpg?height=500&name=File%20(6).jpg)

Blog comments