What Bank Executives MUST Know When Investing in Digital

A lot of financial institutions miss the mark when it comes to growth because they think just broadcasting their services is enough. Read this eBook or download your own copy to find out how you're missing the mark and what to do to change NOW!

Introduction

As a community-based financial institution, you have a unique position in the banking industry. You are offering a more personal, customer-centric experience than other larger banking institutions. When you are considering

digital marketing, a customer-centric experience should be at the core of your financial institution’s organizational strategy.

A lot of financial institutions miss the mark when it comes to growth because they think broadcasting their services is enough. Many try to compete on rates and promotions alone, without clear and consistent emphasis on the real difference between large national and international banks and community-based financial institutions.

Your Fis are all about their community and their members, and everything you do should revolve around this messaging. Your mission revolves around service and that is what sets you apart from big banks, and this message,

this differentiator is also the key to fostering consistent growth!

Keep reading as we review what we have learned are the 10 key steps to grow your financial institution for many years to come!

Send a free copy to your inbox now!

Make Digital Marketing a Strategic Initiative

Coordinate with all department leaders to set digital transformation goals that they can disseminate to their Staff and each plays a role within the digital ecosystem.

- Identify that digital experience is more than your online/mobile banking experience. Your website is your digital branch and every online touchpoint contributes to your digital experience. All digital efforts need to have the multi-department experience that your physical branch provides, but from the convenience of the customers’ home.

- If you have assigned digital to the marketing department to check it off the list, you have already failed at digital. It is important to know that although marketing handles digital marketing efforts for you to drive leads, other departments need to be involved to close those leads and provide the best customer experience.

- Prioritize your company mission and how it translates to drive your digital strategy. For people to remember your brand there must be a consistent brand voice that is repetitive and memorable across all online and offline channels.

Challenges with Organizational Structure Abound Within the Banking Industry

As community banks and credit unions grow, staffing tends to expand along with the assets, and this can sometimes lead to counter-intuitive segregation of duties.

We have seen credit unions where digital responsibilities were grouped with mobile banking staff, outside of marketing or communication departments.

We have also seen financial institutions with too many staff in the mix, leading to a lack of a clear chain-of-command and thus failing to adequately follow-up on what is or is NOT being accomplished.

Unfortunately, there is no template for how a community financial institution SHOULD be organized, but with a greater number and specialization of staff comes the potential for inefficiency and decentralization of responsibilities. Both can lead to marketing and sales campaigns that are disjointed and lack clear implementation.

And certainly, this makes it harder to track deliverables and results.

Usually, community financial institutions tend to hire from within when it comes to various department heads. They do not always hire from outside the institution unless someone leaves the organization. Although growth from within is a great motivator for employees, this kind of hiring may not get the right skill set and technical expertise in some department areas.

It is essential that your institution periodically restructure staff based on skill sets, assessing areas of need, rather than just letting departments grow via attrition. You must use these times as opportunities to ensure that you have the right people, with the right skill sets, in the right seats or positions at your institution.

Remaining as you have always been for the sake of preserving the status quo is a dangerous habit, though one that is all too common.

Be wary… when evaluating FI organizational structure… the 'path of least resistance' may lead to inertia and stagnation.

Innovative financial institutions are shifting to revenue or growth departments, where you connect all marketing and new sales efforts within the same groups and build goals and objectives for these new departments accordingly.

Other financial institutions group marketing and business development into one department to better connect new leads with marketing automation follow-up efforts. This is potentially a good practice but depending on the size of the FI this may or may not be practical.

We also recommend a Customer Relationship Management (CRM) tool be utilized by BOTH marketing and sales/business development so that relationships with new leads can be better nurtured over time.

KEY: It is essential to make digital initiatives part of strategic goals for not only the marketing department but with sales and lending staff as well. We recommend that you keep all forms of member communications and marketing within ONE department’s chain of command, but marketing goals and objectives to be coordinated directly with sales and lending to follow up and close the leads.

Send a free copy to your inbox now!

