Episode 30 - How Brand Ambassadors can be a Game Changer for Your Bank or Credit Union

Don't Miss An Episode, Subscribe Now

It's important to humanize your brand and really lean into one of your greatest assets as a smaller financial institution, which is your staff. This is how you differentiate yourself from other bigger institutions competing for the same potential customers and/or your existing customers. While they might be able to beat you on rates, they can't beat you on personality, on service, and on making people feel like they're part of a family at your community bank or credit union.

Transcription:

If you're looking for best practices for your bank or credit union, join us while we talk all things sales, marketing, and strategy for financial institutions. Let's make it happen with FI GROW Solutions.

Meredith Olmstead:

Hi, there. I am Meredith Olmstead, CEO and founder of FI GROW Solutions. We are an inbound marketing and sales agency. We work exclusively with financial institutions, and I am here with our Head of Client Success, Nida Ajaz. Say hi, Nida.

Nida Ajaz:

Hi, everyone.

Meredith Olmstead:

And we were just having a great conversation about how to humanize the brand of a bank or a credit union, really, and why that's so important. And I said, "Look, let's push record on this, so we can share it with our viewers and our listeners and really talk about how to humanize your brand, really specifically, too." We were talking about in relation to using an employee or using employees as brand ambassadors.

Meredith Olmstead:

So the first thing I'll say is the reason why it's so important to humanize your brand and really lean into one of your greatest assets, as a smaller financial institution, which is your staff, is because this is how you differentiate yourself from other bigger institutions that are options out there for potential customers and existing customers. So you've got all these mega banks. You've got all these online-only financial institutions now, or lenders like Lending Tree and those kind of places. They're faceless, nameless kinds of interactions, right?

Meredith Olmstead:

So while they might be able to beat you on rates, they can't beat you on personality, on service, on making people feel like they're part of a family, in a sense, with your financial institution. And so really humanizing your brand is such a great way to set yourselves apart from some of those other options out there.

Meredith Olmstead:

So we have lots of clients who actually have some form of a brand ambassador that they have designated or they've been working with, with internal staff members. Some of that has come from our suggestions. Some of it comes from them really wanting to actually show off their staff. So Nida works with a few of those clients, and I'm just curious, Nida: Why are you seeing this growth of brand ambassadors with our clients, and why do you think it makes sense?

Nida Ajaz:

Yeah, well, we actually recommend them to use their employees as the faces within various capacities, and one of the main things is because your employees are actually the target market, too. Their network of people, with their family, their friends, it's all local, and it's a local community that you can reach out to and deepen the relationship with your employees. And at the same time, use their network to get the word out about your financial institutions, so it's definitely a great target to use.

Meredith Olmstead:

Yeah, so with a number of our brand ambassadors, across a few different clients, because I see lots of different examples, they're doing a lot with contributing to social media content, specifically. And so brand ambassadors are really showing off the internal culture, their personality, and maybe even the personality of other employees, which again, is great to humanize the brand.

Meredith Olmstead:

I know that we're seeing brand ambassadors creating reels and really interactive fun, short-form video content that's super trending right now, on Instagram and even Facebook. So it makes sense. It's hard to come up with a reel that's talking about a lending product or service, but when you have the face of a brand ambassador in there who can make it fun and interesting and maybe tell a personal story or do a quick little interview, then it makes sense, right?

Nida Ajaz:

Yeah, and even attending local events. So creating a quick reel about local events and what the employees have contributed to, or a nonprofit that they contributed to as an organization, all those things are great for the social media content. And just highlighting your employees. Like, hey, employee of the week, something like that, where the social media trend is that you incorporate something that makes the employee feel good, as well.

Meredith Olmstead:

Yeah. I just saw on one of our clients, they had a reel on Instagram that was totally in one of those trends where it was the music, and they were cutting to different positions. And it was five different employees, all in a conference room, laying on the table or sitting funny or doing something silly.

Nida Ajaz:

Oh, that's awesome.

Meredith Olmstead:

And it's a bank or a credit union, but you can still have a sense of humor, really show off the fun side of the staff, and that's definitely driven by some of those brand ambassadors.

Meredith Olmstead:

I know that you've been working with another smaller bank in the Boston area who has some really talented and really knowledgeable lending staff in their mortgage department. And one of those guys is actually doing some really cool videos. Tell us a little bit about that. He's becoming a brand ambassador for them.

Nida Ajaz:

Yeah, the idea came first, where the mortgage loan officer showed interest, that, "Hey, I'd be up for making videos," because he wants to get more leads and build a following within the local area. So we helped them develop a brand that goes with just his personality. So his name is Frank, and it's Frankly Speaking Mortgage Matters. That's the theme, and he basically is creating content on his own time, on his own terms, with the topics that he likes to talk about. So it's very full ownership to him.

Nida Ajaz:

Of course, the marketing team is working together with him to get that rolling, but the great thing is that it's allowing him to be creative, take ownership of the project, and then at the same time, nurture a really good network of people with some great advice and the knowledge that he already has acquired within the field- [crosstalk 00:06:20].

