How to Build a Credit Union or Bank Website that Drives Growth

Don't Miss An Episode, Subscribe Now

Developing a New Credit Union or Bank Website

If you categorize website functionality using the crawl, walk, run framework, the features that fit into each stage have changed significantly in the last few years. While strategically placed call-to-action buttons in the latest 'must-click' color and mobile responsiveness were considered "run" stage features not too long ago, they're now "walk" level functions at best.

At this point in the digital evolution of online banking, your institution's website should be working harder for you, offering far more value than simply looking good on a mobile device.

Your institution’s website needs to be an agile digital asset that delivers a unique, individualized, value-added experience for each member or potential new member. If it’s not your largest fully functioning branch, top sales producer, and the premier face of your credit union you should consider these three areas for improvement.

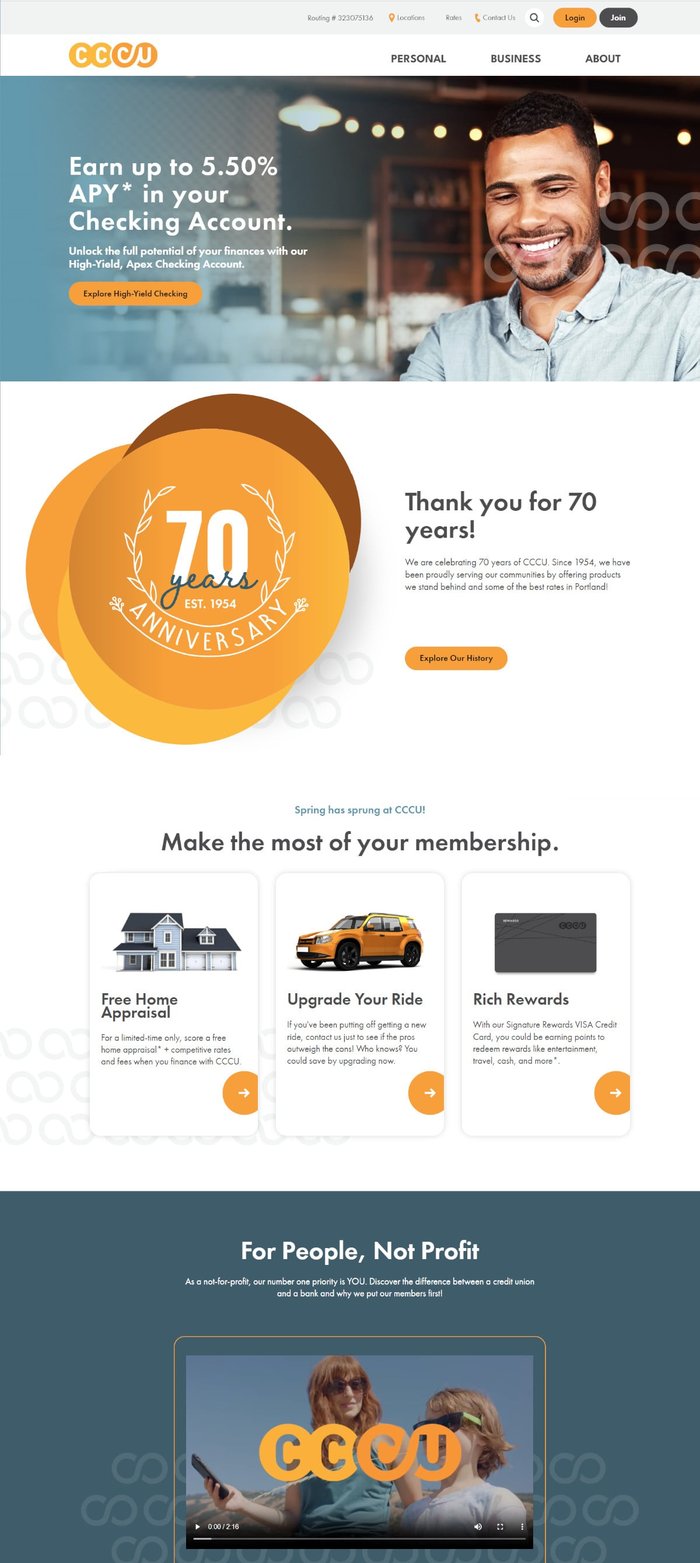

The website featured in this post is Consolidated Community Credit Union based in Portland, OR. We worked with CCCU on the design, development, and strategy behind their new website in 2023. Here are our 5 favorite functions implemented on this site!