Create Smart Growth Goals

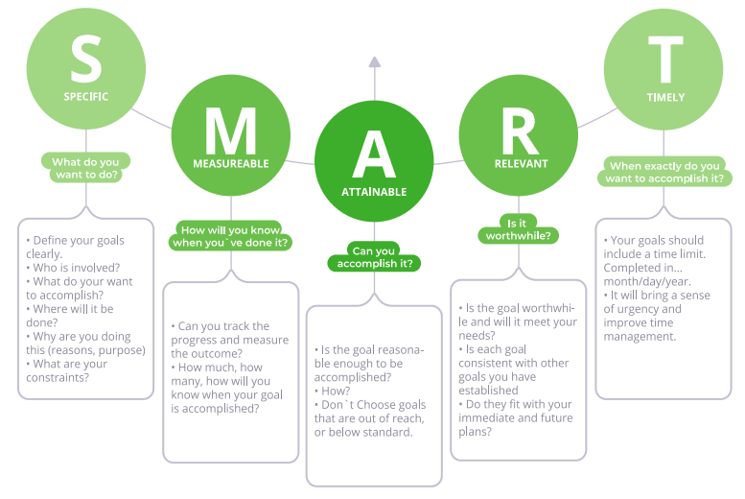

One of the most important steps is to create SMART goals for your digital marketing initiatives.

Example of a broad goal: Grow loans for the financial institution

Specific goal: Get 25-30 new sales qualified leads during the first quarter of the year.

Specific and Measurable:

The specific goal is a much better way to begin working toward the larger positive revenue impact. Setting a goal like this allows it to be measurable as well. These specific goals will also help identify a consumer journey and where the leads are dropping off. The questions to ask would be:

- Are there enough marketing qualified leads?

- Are there enough sales qualified leads?

- Are the leads being followed up and closed by sales?

- Does the automation process need work?

- Does marketing need to concentrate more on diversifying content?

- Is marketing creating engaging and SEO optimized content to drive inbound leads?

Attainable goals are complicated if there is no data that can be used. Usually looking at the history of a campaign and how it did the previous year or if there is a consistent number of loans or accounts that open on average per month. Try using that historical data to set attainable goals. The key here is to have the goals challenging enough to keep the team motivated and attainable enough for the people to not lose hope in achieving the goals.

Relevant goals are a bit easier to identify, but again these will often shift over time depending on past successes or failures. For example, if you miss a goal due to the time frame being a bit tight for converting new leads, you might consider goals that allow for a longer time for future follow-ups. For example: Give 30 sales qualified leads to the lending staff. Then track their follow-ups and based on the closing rate, give a conversion percentage for a certain time-frame (typically 3-month duration of a product campaign).

Timely (also referred to as Time-Bound) basically creates the goal to have urgency and limit. Having goals that stretch out for long periods of time often make them either not really specific enough, or perhaps not likely to be successful.

KEY: Quarterly goals should be measured in smaller increments of time for progress toward the larger

annual revenue goals.

Make Your Organizational Strategic Goals Align with Digital

To make the most of your marketing dollars, begin with a strategic plan that helps you achieve the business goals you have identified above. As you brainstorm and execute your marketing and sales tactics and strategy, avoid making choices based principally on personal preference or what’s always been done in the past. Instead, craft an approach that is frequent, consistent, and drives your point home to customers or potential new customers.

Example 1:

Strategic Goal: Grow core deposits, deepen relationships, and increase share wallet for current customers.

Digital Marketing Ideas:

- Consider concentrating on a robust onboarding process online

- Rewards and offers just for current customers

- Developing resources and content to be shared on email and social media platform

- Deepening Relationships by offering services like one-on-one free financial coaching

- Drive ratings and reviews campaign and incorporate authentic reviews and rating tools on the website

Example 2:

Strategic Goal: Grow total membership and lower membership average age

Digital Marketing Ideas:

- Introduce an online referral campaign

- Concentrate on social media and Pay Per Click Ads

- Concentrate on SEO optimized content strategy

- Create brand awareness campaigns

- Work with business development to reach out to SEGs, business partners, and local influencers

KEY: What you cannot do is veer off in a random direction, say business checking promotions, if these are not tied to your larger quarterly and annual goals and objectives. Revisiting and documenting goals and strategies each quarter is essential to staying on track.

Define Your Brand And Keep It Consistent Across Online And Offline Channels.

For some, the brand only means a new name or logo, maybe new colors, or design. For others, it is a little more beyond that with defining a mission, vision, values, and tagline. For us at FIGROW, branding is reinforcing your message through every interaction. This means that all your marketing channels need to have a consistent message. Don Miller from Story Brand says it best “Branding is just an exercise of memorization”.

The words you use in your marketing especially when engaging with customers will help you drive more business and help people remember your organization at the time they are ready to purchase. This applies very true to financial institutions because not everyone is ready for a new house or car when you are advertising, but if your message is memorable and provides great value when the customer is ready to make a purchase you will be the first one they think of.

