5 Steps to Running a Successful Indirect Onboarding Campaign

Don't Miss An Episode, Subscribe Now

If your financial institution provides indirect loans, you probably struggle with having a large number of unengaged members/ customers and lose them once their loan is paid off. An indirect onboarding process may be a great strategy for you to deepen the relationship with these unengaged customers.

Here are 5 steps to run a successful indirect onboarding process that is automated, personalized, and yields results right away!

1. Align the onboarding process across online and offline channels.

The first step is to bring your indirect department head to the table and understand the communication that is already happening with the indirect customers/members and what is in place already. This will help to assess how this process can be improved.

During this time, think of how many touch points and the frequency of communication you want to have with new customers.

Traditionally we recommend 4-5 emails, and a couple of phone calls are most important for the process. Also, during the planning phase, you want to determine what products and services you want to communicate about and if there are any financial education resources you can tie with your products to deepen these relationships.

Also, it makes sense to try to see if the disclosures can be delivered electronically to eliminate the heavy paperwork and cost associated with mailing it.

2. Develop a product offer based on their indirect auto loan approval application.

The majority of the indirect members/customers are from auto loans through dealerships. Usually, if they are authorized for an auto loan for $5k or more, you know they will be a good customer to take on another product from you.

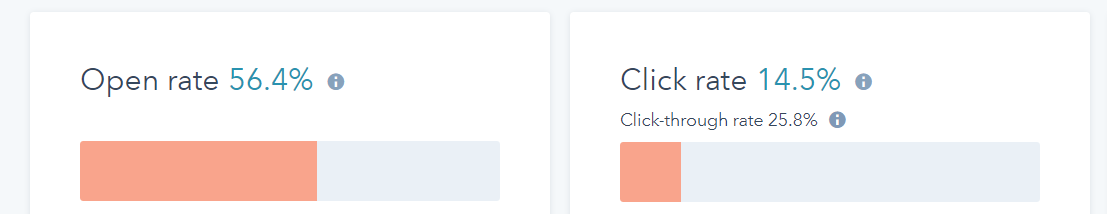

We have succeeded in offering a beneficial product pre-approval to the indirect customers for various financial institutions. This helps widen the share of wallet and deepen the relationship with these indirect customers/members. Here is a case study for one of our clients with successful indirect onboarding process implementation.

Here is an example of an offer another client is running:

3. Personalize your subject line and messaging with loan details.

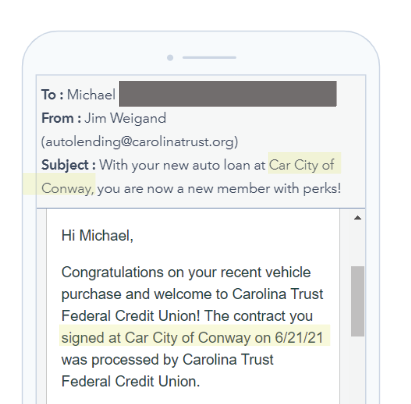

The first contact you make through email may be the first time this new indirect customer hears of your financial institution name or even the fact that you have their auto loan. To get a high open-rate and engagement on email, make sure to personalize your subject line with items like vehicle type, dealership name, loan amount, and/or close date.

Personalizing this information will help the email recipients to prioritize an email about their new auto loan. An example of a personalized subject line using the data that the financial institution already had is below:

4. Reach out on multiple platforms with various formats.

Although you may have a welcome package that is already part of the indirect onboarding process, it is important to add a welcome letter in the physical package, do a courtesy call, as well as reach out with multiple emails spread across a short period of time.

Doing multiple touch points enhances the customer experience and allows the customer/member to really familiarize themselves with your financial institution. The goal is to stay top of mind for them and provide great customer service so they think of you for other financial products and services.

5. Stay focused and precise, don’t waste time with fluff.

Often, financial institutions are afraid to come off as too sales-y and neglect cross-selling their products during an onboarding process. That is a huge mistake because if you really thought your products and services are actual solutions for financial success, offering them to your new customers should be a sense of pride.

Add-ons like mechanical breakdowns, GAP, payment protection and auto insurance are great next steps to offer these new members or customers.

Yes, sharing about your company culture and membership perks is great, but if you can let them know how they benefit by signing up for other products and services, it will help both sides. Consumers nowadays appreciate clear and precise messaging and information. Tie in your financial education resources as well as product knowledge to give them the best options possible.

Contact us if you would like personalized help on putting together your onboarding process.

Blog comments