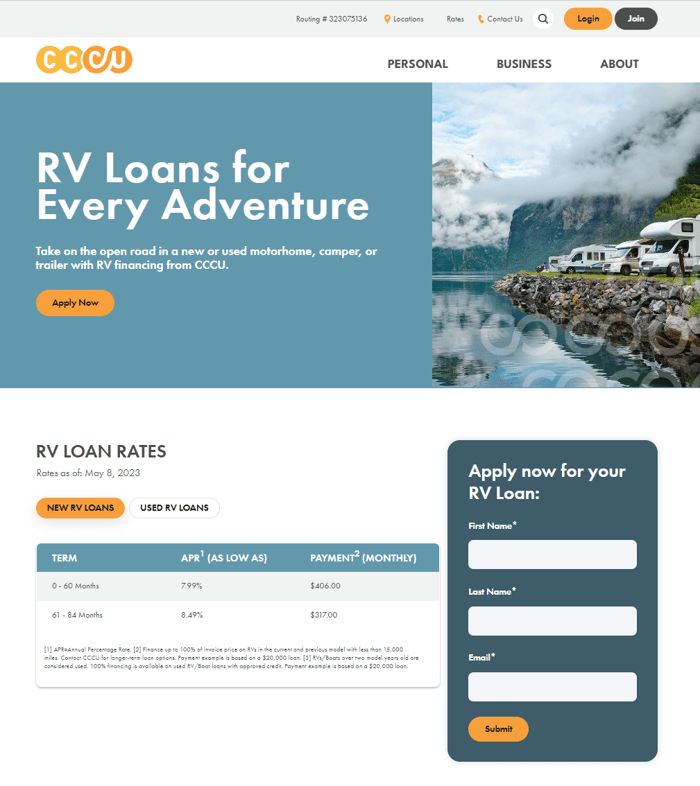

1. Online Account and Loan Applications

It's probably no surprise this is first on the list. Today's consumer expects to be able to apply for anything from the palm of their hand 24/7. If your website still doesn't offer online applications you're very much still in the "crawl stage" of website functionality.

Keeping your online applications front and center is key. For CCCU, we strategically positioned every account and loan application at the top of each product page.

We've found that many credit unions and community banks with online applications are severely limited by third-party technology and stipulations from contracts signed years ago. If this is you, aim for some quick wins with your vendor.

For example, simply ask for the savings account to be automatically selected on the application when someone joins your financial institution. If they can't handle simple requests to remove friction in the application process it may be time for a new vendor.

2. Dynamic Content

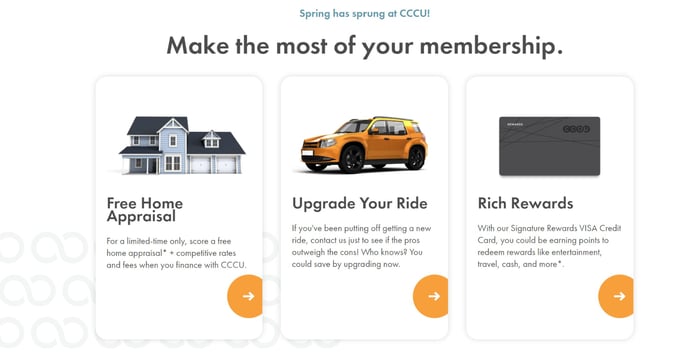

This is a feature we LOVE about the new CCCU website! The homepage hero image, text, and elements on the page all change based on the user's past experience with the website and the information they already have about them.

If you've recently visited the Auto Loan page for example, you'll see a homepage banner with the same graphic from the product page if you revisit the site within a week.

Similarly, if your most recent visit was to the Credit Card page, you'll see a Credit Card related banner.

