10 Ways to Maximize Results from Digital Marketing For Financial Institutions

Don't Miss An Episode, Subscribe Now

We've put together 10 Quick Tips to Maximize Results from Digital Marketing for Banks and Credit Unions!

1) Update Your Website:

If it has been more than 5 or 6 years since your website has gone through a major update, this should be your first priority.

Banks and Credit Unions will invest on average over a million dollars to build a new branch and consider it an asset. Yet, any money spent on their website is considered an expense. With branch traffic declining and mobile traffic on a rise Financial Institutions should change this kind of thinking and consider their website a digital asset. And every asset needs maintenance!

Learn more... The Ultimate Guide to Successful Inbound Marketing for Financial Institutions

The key for your website is that it must be mobile responsive and provide a good experience for the user, regardless of device. We often recommend a mobile-first design, in that you don't just make your site responsive after the design process, but in fact you design FOR mobile first, and then also make sure it functions well on tablets and desktops.

We also recommend reducing the number of Calls-to-Action on the website so that visitors aren't overwhelmed with options and can focus on a more narrow set of possible choices when visiting your site for the first time. Even limiting your Credit Union or Bank website to 40-50 product or service pages is a great goal!

2) Start a Blog:

Blogs are essential to getting organic traffic to your website. Not only that but educational content found in a blog can be a useful resource for your members.

It is important to write about things that interest your members or potential new members. The purpose of your blog should be to inform or entertain, not just sell. The only time you should add any selling points is when it fits naturally within the buyers journey.

Say you write an article on how get the best price for a new car, and this how-to piece of content includes information for how to best compare interest rates. Then it would be appropriate to add a link to your car loan rates page. And don't forget to add social sharing buttons to every blog!

3) Improve Your SEO

Search Engine Optimization (SEO) is the process of boosting the visibility of your website on a search engine results page (SERP), and the result is increased page views.

When creating a page or blog start with a keyword. The keyword should be in the URL and used naturally throughout the page. Keywords should be in the natural search language your target audience would be using in a Google search. Keywords should be popular but specific enough to show up when people are searching for specific products or services or other information you are providing.

For example, don't use a keyword like "car loan," that's WAY too broad. Instead maybe use what's called a 'long-tail' search phrase like "best car loan rates in (your target city)" as your keyword. Then create several pieces of content around this target search phrase.

This kind of content strategy will drive much more traffic to your website and get better results with digital marketing for your bank or credit union.

4) Complete Your Website's Metadata:

Metadata is data that explains other what other information is on your website, in the event that it cannot be displayed for some reason.

Things like alt-text, title tags and meta descriptions are inspected by search engine "crawlers" and help search engines like Bing or Google better understand what your web page is all about. Not completing your website's metadata will negatively impact your placement in search results.

Learn More: The Ultimate Guide to Successful Inbound Marketing for Financial Institutions

5) Optimize Your Social Media Profiles

If your Credit Union has Social Media Profiles (which it absolutely should) make sure they are fully optimized. You should always add the link to your website in your short description and make sure your long description includes key words for search engine optimization.

You should also add useful links to the description in your profile pictures and cover images, as these appear in news feeds and are clickable. Depending on thew platform you must also consistently post on these social media site in order for them to be successful. Which leads to the next tip...

6) Invest in Social Media Ads

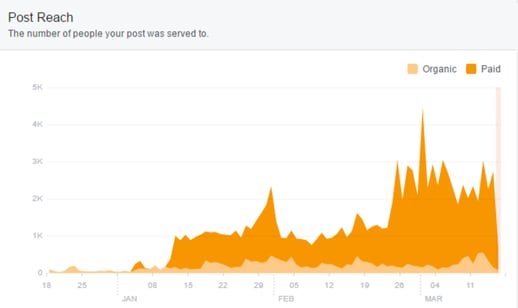

Yes, Social Media is technically free, but to fully maximize your potential reach your Credit Union should definitely consider investing ad dollars to increase the reach of your social media content. As you can see in the Facebook reach chart below, spikes in paid page reach created spikes in organic reach.

In short, spending money to increase your reach on social media will also help other people see content more, even when you don't pay for these additional impressions! And the targeting is incredible, especially with Facebook Ads, which can also be placed on Instagram. You can target by demographics, location, income, interest, job title... the list is incredible!

7) Implement a Social Media Policy For Your Employees

Your Credit Union MUST have a full-proof Social Media Staff Policy in place, in order to avoid online disaster! This social media policy should include expectations for staff when they are at work and when they are using social media on their personal time.

8) Engage With Your Followers

Talk to your followers and let them know you're listening. We believe that every comment and share should be liked and replied to, 100% of the time. Most people expect responses quickly, but if it is a non-issue comment, a response within 24-48 hours is adequate.

If you're not sure how to respond to negative comments, we can help! Social Media Marketing: 4 Responses for Tough Comments.

9) When You Send an Emails Make Sure They Have a Clear and Defined Purpose

Many Credit Unions tend to email haphazardly, when something comes up they want to share. But they aren't strategic with this valuable communication medium. Keep in mind that your members have trusted you with their emails, so don't waste their time. We recommend emailing no more than once per week, and doing so with a meaningful message that is tied to a larger marketing or messaging campaign.

Consider sharing member testimonials via email or other case studies that help highlight the bigger mission of the Credit Union. Also share links to valuable blogs or other useful content on your website. Then slowly over time you can ask members to consider a new product or service offering, but only after you have nurtured them and built trust.

10) Set Goals and Measure Your Success

Make sure your goals are measurable and timely. We recommend using SMART Goals, and we have an entire blog devoted to how to create them properly. Setting and measuring your goals is essential to determining what works with digital marketing for credit unions, and what you will need to adjust!

Blog comments