In order for you to have a memorable brand, defining its key components is very important. Can every single staff member of your financial institution answer all the following questions?

- What sets your financial institution apart?

- Are there consistent actions that your staff take that are repetitive?

- How is your product offering tweaked to help align with your mission?

- Do you have processes in place that reinforce your brand?

Staff members should embody your brand in everything they do, or at least all customer-facing activities and messages.

Let your brand shine through in all your marketing efforts and communications, and endeavor to authentically differentiate yourself, and show potential new customers what they can expect from your financial institution.

KEY: It is important for your institution to consider what values your customers give importance

to. As the majority of the community banks and credit unions are looking to reduce their average age

consider understanding current customer behavior, driving reviews and testimonials, and working

to form a consistent and memorable brand.

Hire a Marketing Professional to Help

You could ask just about anyone to write an email campaign or draft a postcard or flier. You could also have multiple people managing your social media accounts in their free time or adding web content as they see fit. But if you want to be strategic and effective in your efforts, it pays to hire a marketing professional who understands what successful digital marketing is and what it isn’t.

The team at a full-service digital marketing agency can pave the way from strategy to implementation, staff training to revenue goal achievement. It is important to have all marketing efforts filter back to one person to ensure consistency in brand and message, which will help you achieve your business goals.

Financial institutions hire professionals to help with MANY specific areas of business functions, from card processing to branch planning. Bringing in highly trained marketing and sales assistance is no different. Even if you get temporary help to bring staff up to speed on new best practices, or perhaps have someone come in annually to review your efforts, a fresh set of eyes can make all the difference!

KEY: There’s just too much to keep up within the marketplace to not bring in assistance, and with internal staff being tasked with so many areas of responsibility, outside help is essential to see

results with branding and digital marketing.

Personas And Personalization Is Key To Success In Digital Marketing

If your marketing strategy consists of speaking without listening, you will lose out on the very customers you are trying to connect with. People looking for a community bank or credit union want a personal touch. They want to be understood and appreciated. If that did not matter, they would have left for a larger institution long ago.

Rather than simply delivering a product or service broadcast message, engage your members and potential new members in conversations to learn about their needs and exceed their expectations. A persona is understanding customer patterns and behaviors and forming certain target markets within your market segment and reaching out to them based on their personalized needs.

Example 1:

Aiming to lower by reaching out to younger audiences may mean that you are actually forming a persona for their parents as the decision-maker and sharing financial resources that can help them in their child’s financial plan for college. This kind of content will have a specific aim and range of products offered to them to fulfill their needs.

KEY: Responding to customers interacting with you on social media right away will help build a better experience for your customers. Use social media platforms for brand awareness as well as customer service. Use features like polls and questions to learn more about your audience.

When creating content for your customers, think about what they will find useful, rather than just looking for promotional content. If you are constantly trying to sell your audience something, eventually they will stop listening.

It is important to give value to your content to build your expertise. This makes people feel like you know who they are and are interested in their hopes and fears, wants, and needs. You will understand their preferences

by listening to them and using the existing data before you begin a new campaign or content marketing approach.

When you respond to comments on social media, email your contacts on the list or even reach out personally to follow-up, personalizing your message allows you to genuinely connect with them. Refer to users by name and do

not say the same thing to every single reply. People will notice this and feel like a robot is responding to them.

It is also important to have fun when responding to comments. If someone says something silly, put in a little extra effort and speak their language. It is even more important to respond to negative comments on social media. By

responding and not deleting the conversation you show your members you take their feedback and concerns seriously

Send a free copy to your inbox now!

Focus on Yourself, Not Your Competitors

When your marketing strategy focuses on what others are doing, the message about what you do best can often fall through the cracks. Other banks may be able to match your rates or replicate your services, so rather than selling the comparison, simply highlight your strengths and unique qualities.

Our philosophy is that big national banks and online fintech solutions are your principal competitors, not other community financial institutions. These locally focused institutions have similar customer service priorities, and most will bend over backward to help their community in any way they can. When you try to focus on your competitor’s rates you can lose this customer-centric mission that sets you apart. And people will start to notice if you are not being genuine and authentic.

KEY: We recommend you use customer testimonials and staff profiles to continually humanize their brand and level of service. You will RARELY see such personal stories coming from big banks.