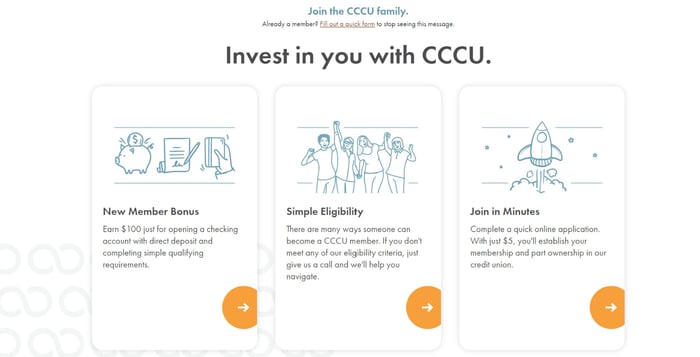

If that wasn't enough homepage customization for you, CCCU also changes the on-page modules based on membership status and other variables. A non-member for example will see this module right below the homepage banner:

While a member will see the following:

Through individualized messaging and graphics, the CCCU website works 24/7 to deepen relationships by offering relevant, timely information to its visitors.

3. Dynamic Campaigns Driven by User Behavior

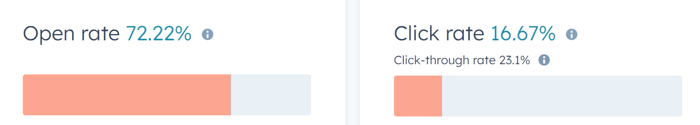

Beyond the graphic and module changes, CCCU can send relevant emails to users based on their on-site behavior. Engaging with a page or completing a form can prompt the sending of a well-timed email or a series of emails tailored to provide the user with content that aligns with their interests.

CCCU has experienced a 72.2% open rate and a 23.1% click-through rate with their Debt Consolidation email sent 2 days after downloading Debt Consolidation content. There have been 0 unsubscribes and 0 SPAM reports from this email.

Your website should be working in conjunction with a robust CRM tool to deliver value-add messaging that builds trust and deepens relationships. Having your website and CRM on the same software platform helps significantly.

We're big fans of HubSpot here at FI GROW Solutions. We're also an agency partner. If you have questions about how their tools can help your credit union or community bank contact us to learn more. We're happy to help!

4. Searchable Knowledge Base, Chat, and Lead Flow Pop-Ups

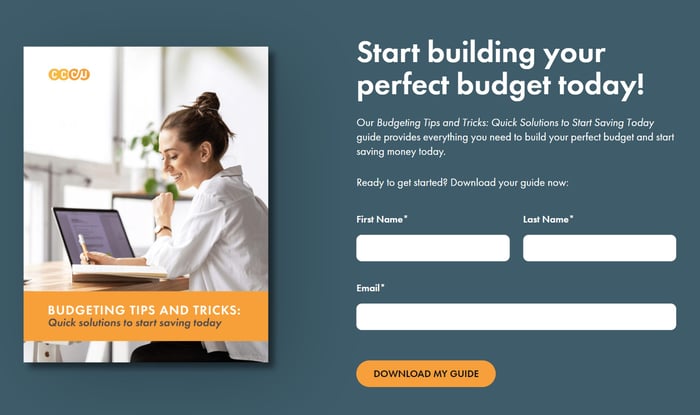

Wait, did we just say "Pop-Ups?" Yes... we did! When used responsibly, lead flow pop-ups can help grow the number of leads in your CRM by delivering value-added content. They must offer something a user would find useful, like a guide or checklist, that's helpful in some way to the visitor.

Ask for as little information as possible on the pop-up and don't barrage them with non-stop emails after they've given you their contact information. Always be providing value.

Chatbots are another fantastic way to provide assistance to your website visitors. Today's consumer is accustomed to chatbots that help through automated workflows that provide relevant answers and resources.

Building a robust knowledge base to provide a chatbot with answers and allow users to search for answers on their own is a great way to add value to your website while also reducing the number of calls and emails your customer service team receives.

CCCU launched their website with over 150 knowledge base articles providing detailed answers to frequently asked questions.

