- FI Type

- Credit Union

- Location

- Portland, OR, U.S.

- Objective

- New Digital Branch

- Website

- www.consolidatedccu.com/

Results

-

-

A New Digital Branch

Optimized for Search Engines!

-

-

Improved User Experience

With a Clear Path to Conversion

-

-

Lead Generation

100s of Loan & New Acct Leads

The Challenge

The financial institution approached us in need of a solution to turn their basic website into a lead-generating digital branch with a robust user experience and modern design.

The Goal

Develop a well-organized user experience with clear Key Performance Indicators and Reports to show real results:-

- Lead Generation Strategy for Website

- Content Strategy and Lead Nurturing

- Organize and SEO Optimize Content

- Integrate Knowledge Base and Effective Calls-to-Action

The Result

There is a reason why we refer to all our website projects and transform them into digital branches. These digital branches require the same treatment if not better than your regular brick and mortar branches. It is your only branch that operates 24/7/365, helps build your brand, and contributes to generating the highest amount of leads in comparison to your physical branches.

With this project we were able to help Consolidated Community Credit Union (CCCU) not only differentiate with its SEO optimized content and lead generation, but also allow the marketing team to get key insight into the consumer behavior and reporting to build custom member experiences all through smart content that is seamless from website pages to automated emails. The digital branch experience is upgraded with brand-relevant and custom design to showcase their playful and outdoorsy culture.

Digital Branch Case Study

Once designs were approved, our team was tasked to develop, write, and launch a fully-functioning new digital branch ready to launch in 6 months complete with a knowledge base and fresh blog content.