Meredith Olmstead:

Yeah, and then-

Nida Ajaz:

And the same thing for ... Yeah, go ahead.

Meredith Olmstead:

Well, I was going to say, I know, too, we're going to be using some of those videos, potentially on landing pages, but also in emails and him sending some of them out. They're going to live on the blog, as well, so it's a great way to- [crosstalk 00:06:37].

Nida Ajaz:

It's multi-channel.

Meredith Olmstead:

Yeah, use the content in different ways, but multi-purpose those videos.

Nida Ajaz:

Yeah, and then there are other topics they could do. A consumer loan officer could talk about auto buying. There's also credit building and debt management topics that are very, very hot, especially after the whole COVID thing. So all those different areas can definitely be covered.

Meredith Olmstead:

Yeah, awesome. The other thing that I find that I really appreciate with brand ambassadors and with employees in general, showing up employees in general, is really leaning into real pictures on websites for financial institutions. So trying not to get away from stock images on websites and actually taking pictures, getting images of employees interacting with members or with customers or doing their jobs or working in the community. And really putting some of those kind of images front-and-center on website, instead of out-of-the box stock photos.

Nida Ajaz:

Yeah, and we do that right now with most of our clients. With any of the follow-up automated emails, we like to get a real person following up. So even though they are automated emails, they are coming from a real person who can actually follow up. And when you reply to the email, a person will respond to you. So using those within the signature and putting in their pictures is definitely integrated.

Meredith Olmstead:

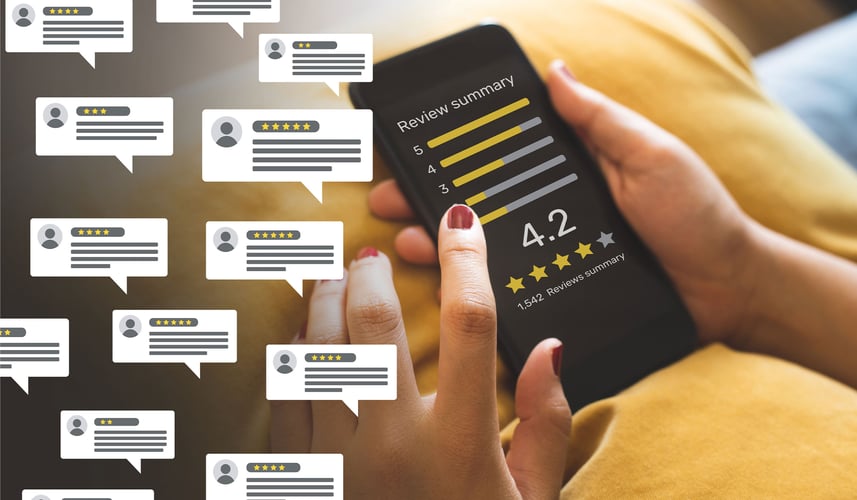

Yeah, again, another way to highlight brand ambassadors. So we've talked a lot about the pros of a brand ambassador. The one really big con, obviously, the elephant in the room, is what if they leave your bank or credit union? They're an employee. They can definitely go find a job somewhere else. So what happens if that's the case or that goes down?

Nida Ajaz:

Yeah, so I think it is definitely one thing that you do have to discuss, and if you discuss it in advance, there are some common practices that you can put in place to help avoid some of this. Especially making them sign a contract when they are putting this content out, so you are still able to use that content.

Meredith Olmstead:

Basically, they give you permission to utilize any content with them in it?

Nida Ajaz:

Yeah.

Meredith Olmstead:

Even if they have left the institution.

Nida Ajaz:

Yeah, exactly. So anyone being used in any form of video or any kind of photos should have that photo or release form. Yeah, exactly.

Meredith Olmstead:

Yeah, and the other thing is just having a plan in place for a transition period. With a contract with a brand ambassador, specifically, you would have a minimum notice period, where maybe it's a little longer than the typical employee two-weeks-and-I'm-leaving. But maybe you contract with them to give you a minimum of four weeks' notice or something along those lines, so that you have a little bit more transition time to make sure you have access to all of their content, that you maybe even bring in a new person to interact with them for a little bit before they exit, or something like that.

Meredith Olmstead:

So it's a chance you have to take, but at the same time, we've found that we think that it's worth the effort and that risk, in some sense, to have some really great personalized and engaging content.

Meredith Olmstead:

So awesome. Well, thanks, Nida. This has been really informative, and I hope you guys got some great tips out of this for driving personalizing and showing off employees at your institutions.

Meredith Olmstead:

Please feel free to come and visit us at figrow.com. We have lots of other awesome episodes, talking about tidbits for marketing and sales at financial institutions. We also have our Academy and all of our products and services there. So visit us at figrow.com, and in the meantime, let's just all get out there, and let's make it happen.

Blog comments