Optimize Website & Social Media

Although your website and social media are not your sole marketing vehicles, they may be your most visible. We at FIGROW consider your website your digital branch. Anyone who searches for information about your financial institution online or reads one of your fliers, postcards or other collateral is likely to visit at least one of your online assets. In today’s world, you absolutely MUST optimize your website and social media. Further, you will also want

your online content to reflect your current marketing strategy, so regular updates are essential to keep messaging consistent.

It is especially important that your website is mobile-friendly, so it will provide a seamless experience for any user, regardless of device. We even suggest a mobile-first approach is often appropriate, where you design your site for mobile and then make it function in a similar fashion on desktop. After all, a typical website has over 60% of its traffic coming from a mobile device!

KEY: If it has been more than 2-3 years since your website had a major update, this should be your priority. Branch traffic has been declining and mobile traffic is on the rise, so banks and credit unions should stop looking at their website as an expense and start treating it as an asset. If structured correctly, the website is your branch that never closes and the salesperson that never goes home or on vacation!

You should also improve your website’s SEO (Search Engine Optimization). SEO is the process of boosting the visibility of your website in search engine results, and the result is increased organic (unpaid) page views for your institution’s website. Who would not want that?

A lot of credit unions have come on board to dedicate a staff member to start blogging but they may necessarily not have the expertise to do keyword optimization to help the content rank higher on searches. A lot of organizations put a lot of effort into creating the content and not much time disbursing the content by optimizing certain keywords that the customers will search for. This is key when putting appropriate content together to get in front of the right audience

For Example:

Do not use a keyword like “car loan” that’s WAY too broad. Instead, maybe use a long tail search term like “best car loan rates” as your keyword. Then create several pieces of content around this keyword and link these to a pillar page of content that includes all the important information about this valuable topic. This strategy will drive much more traffic and get better results with digital marketing for your financial institution.

Invest in Mobile

Between smartphones and tablets, more and more consumers are accessing social media and searching the web via mobile devices. If your website is not mobile responsive you are WAY behind, and you are already missing out on valuable new business opportunities. Make your mobile site easy to navigate with clear calls-to-action so that users

know exactly what you have to offer and what they should do next.

People are turning to their smartphones for anywhere, anytime access to the web. If your website is not mobile responsive it will overwhelm a mobile device and you could lose customers who expect an optimized and well-functioning mobile banking experience.

Your financial institution also needs a mobile banking app with all the basic functions, including credit and debit card integration and remote deposit capture. These are now basic banking services at this point, and they MUST be a priority or millennials and the next generation of customers will pass you by.

Now, most banks and credit unions offer an app for their mobile banking. The app allows members to transfer money, pay bills, and even deposit checks from their phones. Being able to bank anywhere at any time is no longer considered a luxury in consumer minds. They expect to be in control of their money 24/7.

KEY: Partner with a strategy driven agency that can help with the marketing strategy to look at your

consumer journey and help remove friction when redoing the website and customer followup processes.

Take Advantage of Video Marketing

Is your financial institution taking advantage of video in your digital marketing initiatives?

Here are some ideas for using videos in your digital marketing:

1. Social Media:

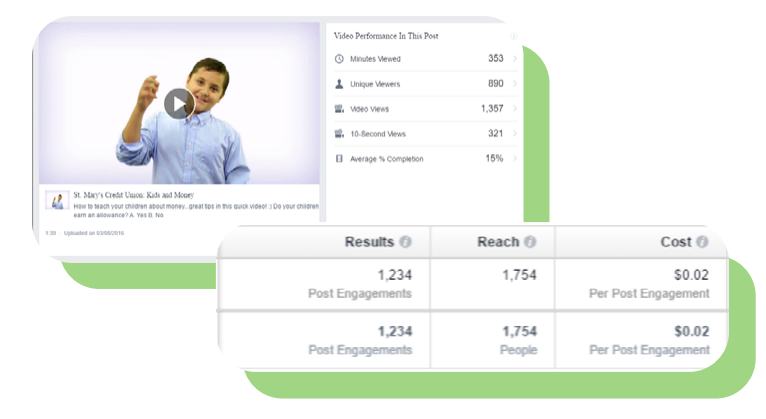

Native Facebook Videos are videos that are directly uploaded to Facebook rather than shared with a linking URL from another site like YouTube or Vimeo. Native videos get much higher engagement than videos that are hosted elsewhere, and these videos get significantly higher engagement than pictures or other types of content.