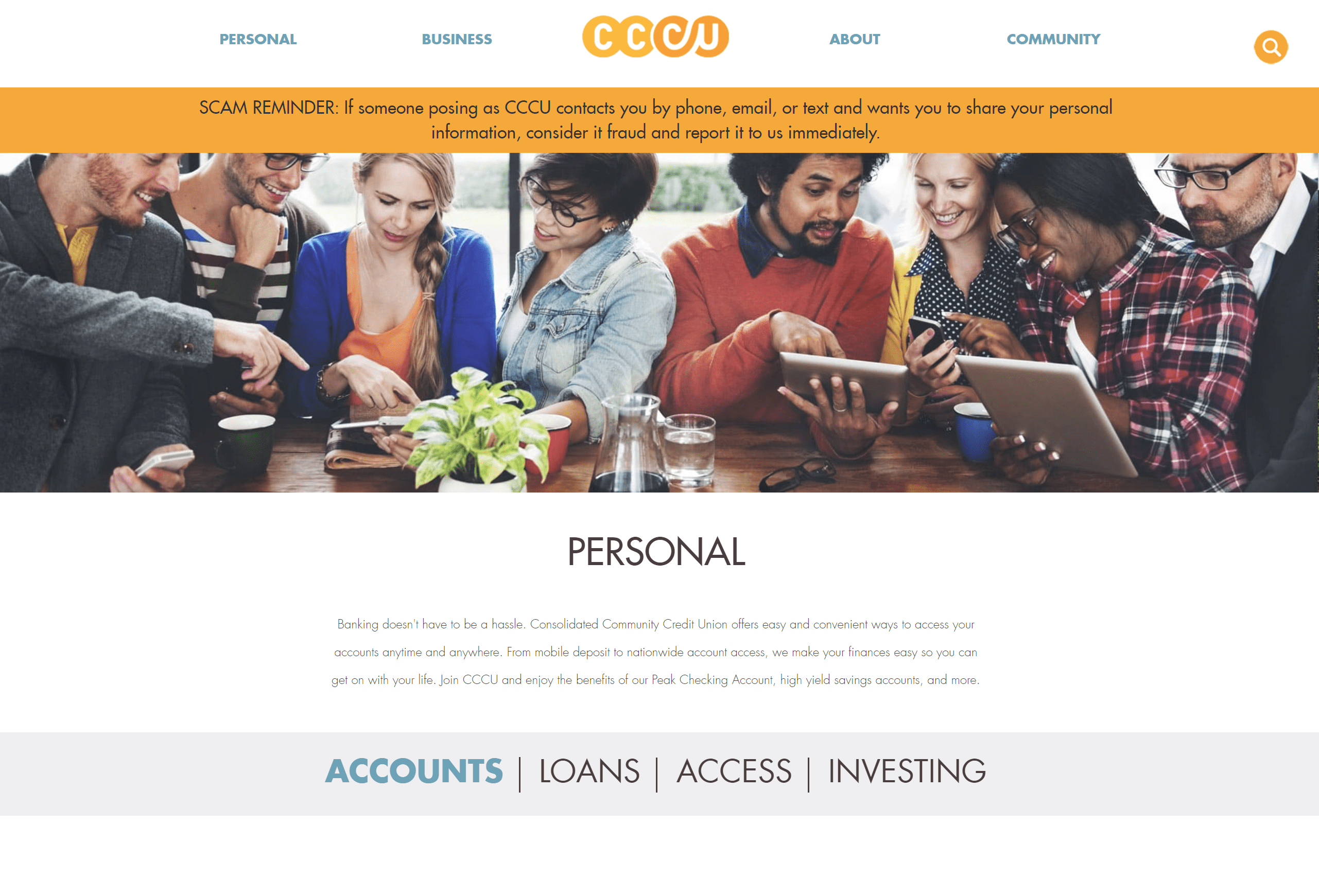

Website Content Structure

The existing website had all personal banking options on a single webpage, which is not ideal for search engines. Because a potential member would search for "checking accounts" or "personal loans", the content on the website needs to have a page for each of these search terms so search engines can deliver the most accurate results. This meant that existing content needed to be reorganized into individual product pages, and a lot of new content needed to be created.

Original Personal Banking Page:

The original Personal Banking page included all Personal Banking options from Checking Accounts to RV Loans under the "Personal" umbrella.