Preferable to all others is Live Chat. If you can provide this feature, having a live person accessible is ideal for addressing inquiries, providing assistance, and resolving issues so that your website visitors receive top-notch real-time support whenever they need it.

5. Data, Data, Data

An agile website can only deliver an experience as good as the quality of the data that fuels it. This is why hosting your website and CRM in the same place is so important.

Knowing if a marketing email drove traffic to your website which then ultimately ended in a booked loan is valuable information for marketing, sales, and operations. Knowing which pages are the most popular on your website, or which competitor sites rank higher or lower than yours, is also valuable information for making data-driven decisions.

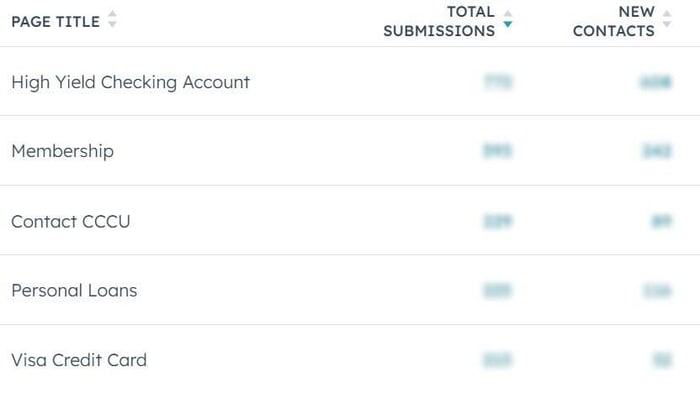

One data point considered at CCCU is how many leads each website page generates and how much value-added content is provided to visitors. To this end, every product page on the CCCU website offers a content piece with a lead capture form. Analytics can tell us which pages are capturing the most leads and which pieces of content are being downloaded.

In the first six months after launch, the Checking Account and Membership pages were garnering the most leads and downloads of all the product pages.

The High Yield Checking Account Page had the most submissions. 78.7% were new leads, and 21.3% were existing contacts who downloaded the information available on those pages. This is a measurement of continuing to deepen relationships with existing members by providing them with educational content they find valuable.

We recommend offering content available for download on every product page you have. A budgeting eBook, for example, can be used on several pages until you have a custom offer for each product line.

Many financial institutions struggle to measure the impact of their content or produce a metric that signifies how many relationships they've deepened with their content strategy. A robust CMS (content management system) combined with an equally robust CRM gets you the results you've been looking for!

In Summary...

The new CCCU website offers a ton of great new features. It was difficult to pick just FIVE to highlight here. From ADA compliance to an integrated digital Onboarding Program, there are many, many other considerations in a new website build.

If you're building a new website in the near future, let's chat about your goals, expectations, and strategy. Ensuring that the investment you make in your largest branch will meet your needs is a critical starting point.

Congratulations to the CCCU team! The new site is fantastic.

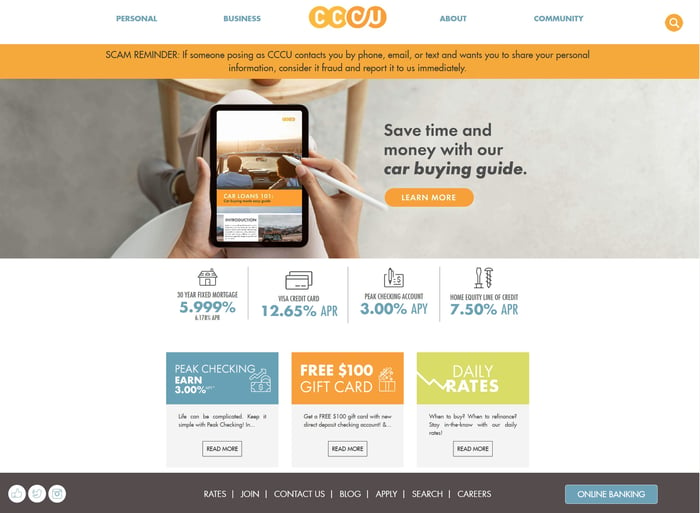

Before

After

Check it out at www.consolidatedccu.com

Blog comments