In the example below, we boosted this video for a week and spent just over $20 total, the results speak for themselves. We reached over 1700 people, and engaged with well over half of them, all at a cost of $.02 per engagement! Wouldn’t you pay that for a positive customer touchpoint?

TIP: When using Facebook’s video uploader, you can set custom starting thumbnails, include keywords and titles, and even narrow the audience for your videos. You can also use their tool to add sub-titles, which are important as over 85% of Facebook videos are watched without sound. The videos MUST be licensed by your Credit Union to be

uploaded to Facebook.

2. Custom Email Follow-Ups:

Customized email follow-ups through marketing automation are great but go a step further by not only personalizing the email coming from your individual sales and loan officers but have them put a quick

personal video put together for every person to onboard them, follow up about downloading content, or engaging a lead. These emails with custom follow-ups will personalize the email even further and give a more humanized approach to your digital marketing.

3. Organization Branding Videos

Even if you are a community-based organization, you may have prioritized local brand awareness by investing in local tv station commercials or partnerships. Take that investment further by getting a digital version of those videos and sharing them on your social channels as well as on your website.

TIP: If you have invested in regular new content that you get featured weekly or monthly on your local tv station, that is great content that you can also share on your email follow-ups to your current and potential customers.

3. Going Live on Social Media Platforms:

Use the opportunity of hosting online events, trivia games, interviews, employee, and customer spotlights and go live more often. All social media platforms introduced the live feature recently so they give notifications to all followers when someone goes live, so it is very important to use this or other newly introduced features to your benefit so you are engaging with your audience.

What is next?

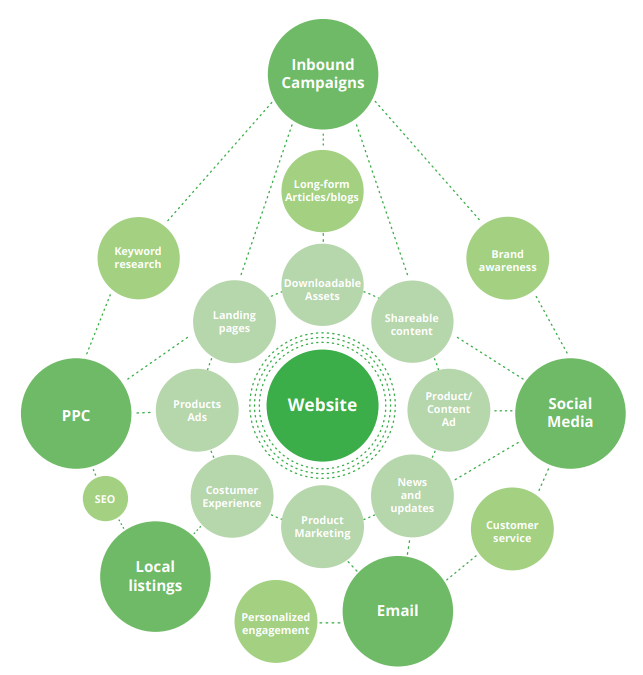

What you must know is whether you like it or not your financial institution already has a digital face. Your customers are leaving reviews (positive or negative), speaking offline about their interaction with you, and sharing their experiences on their personal social media channels. Your website is no longer a glorified online brochure but rather a fully functioning digital branch. If structured correctly it will become an engine that generates leads, follows up with them, and provides an experience the way your employees provide an experience when someone walks in your branch. Knowing the power of your website and using social media, seo-optimized content, and pay-per-click ads, as well as retargeting will be a powerful tool for your organization.

Below is a diagram to see how all the different digital components connect and work together as your digital ecosystem.

Your next step is to assess where you are at as an organization and where you want to go. This is the most important step you will take to create the exact roadmap for your organizational success. Identifying the current strengths and weaknesses and getting the whole organization on board with a digital initiative is extremely important. This step allows you to go through your marketing and sales processes and analyze your strengths, weaknesses, opportunities, and threats for you to structure your digital strategy in the best way possible.

Digital Marketing is a marathon. It is not an item on the list that needs to be checked off and it is not a marketing-only initiative. It is a way of changing your operations to become more efficient combining your strategic goals and using digital marketing to help achieve them.

Send a free copy to your inbox now!

Work With Us

FI GROW Solutions helps banks and credit unions with marketing and sales strategy from individual campaigns to mergers and full rebrands. We also build new websites into fully functioning and robust digital branches.