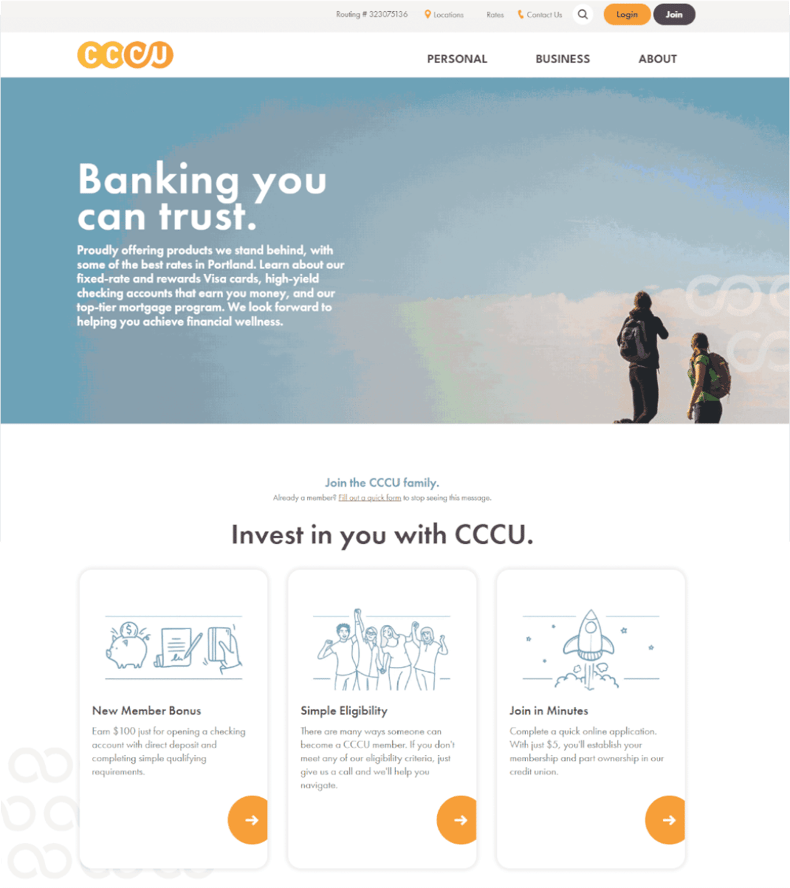

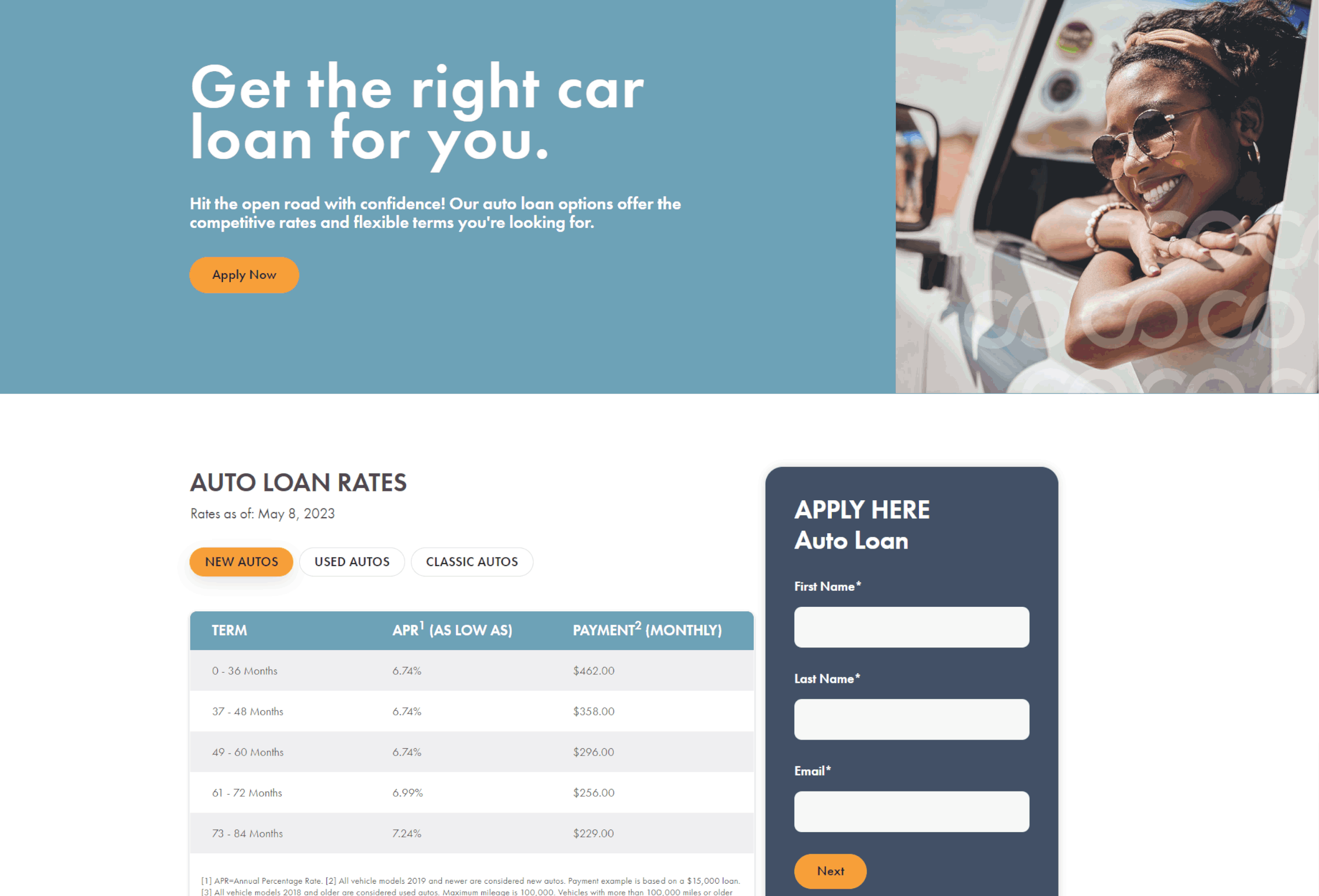

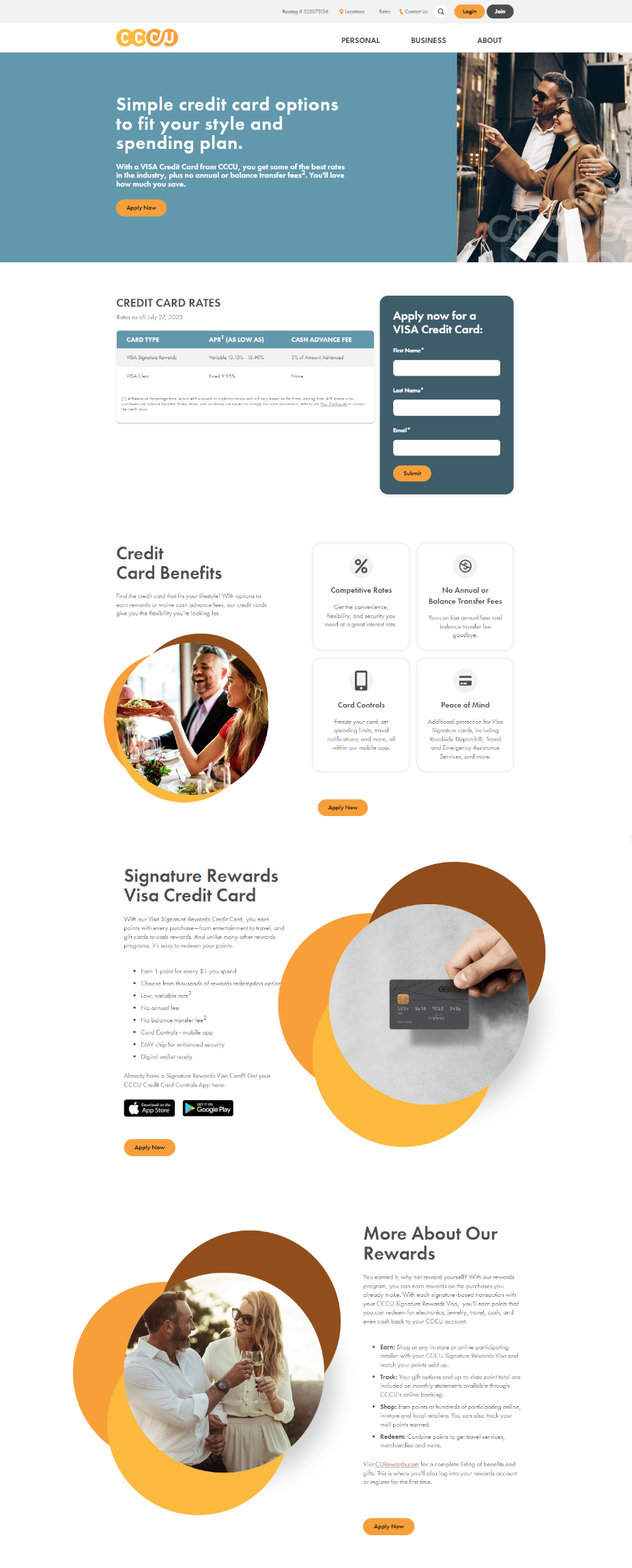

New Digital Branch:

The new digital branch gives each product its own search-optimized page with all the product details, rates, and a form to start your online application.

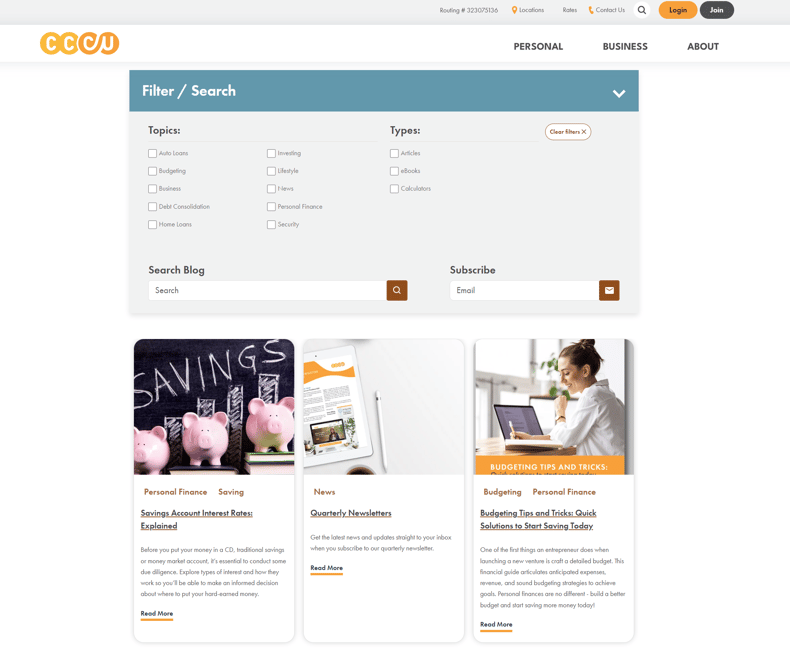

Blog

Part of reorganizing this website's content was optimizing the blog. Blog content can improve domain authority on a topic which will help boost search rankings. But if your blog content is sitting on a different domain, your main website is not seeing that benefit. We brought the existing blog posts, along with five new posts each for CCCU's five priority products onto the main domain of their new website.

The new structure allows blog content to contribute to the website's domain authority. The new blog also features search functionality and topic tags so the user can easily navigate to the content most relevant to them. With an improved user experience on the blog, we've seen improvements in page views and time on site.

The Knowledge Base

The final piece of structuring the website content was building a robust knowledge base. For users with questions that go a little deeper than the content on each product page, they can use the site search feature to self-serve and discover answers on their own. While a knowledge base is always a helpful tool, this solution was built specifically to help reduce the load on CCCU's customer service team.

Now, when members can't figure out how to log into their online banking or they have questions that are easily answered, the knowledge base can provide them the information rather than the customer service team receiving the question.

Improved User Journey

From searching for a product on Google or using the website menu to navigate to the desired product page, users can see all the benefits, requirements, rates, and any other information about that specific product in one place. When they are ready to apply for the product, the application start form is at the top of the product page. Not only that but there are calls to action in each section of the page that bring the user back to the application form at the top. This allows the user to read as much or as little content as they need to be ready to apply before starting the process.

The first step of any user journey is awareness. With comprehensive SEO research and implementation, the new digital branch has seen a 20% increase in organic search impressions in just a few months. By showing up in search results more frequently, more traffic is driven to the website. The content on the page takes users through the consideration page and offers an opportunity for conversion with each section of content.

Each section of content has a CTA prompting the user to apply for a Credit Card. Regardless of how far down a user scrolls, they are never far from an opportunity to convert.

Lead Capture

The unfortunate part about a user journey is that it is sometimes abandoned. This is why we implement lead capture forms at the point of conversion. Once someone decides to convert and apply for the product, they are given a simple form that asks for their name and email address. Once this form is submitted, we have captured their interest and can now nurture the lead.

Especially if the application process is started and not completed, these leads can now receive communication thanking them for starting the application, providing a contact if they have questions, and even marketing to them based on their interest in a particular product.

Personalized Content

As more site visitors view product pages and complete lead capture forms, the website is further customized to the user’s unique journey through SMART content. SMART content is the ability to change what a user sees when visiting the page based on list membership or recent digital behavior. Here are a few ways we use SMART content:

- Show a known customer information about a product or service they don't currently have.

- Show a known user more information about a product they have recently shown interest in by visiting a specific page on your website.

- Add a user's name right on your website page to grab their attention.

- Prefill form fields with a user's contact information to help prompt them to action on an application start page or lead capture opportunity.

In Conclusion

The CCCU Digital Branch is positioned to drive organic traffic and guide users to open accounts and apply for loans. At the beginning of this project, CCCU had website and blog content that was not strategically organized and did not offer a clear path to conversion or capture leads. Their new digital branch has over 80 SEO-optimized pages with an improved user experience and lead capture forms throughout.

FI GROW Solutions was thrilled to have been chosen for this project for the credit union. We are pleased with the results we have seen so far and can continue to monitor and optimize the site's performance.

If your website isn't working for you, we'd love to help you build an optimized digital branch that drives and nurtures leads.

Learn more about how we can help your bank or credit union with similar results! Click below to get in touch.

SHARE THIS CASE STUDY: